epaid insurance expired, P 6,000. erest revenue Accrued, P 41,000. Learned service revenue earned, P8,000. preciation, P 62,000 ployee salaries owed for two days of a five-day workweek: Task 2: Journalize the entries for the following adjustments unting period: Account Titles Debit

epaid insurance expired, P 6,000. erest revenue Accrued, P 41,000. Learned service revenue earned, P8,000. preciation, P 62,000 ployee salaries owed for two days of a five-day workweek: Task 2: Journalize the entries for the following adjustments unting period: Account Titles Debit

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

PLEASE SKIP IF YOU ALREADY DID THIS

Transcribed Image Text:Santos

LaN Fin

Nork sheet

month ended December 31, 2016

Adjusted

Trial balance

CR

DR

385,800

90,000

1,000

100,000

1,200,000

1,000

1,000,000

600,000

40.000

250,000

f.

Jaime

For the

Adjustments

DR

OR

(2) 4,000

Trial Balance

OR

cash

DR

985,800

Accounts Receivable 90,000

Office Supplies 5,000

Computer Equipment 100,000

Condominium Unit 1,200,000

Accounts Payable

Note Payable

1,000

1.000,000

600,000

Jaine Santos, Capital

Jaine Santos,

40,000

with drainals

Service Revenue

250.000

(3) 5,000

utilities Expense 6.200

Salary Expense. 15,000

Transportation Expore 9,000

Total

1,231,000 1,851.000

Step 1

(1) 10,000

Interest Receivable

(2) 4,000

Interest Incone

Office Supplies Exp.

Salary Payable

5,000

Depreciation Expens-

(4) 10,000

Computer Equipment

Depreciation Expons-

4 (20,000)

Condominium unit

Accumulated

Depreciation-

10.000

10,000

Computer Equipment

Accumulated

Pepreciation-

Condominium whit

20,000

1,896,000 1,896,000

Not Incone

49,000

240,000

69,200

190,800

260,000

20,000

1,826, 800 1. 696,000

190,800

260, 000 1.826, 800 1,224.800

STEP 45

STEP 12 ←

STEP 3

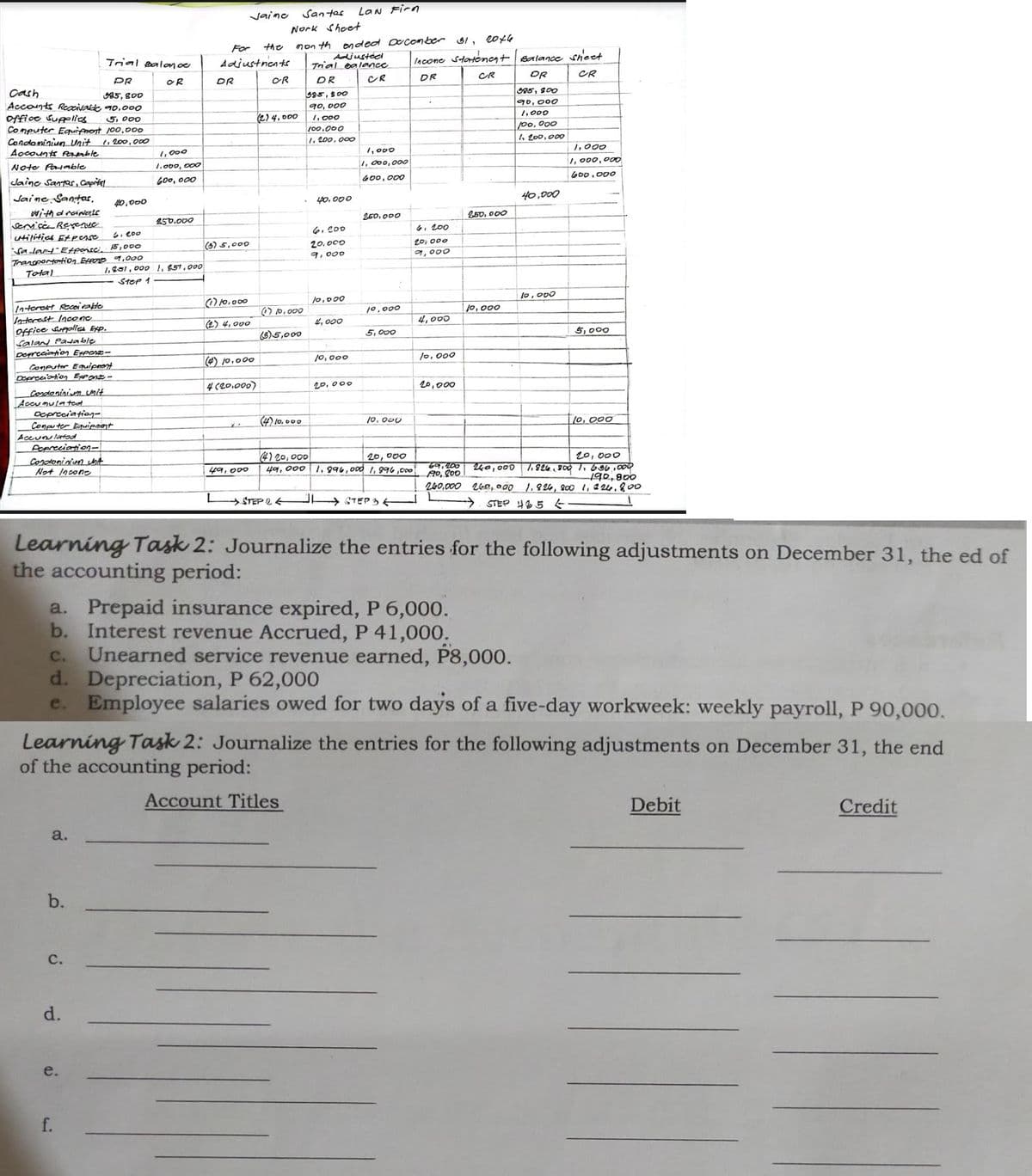

Learning Task 2: Journalize the entries for the following adjustments on December 31, the ed of

the accounting period:

a. Prepaid insurance expired, P 6,000.

b. Interest revenue Accrued, P 41,000.

C. Unearned service revenue earned, P8,000.

d. Depreciation, P 62,000

e. Employee salaries owed for two days of a five-day workweek: weekly payroll, P 90,000.

Learning Task 2: Journalize the entries for the following adjustments on December 31, the end

of the accounting period:

Account Titles

Debit

Credit

a.

b.

C.

d.

e.

(1) 10,000

(3) 5,000

6,200

20.000

9,000

10,000

4,000

10,000

20,000

(4) 10,000

(4) 20,000

49,000

Income statement Balance sheet

DR

CR

CR

DR

385,800

90,000

1,000

100,000

1,200,000

1,000

1,000,000

600,000

40,000

10,000

5,000

6, 200

20,000

9,000

4,000

10,000

20,000

250,000

10,000

10,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education