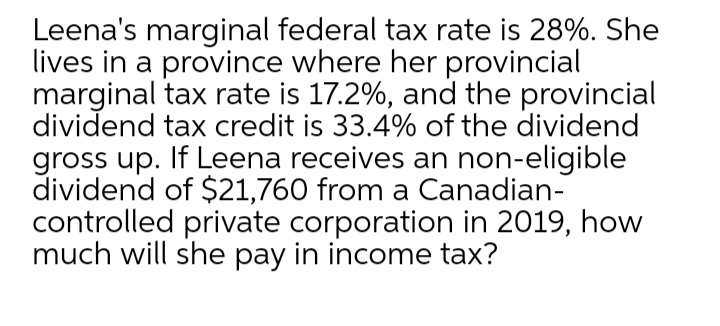

Leena's marginal federal tax rate is 28%. She lives in a province where her provincial marginal tax rate is 17.2%, and the provincial dividend tax credit is 33.4% of the dividend gross up. If Leena receives an non-eligible dividend of $21,760 from a Canadian- controlled private corporation in 2019, how much will she pay in income tax?

Leena's marginal federal tax rate is 28%. She lives in a province where her provincial marginal tax rate is 17.2%, and the provincial dividend tax credit is 33.4% of the dividend gross up. If Leena receives an non-eligible dividend of $21,760 from a Canadian- controlled private corporation in 2019, how much will she pay in income tax?

Chapter12: Tax Administration And Tax Planning

Section: Chapter Questions

Problem 22MCQ: Melodie's taxable income is $39,000 and she pays income tax of $4,489. If Melodie's taxable income...

Related questions

Question

Transcribed Image Text:Leena's marginal federal tax rate is 28%. She

lives in a province where her provincial

marginal tax rate is 17.2%, and the provincial

dividend tax credit is 33.4% of the dividend

gross up. If Leena receives an non-eligible

dividend of $21,760 from a Canadian-

controlled private corporation in 2019, how

much will she pay in income tax?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you