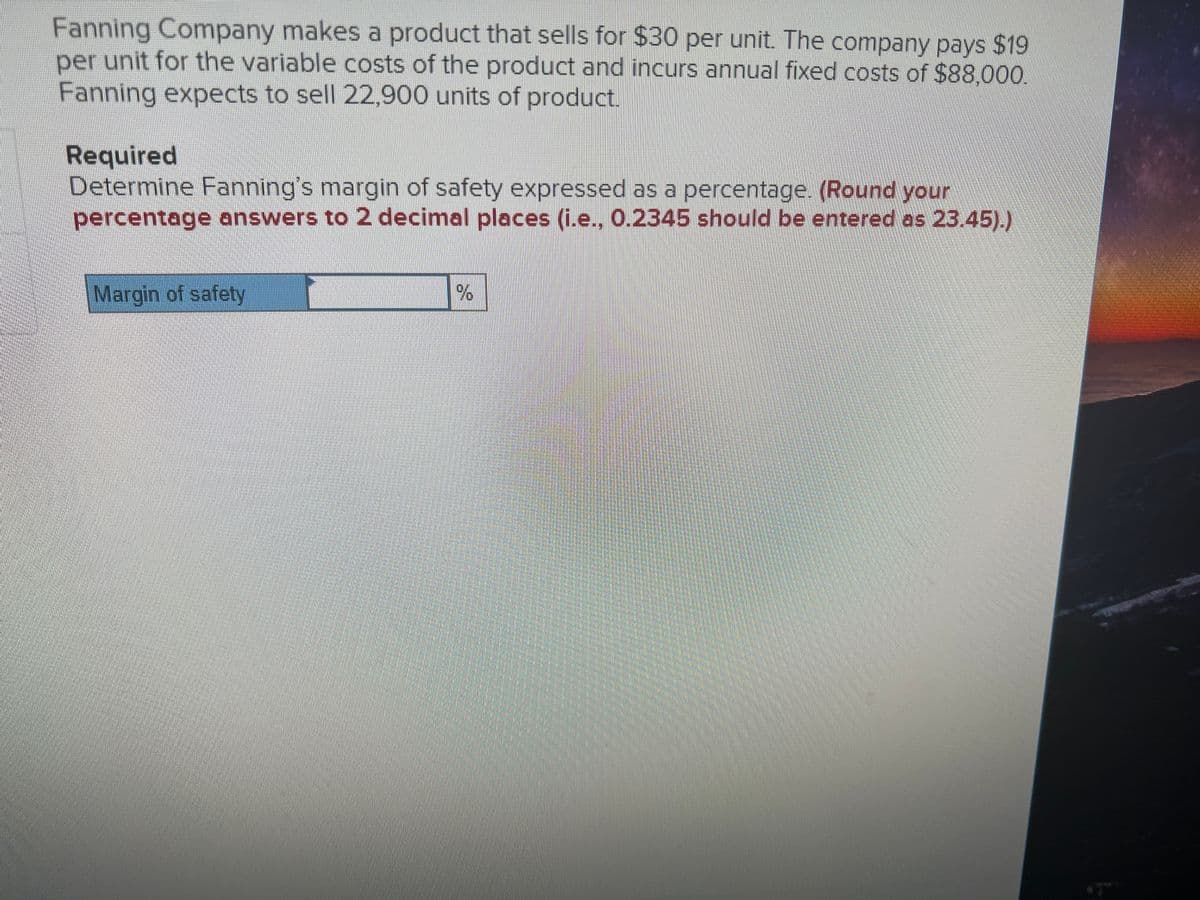

Fanning Company makes a product that sells for $30 per unit. The company pays $19 per unit for the variable costs of the product and incurs annual fixed costs of $88,000. Fanning expects to sell 22,900 units of product. Required Determine Fanning's margin of safety expressed as a percentage. (Round your percentage answers to 2 decimal places (i.e., 0.2345 should be entered as 23.45).) Margin of safety %

A margin of safety is an investing principle that states that an investor should only purchase securities when their current value is significantly lower than their intrinsic value. In other words, the margin of safety is indeed the difference between a security's market price and your estimated intrinsic value. Because investors can define their own margin of safety based on their risk tolerance, investing in securities when this difference exists allows for just a low-risk investment. The margin of safety, also known as the safety margin in accounting, is the difference between actual and break-even sales.

Managers can use the margin of safety to ascertain how far sales can fall before the company or project loses money. Benjamin Graham (dubbed the "Father of Value Stocks") and his followers, most notably Warren Buffett, popularized the margin of safety principle. Investors consider both qualitative and quantitative factors when determining the intrinsic value of a security, such as firm management, governance, industry performance, assets, and earnings.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps