liabilities uity (D/E)- UCW Brewery Ltd. 2024 iabilities $91,900 $103,900 12,000 0.72 me net debt as a percentage of total capitalization for both companies. UCW Brewery Ltd. 2024 SFU Beer Ltd. 2024 $103,900 $3,500 $8,000 4,500 0.12 SFU Beer Ltd. 2024 $8000

liabilities uity (D/E)- UCW Brewery Ltd. 2024 iabilities $91,900 $103,900 12,000 0.72 me net debt as a percentage of total capitalization for both companies. UCW Brewery Ltd. 2024 SFU Beer Ltd. 2024 $103,900 $3,500 $8,000 4,500 0.12 SFU Beer Ltd. 2024 $8000

Essentials Of Investments

11th Edition

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Chapter1: Investments: Background And Issues

Section: Chapter Questions

Problem 1PS

Related questions

Question

Please solve question g

Transcribed Image Text:1

858

65

66

67

68

69

70

71

72

73

74

Paste

75

76

77

78

79

80

81

File

82

83

84

85

86

Home Insert Page Layout

Ready

#

Cut

Copy

Format Painter

?

Clipboard

X

4 A

B

C

D

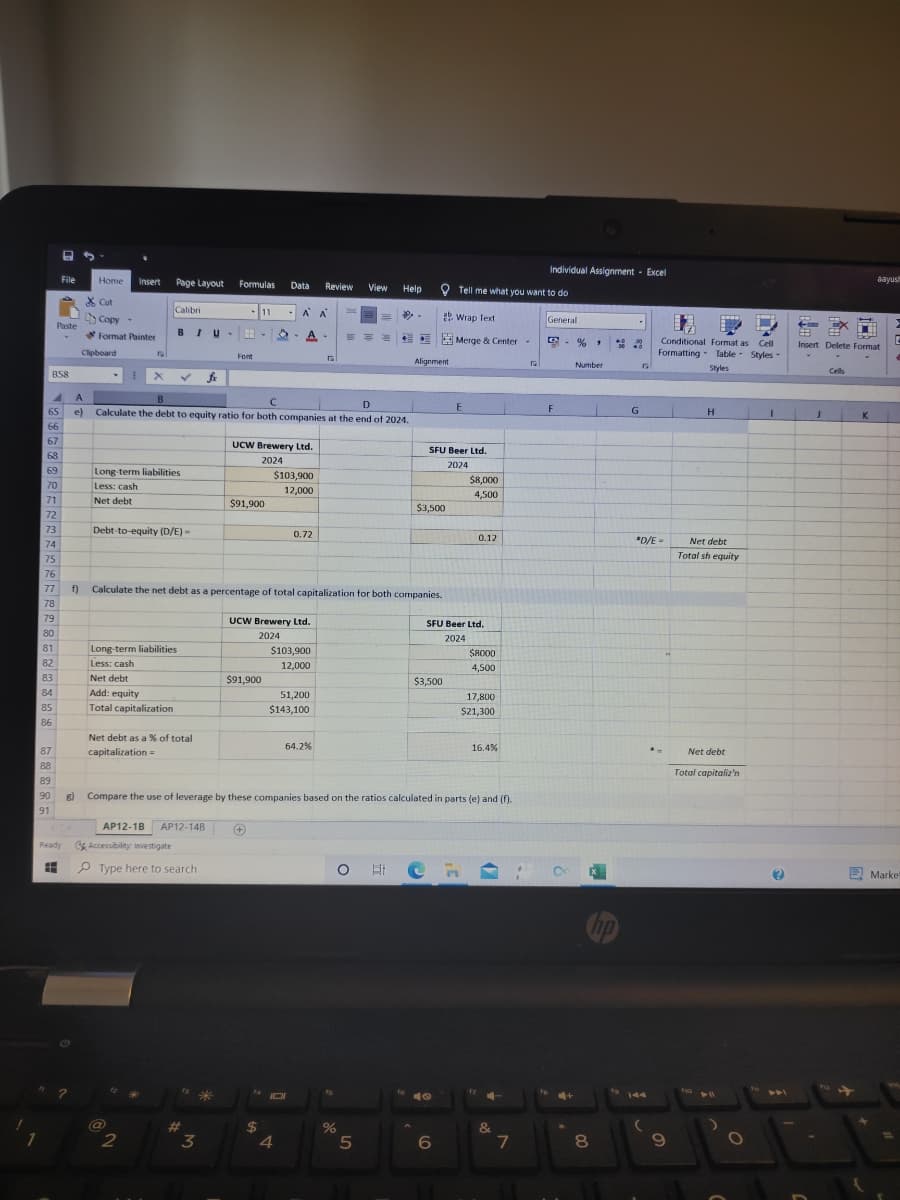

e) Calculate the debt to equity ratio for both companies at the end of 2024.

3

19

Calibri

Long-term liabilities.

Less: cash

Net debt

Debt-to-equity (D/E)-

BIU-

Long-term liabilities

Less: cash

Net debt

Add: equity

Total capitalization

Net debt as a % of total

capitalization =

Accessibility: Investigate

@

AP12-1B AP12-148

2

Type here to search

fx

Formulas Data Review

#

3

H.

Font

11

UCW Brewery Ltd.

2024

$91,900

f) Calculate the net debt as a percentage of total capitalization for both companies.

$91,900

A A

А.

A

+

UCW Brewery Ltd.

2024

$

$103,900

12,000

0.72

$103,900

12,000

51,200

$143,100

4

JOI

64.2%

View

=

%

Help

87

88

89

90 8) Compare the use of leverage by these companies based on the ratios calculated in parts (e) and (f).

91

O Hi

5

Alignment

$3,500

SFU Beer Ltd.

2024

$3,500

Tell me what you want to do

Wrap Text

Merge & Center

E

6

$8,000

4,500

SFU Beer Ltd.

2024

0.12

$8000

4,500

17,800

$21,300

16.4%

▼ !

4-

&

7

Individual Assignment - Excel

F

General

S %, 4000

F

O

Number

8

hp

G

1

7 D

Conditional Format as Cell

Formatting Table Styles-

Styles

*D/E=

(

.-

9

H

Net debt

Total sh equity

Net debt

Total capitaliz'n

▶11

O

I

?

Gm

Insert Delete Format

J

Cells

aayush

K

Marken

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Essentials Of Investments

Finance

ISBN:

9781260013924

Author:

Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:

Mcgraw-hill Education,

Essentials Of Investments

Finance

ISBN:

9781260013924

Author:

Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:

Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:

9780134897264

Author:

KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:

Pearson,

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i…

Finance

ISBN:

9780077861759

Author:

Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:

McGraw-Hill Education