Required 1. Enter the balances as of 11/30/2021 in the general ledger. 2. Prepare journal entries to record each of the December transactions for Premier Construction. If an event is not a transaction, write the date and “no entry needed" on the journal page. The explanation on the journal and in the general ledger must include at a minimum the available document reference and a name (for example Check 100; Ellie Smith).

Required 1. Enter the balances as of 11/30/2021 in the general ledger. 2. Prepare journal entries to record each of the December transactions for Premier Construction. If an event is not a transaction, write the date and “no entry needed" on the journal page. The explanation on the journal and in the general ledger must include at a minimum the available document reference and a name (for example Check 100; Ellie Smith).

College Accounting (Book Only): A Career Approach

13th Edition

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:Scott, Cathy J.

Chapter11: Work Sheet And Adjusting Entries

Section: Chapter Questions

Problem 3A

Related questions

Question

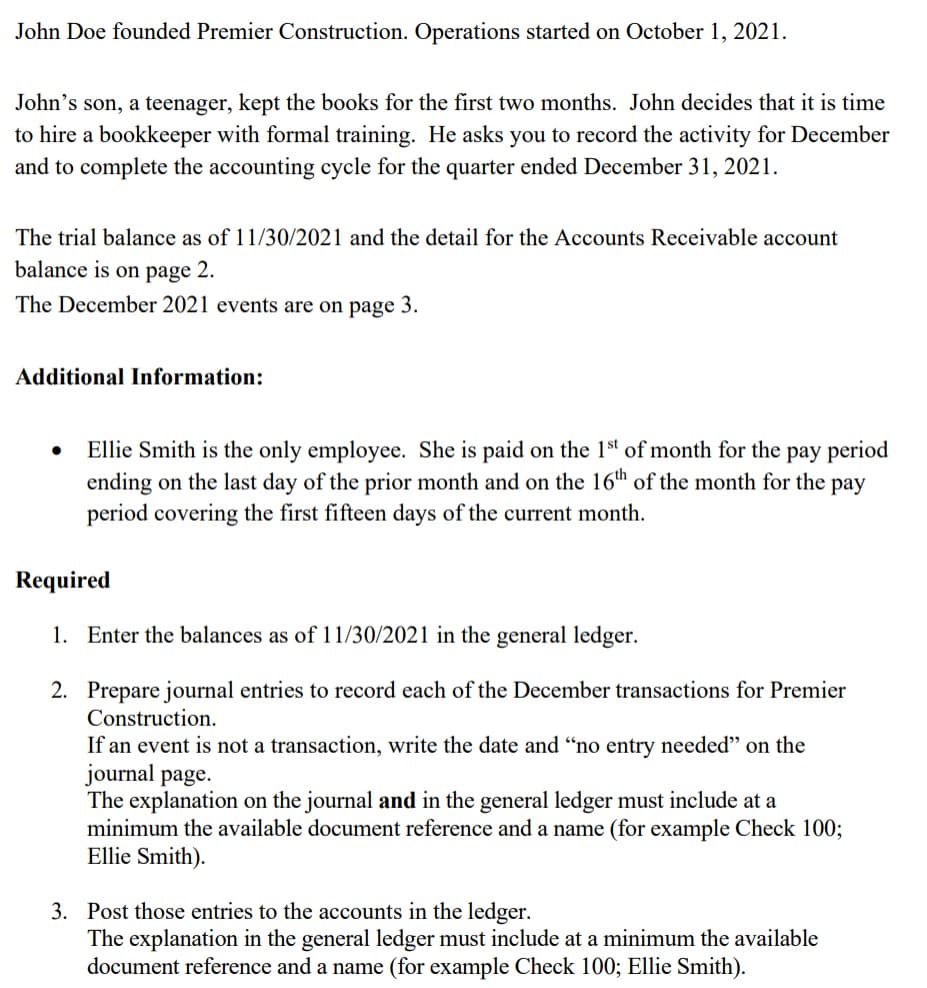

Transcribed Image Text:John Doe founded Premier Construction. Operations started on October 1, 2021.

John's son, a teenager, kept the books for the first two months. John decides that it is time

to hire a bookkeeper with formal training. He asks you to record the activity for December

and to complete the accounting cycle for the quarter ended December 31, 2021.

The trial balance as of 11/30/2021 and the detail for the Accounts Receivable account

balance is on page 2.

The December 2021 events are on page 3.

Additional Information:

Ellie Smith is the only employee. She is paid on the 1st of month for the pay period

ending on the last day of the prior month and on the 16th of the month for the pay

period covering the first fifteen days of the current month.

Required

1. Enter the balances as of 11/30/2021 in the general ledger.

2. Prepare journal entries to record each of the December transactions for Premier

Construction.

If an event is not a transaction, write the date and "no entry needed" on the

journal page.

The explanation on the journal and in the general ledger must include at a

minimum the available document reference and a name (for example Check 100;

Ellie Smith).

3. Post those entries to the accounts in the ledger.

The explanation in the general ledger must include at a minimum the available

document reference and a name (for example Check 100; Ellie Smith).

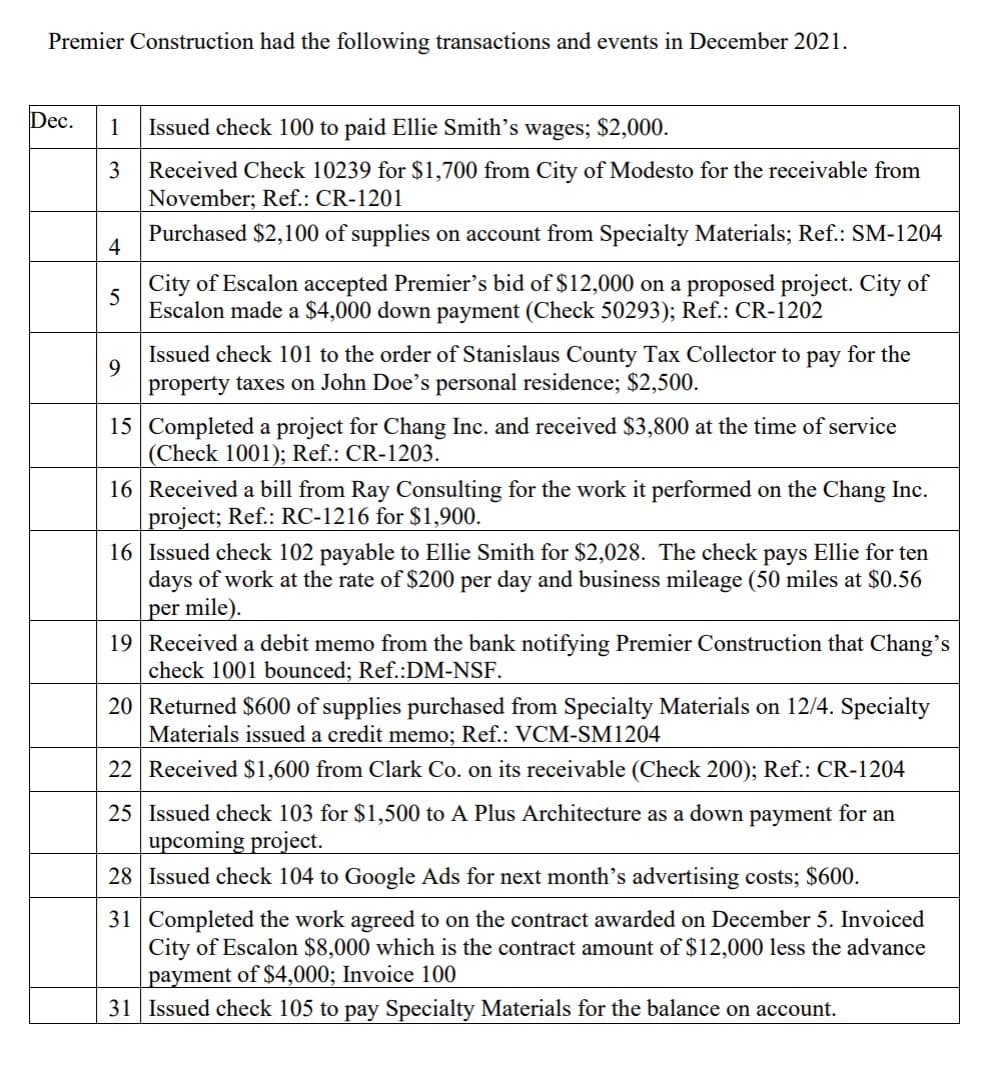

Transcribed Image Text:Premier Construction had the following transactions and events in December 2021.

Dec.

Issued check 100 to paid Ellie Smith's wages; $2,000.

1

Received Check 10239 for $1,700 from City of Modesto for the receivable from

November; Ref.: CR-1201

Purchased $2,100 of supplies on account from Specialty Materials; Ref.: SM-1204

4

City of Escalon accepted Premier's bid of $12,000 on a proposed project. City of

Escalon made a $4,000 down payment (Check 50293); Ref.: CR-1202

Issued check 101 to the order of Stanislaus County Tax Collector to pay for the

9

property taxes on John Doe's personal residence; $2,500.

15 Completed a project for Chang Inc. and received $3,800 at the time of service

(Check 1001); Ref.: CR-1203.

16 Received a bill from Ray Consulting for the work it performed on the Chang Inc.

project; Ref.: RC-1216 for $1,900.

16 Issued check 102 payable to Ellie Smith for $2,028. The check pays Ellie for ten

days of work at the rate of $200 per day and business mileage (50 miles at $0.56

per mile).

19 Received a debit memo from the bank notifying Premier Construction that Chang's

check 1001 bounced; Ref.:DM-NSF.

20 Returned $600 of supplies purchased from Specialty Materials on 12/4. Specialty

Materials issued a credit memo; Ref.: VCM-SM1204

22 Received $1,600 from Clark Co. on its receivable (Check 200); Ref.: CR-1204

25 Issued check 103 for $1,500 to A Plus Architecture as a down payment for an

upcoming project.

28 Issued check 104 to Google Ads for next month's advertising costs; $600.

31 Completed the work agreed to on the contract awarded on December 5. Invoiced

City of Escalon $8,000 which is the contract amount of $12,000 less the advance

payment of $4,000; Invoice 100

31 Issued check 105 to pay Specialty Materials for the balance on account.

3.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning