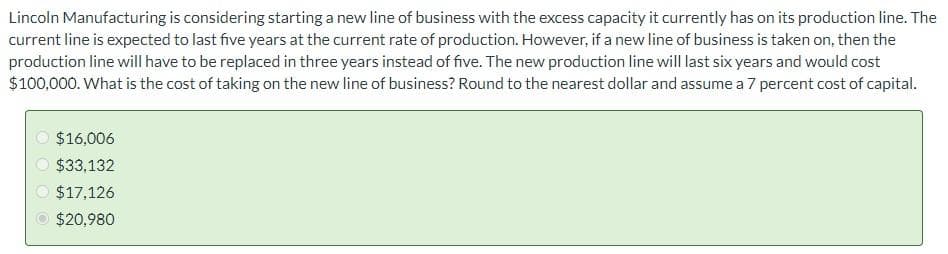

Lincoln Manufacturing is considering starting a new line of business with the excess capacity it currently has on its production line. The current line is expected to last five years at the current rate of production. However, if a new line of business is taken on, then the production line will have to be replaced in three years instead of five. The new production line will last six years and would cost $100,000. What is the cost of taking on the new line of business? Round to the nearest dollar and assume a 7 percent cost of capital. $16,006 $33,132 $17,126 $20,980

Lincoln Manufacturing is considering starting a new line of business with the excess capacity it currently has on its production line. The current line is expected to last five years at the current rate of production. However, if a new line of business is taken on, then the production line will have to be replaced in three years instead of five. The new production line will last six years and would cost $100,000. What is the cost of taking on the new line of business? Round to the nearest dollar and assume a 7 percent cost of capital. $16,006 $33,132 $17,126 $20,980

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter13: Capital Budgeting: Estimating Cash Flows And Analyzing Risk

Section: Chapter Questions

Problem 1P: Talbot Industries is considering launching a new product. The new manufacturing equipment will cost...

Related questions

Question

Transcribed Image Text:Lincoln Manufacturing is considering starting a new line of business with the excess capacity it currently has on its production line. The

current line is expected to last five years at the current rate of production. However, if a new line of business is taken on, then the

production line will have to be replaced in three years instead of five. The new production line will last six years and would cost

$100,000. What is the cost of taking on the new line of business? Round to the nearest dollar and assume a 7 percent cost of capital.

$16,006

$33,132

$17,126

$20,980

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning