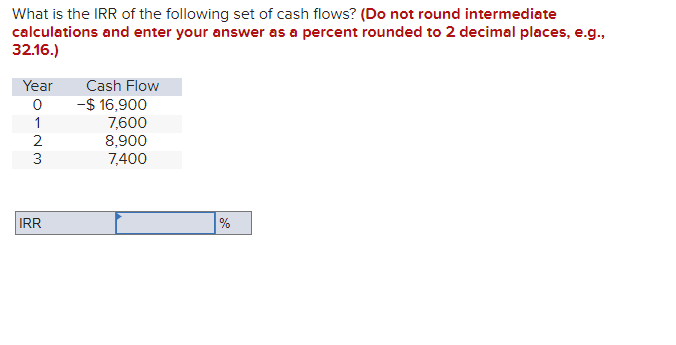

What is the IRR of the following set of cash flows? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Year 0 1 2 3 IRR Cash Flow -$ 16,900 7,600 8,900 7,400 %

What is the IRR of the following set of cash flows? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Year 0 1 2 3 IRR Cash Flow -$ 16,900 7,600 8,900 7,400 %

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter11: The Statement Of Cash Flows

Section: Chapter Questions

Problem 9MCQ: Refer to the information for Cornett Company above. What amount should Cornett report on its...

Related questions

Question

100%

Transcribed Image Text:What is the IRR of the following set of cash flows? (Do not round intermediate

calculations and enter your answer as a percent rounded to 2 decimal places, e.g.,

32.16.)

Year

0

-~3

1

2

IRR

Cash Flow

-$ 16,900

7,600

8,900

7,400

%

Expert Solution

Step 1

Any project/investment's profitability and feasibility are accessed via a process recognized as capital budgeting. It allows the investor to decide on the project's acceptance or rejection. There are multiple techniques employed for capital budgeting. The internal return rate is one of them. It highlights the discount rate at which the project's cash inflow's present worth is equivalent to the initial investment.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT