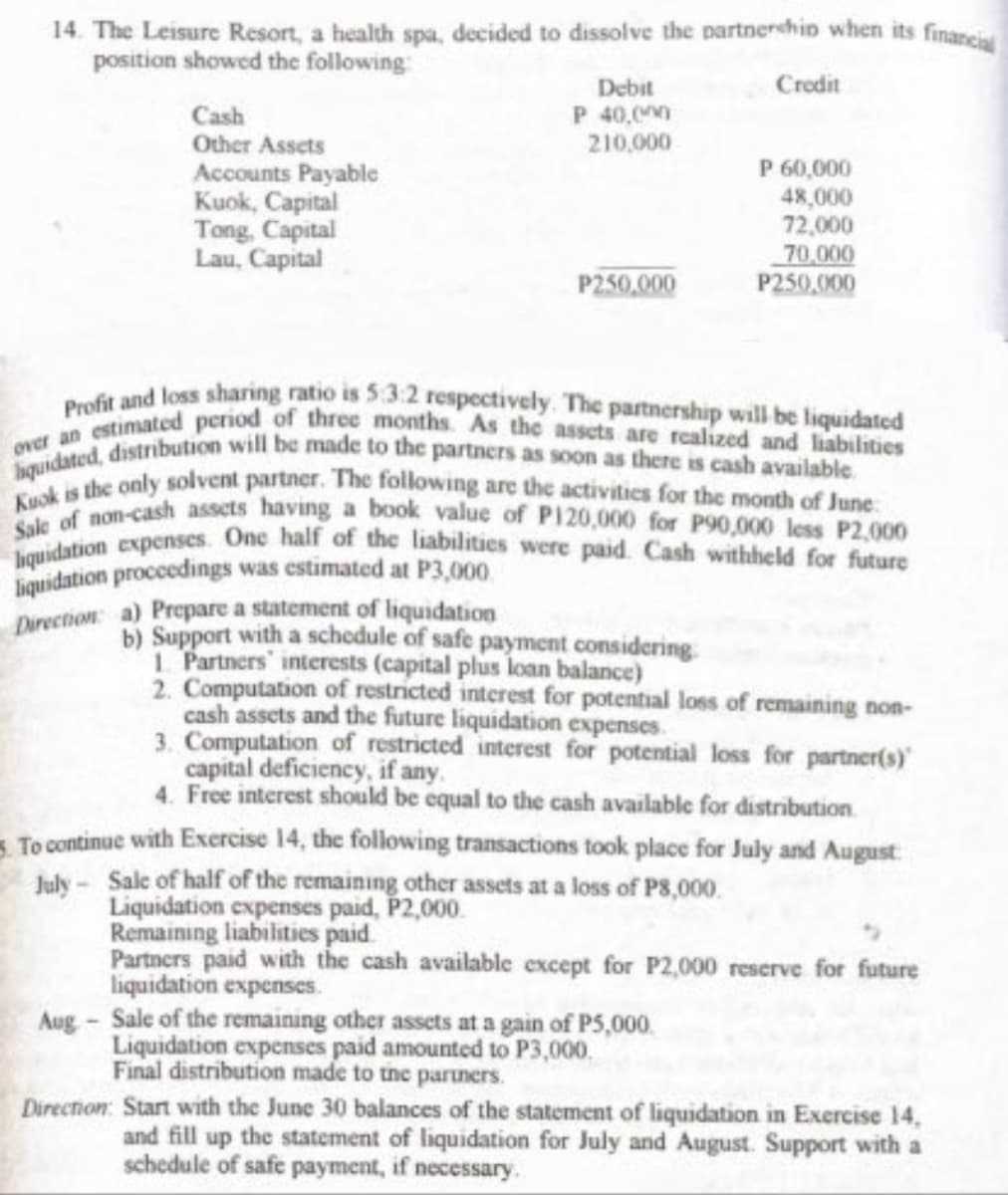

liquidated, distribution will be made to the partners as soon as there is cash available. Profit and loss sharing ratio is 5:3:2 respectively. The partnership will be liquidated Kuok is the only solvent partner. The following are the activities for the month of June: Sale of non-cash assets having a book value of P120,000 for P90,000 less P2,000 over an estimated period of three months. As the assets are rcalized and liabilities hquidation expenses. One half of the liabilities were paid. Cash withheld for future 14. The Leisure Resort, a health spa, decided to dissolve the partnershin when its financia position showed the following Crodit Debit P 40,0) 210,000 Cash Other Assets Accounts Payable Kuok, Capital Tong, Capital Lau, Capital P 60,000 48,000 72,000 70,000 P250,000 P250,000 ouidation proccedings was estimated at P3,000 Direction: a) Prepare a statement of liquidation b) Support with a schedule of safe payment considering. 1 Partners' interests (capital plus loan balance) 2. Computation of restricted interest for potential loss of remaining non- cash assets and the future liquidation expenses. 3. Computation of restricted interest for potential loss for partner(s)" capital deficiency, if any. 4. Free interest should be equal to the cash available for distribution. - To continue with Excercise 14, the following transactions took place for July and August: July - Sale of half of the remaining other assets at a loss of P8,000. Liquidation expenses paid, P2,000. Remaining liabilities paid Partners paid with the cash available except for P2,000 reserve for future liquidation expenses. Aug- Sale of the remaining other assets at a gain of P5,000. Liquidation expenses paid amounted to P3,000. Final distribution made to the paruners. Direcnion: Start with the June 30 balances of the statement of liquidation in Exercise 14, and fill up the statement of liquidation for July and August. Support with a schedule of safe payment, if necessary.

liquidated, distribution will be made to the partners as soon as there is cash available. Profit and loss sharing ratio is 5:3:2 respectively. The partnership will be liquidated Kuok is the only solvent partner. The following are the activities for the month of June: Sale of non-cash assets having a book value of P120,000 for P90,000 less P2,000 over an estimated period of three months. As the assets are rcalized and liabilities hquidation expenses. One half of the liabilities were paid. Cash withheld for future 14. The Leisure Resort, a health spa, decided to dissolve the partnershin when its financia position showed the following Crodit Debit P 40,0) 210,000 Cash Other Assets Accounts Payable Kuok, Capital Tong, Capital Lau, Capital P 60,000 48,000 72,000 70,000 P250,000 P250,000 ouidation proccedings was estimated at P3,000 Direction: a) Prepare a statement of liquidation b) Support with a schedule of safe payment considering. 1 Partners' interests (capital plus loan balance) 2. Computation of restricted interest for potential loss of remaining non- cash assets and the future liquidation expenses. 3. Computation of restricted interest for potential loss for partner(s)" capital deficiency, if any. 4. Free interest should be equal to the cash available for distribution. - To continue with Excercise 14, the following transactions took place for July and August: July - Sale of half of the remaining other assets at a loss of P8,000. Liquidation expenses paid, P2,000. Remaining liabilities paid Partners paid with the cash available except for P2,000 reserve for future liquidation expenses. Aug- Sale of the remaining other assets at a gain of P5,000. Liquidation expenses paid amounted to P3,000. Final distribution made to the paruners. Direcnion: Start with the June 30 balances of the statement of liquidation in Exercise 14, and fill up the statement of liquidation for July and August. Support with a schedule of safe payment, if necessary.

Financial Accounting

15th Edition

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter12: Accounting For Partnerships And Limited Liability Companies

Section: Chapter Questions

Problem 14E

Related questions

Question

Transcribed Image Text:Profit and loss sharing ratio is 5:3:2 respectively. The partnership will be liquidated

Sale of non-cash assets having a book value of P120,000 for P90,000 less P2,000

over an estimated period of three months. As the assets are realized and liabilities

Kuok is the only solvent partner. The following are the activities for the month of June:

laquidated, distribution will be made to the partners as soon as there is cash available.

hquidation expenses. One half of the liabilities were paid. Cash withheld for future

14. The Leisure Resort, a health spa, decided to dissolve the partnership when its financial

position showed the following

Credit

Debit

P 40,0)

210,000

Cash

Other Assets

Accounts Payable

Kuok, Capital

Tong, Capital

Lau, Capital

P 60,000

48,000

72,000

70,000

P250,000

P250,000

liquidation proccedings was estimated at P3,000

b) Support with a schedule of safe payment considering.

1 Partners' interests (capital plus loan balance)

2. Computation of restricted interest for potential loss of remaining non-

cash assets and the future liquidation expenses.

3. Computation of restricted interest for potential loss for partner(s)

capital deficiency, if any.

4. Free interest should be equal to the cash available for distribution.

- To continue with Exercise 14, the following transactions took place for July and August

July-Sale of half of the remaining other assets at a loss of PS,000.

Liquidation expenses paid, P2,000.

Remaining liabilities paid.

Partners paid with the cash available except for P2,000 reserve for future

liquidation expenses.

Aug - Sale of the remaining other assets at a gain of P5,000.

Liquidation expenses paid amounted to P3,000.

Final distribution made to the paruners.

Direction: Start with the June 30 balances of the statement of liquidation in Exercise 14,

and fill up the statement of liquidation for July and August. Support with a

schedule of safe payment, if necessary.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,