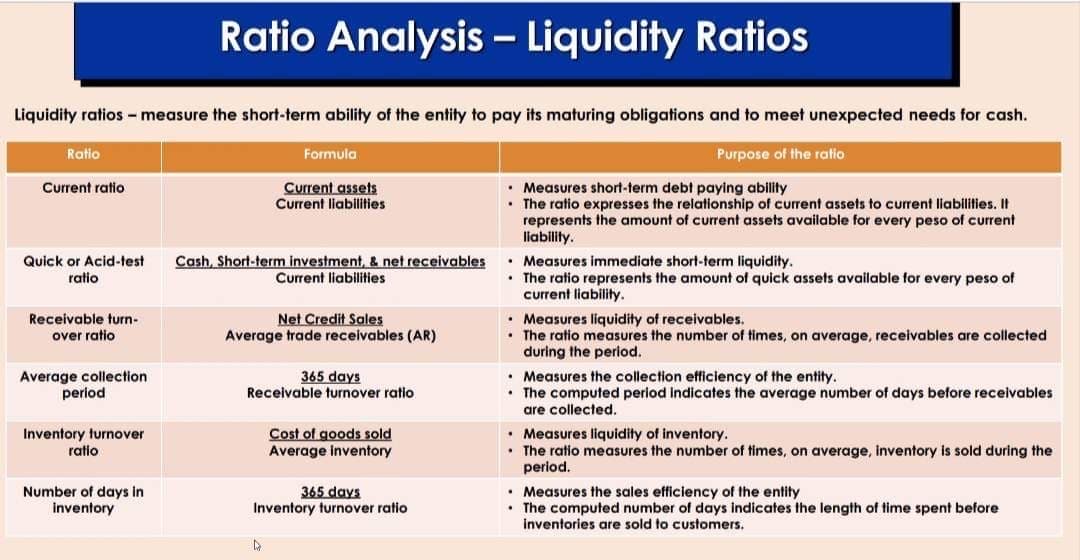

Liquidity ratios - measure the short-term ability of the entity to pay its maturing obligations and to meet unexpected needs for cash. Purpose of the ratio Ratio Current ratio Quick or Acid-test ratio Receivable turn- I over ratio Average collection period Inventory turnover ratio Ratio Analysis - Liquidity Ratios Number of days in inventory Formula Current assets Current liabilities Cash, Short-term investment, & net receivables Current liabilities Net Credit Sales Average trade receivables (AR) 365 days Receivable turnover ratio Cost of goods sold Average Inventory 365 days Inventory turnover ratio • Measures short-term debt paying ability The ratio expresses the relationship of current assets to current liabilities. It represents the amount of current assets available for every peso of current liability. • Measures immediate short-term liquidity. • The ratio represents the amount of quick assets available for every peso of current liability. • Measures liquidity of receivables. • The ratio measures the number of times, on average, receivables are collected during the period. • Measures the collection efficiency of the entity. The computed period indicates the average number of days before receivables are collected. • Measures liquidity of inventory. • The ratio measures the number of times, on average, inventory is sold during the period. • Measures the sales efficiency of the entity . The computed number of days indicates the length of time spent before inventories are sold to customers.

Liquidity ratios - measure the short-term ability of the entity to pay its maturing obligations and to meet unexpected needs for cash. Purpose of the ratio Ratio Current ratio Quick or Acid-test ratio Receivable turn- I over ratio Average collection period Inventory turnover ratio Ratio Analysis - Liquidity Ratios Number of days in inventory Formula Current assets Current liabilities Cash, Short-term investment, & net receivables Current liabilities Net Credit Sales Average trade receivables (AR) 365 days Receivable turnover ratio Cost of goods sold Average Inventory 365 days Inventory turnover ratio • Measures short-term debt paying ability The ratio expresses the relationship of current assets to current liabilities. It represents the amount of current assets available for every peso of current liability. • Measures immediate short-term liquidity. • The ratio represents the amount of quick assets available for every peso of current liability. • Measures liquidity of receivables. • The ratio measures the number of times, on average, receivables are collected during the period. • Measures the collection efficiency of the entity. The computed period indicates the average number of days before receivables are collected. • Measures liquidity of inventory. • The ratio measures the number of times, on average, inventory is sold during the period. • Measures the sales efficiency of the entity . The computed number of days indicates the length of time spent before inventories are sold to customers.

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter16: Financial Statement Analysis

Section: Chapter Questions

Problem 4E

Related questions

Question

Please provide the following:

• quick ratio

• inventory turnover

• account receivable

Important note: please follow the formula on the lesson attached (photo)

Transcribed Image Text:Liquidity ratios - measure the short-term ability of the entity to pay its maturing obligations and to meet unexpected needs for cash.

Purpose of the ratio

Ratio

Current ratio

Quick or Acid-test

ratio

Receivable turn-

over ratio

Average collection

period

Inventory turnover

ratio

Ratio Analysis - Liquidity Ratios

Number of days in

inventory

Formula

Current assets

Current liabilities

Cash, Short-term investment, & net receivables

Current liabilities

Net Credit Sales

Average trade receivables (AR)

365 days

Receivable turnover ratio

D

Cost of goods sold

Average inventory

365 days

Inventory turnover ratio

• Measures short-term debt paying ability

•The ratio expresses the relationship of current assets current liabilities. It

represents the amount of current assets available for every peso of current

liability.

• Measures immediate short-term liquidity.

. The ratio represents the amount of quick assets available for every peso of

current liability.

• Measures liquidity of receivables.

• The ratio measures the number of times, on average, receivables are collected

during the period.

• Measures the collection efficiency of the entity.

. The computed period indicates the average number of days before receivables

are collected.

• Measures liquidity of inventory.

• The ratio measures the number of times, on average, inventory is sold during the

period.

• Measures the sales efficiency of the entity

• The computed number of days indicates the length of time spent before

inventories are sold to customers.

![Prepare common size statement

Gross sales

Sales return

Sales Discount

Net sales

COS

Selling expense

Admin expense

Asset

Cash

AR

Prepaid insurance

Prepaid rent

Marketable securities

Merchandise inventory

Furniture and fixtures [net]

Land

Building [net]

Total assets

Liabilities and Equity

AP

Notes Payable (due in 6 months)

Total liabilities

Shareholders Equity

Ordinary shares

Retained earnings

Treasury shares

Total Shareholders equity

Total liabilities and Shareholders Equity

B

2018

P3,050,000.00

P3,200.00

P3,000.00

P3,043,800.00

P2,790,000.00

P500,000.00

P300,000.00

2018

P350,000.00

P1,500,000.00

P30,000.00

P120,000.00

P200,000.00

P350,000.00

P400,000.00

P900,000.00

P2,500,000.00

P6,350,000.00

P900,000.00

P490,000.00

P1,390,000.00

P4,000,000.00

P1,010,000.00

(P50,000.00)

P4,960,000.00

P6,350,000.00

P0.00

C

D

Comprehensive income

2019

P4,750,000.00

P16,000.00

P7,000.00

P4,727,000.00

P2,299,000.00

P900,000.00

P700,000.00

Statement of Financial position

2019

P627,000.00

P1,600,000.00

P15,000.00

P120,000.00

P500,000.00

P550,000.00

P350,000.00

P900,000.00

P2,250,000.00

P6,912,000.00

P1,100,000.00

P600,000.00

P1,700,000.00

P4,000,000,00

P1,212,000.00

P5,212,000.00

P6,912,000.00

P0.00

E

F

2020

P8,988,000.00

P35,000.00

P20,100.00

P8,932,900.00

P5,051,000.00

P3,000,000.00

P1,500,000.00

2020

P550,000.00

P1,200,000.00

P50.000.00

P150,000.00

P1,000,000.00

P400,000.00

P300,000.00

P900,000.00

P2,000,000.00

P6,550,000.00

P600,000.00

P200,000.00

P800,000.00

P5000.000.00

P750,000.00

P5,750,000.00

P6,550,000.00

P0.00

G

H

2021

P13,450,000.00

P60,000.00

P45,000.00

P13,345,000.00

P7,605,000.00

P3,090,000.00

P1,900,000.00

2021

P1,500,000.00

P2,000,000.00

P50.000.00

P150,000.00

P500,000.00

P500,000.00

P450,000.00

P900,000.00

P1,750,000.00

P7,800,000.00

P990,000.00

P600,000.00

P1,590,000.00

P5,000,000.00

P1,210,000.00

P6,210,000.00

P7,800,000.00

P0.00](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2F0ea05ab3-6a1d-4147-897f-22f8f7b53553%2Fbd23c599-41b8-46e3-8bce-402fbbd76fc1%2Fhramr4t_processed.jpeg&w=3840&q=75)

Transcribed Image Text:Prepare common size statement

Gross sales

Sales return

Sales Discount

Net sales

COS

Selling expense

Admin expense

Asset

Cash

AR

Prepaid insurance

Prepaid rent

Marketable securities

Merchandise inventory

Furniture and fixtures [net]

Land

Building [net]

Total assets

Liabilities and Equity

AP

Notes Payable (due in 6 months)

Total liabilities

Shareholders Equity

Ordinary shares

Retained earnings

Treasury shares

Total Shareholders equity

Total liabilities and Shareholders Equity

B

2018

P3,050,000.00

P3,200.00

P3,000.00

P3,043,800.00

P2,790,000.00

P500,000.00

P300,000.00

2018

P350,000.00

P1,500,000.00

P30,000.00

P120,000.00

P200,000.00

P350,000.00

P400,000.00

P900,000.00

P2,500,000.00

P6,350,000.00

P900,000.00

P490,000.00

P1,390,000.00

P4,000,000.00

P1,010,000.00

(P50,000.00)

P4,960,000.00

P6,350,000.00

P0.00

C

D

Comprehensive income

2019

P4,750,000.00

P16,000.00

P7,000.00

P4,727,000.00

P2,299,000.00

P900,000.00

P700,000.00

Statement of Financial position

2019

P627,000.00

P1,600,000.00

P15,000.00

P120,000.00

P500,000.00

P550,000.00

P350,000.00

P900,000.00

P2,250,000.00

P6,912,000.00

P1,100,000.00

P600,000.00

P1,700,000.00

P4,000,000,00

P1,212,000.00

P5,212,000.00

P6,912,000.00

P0.00

E

F

2020

P8,988,000.00

P35,000.00

P20,100.00

P8,932,900.00

P5,051,000.00

P3,000,000.00

P1,500,000.00

2020

P550,000.00

P1,200,000.00

P50.000.00

P150,000.00

P1,000,000.00

P400,000.00

P300,000.00

P900,000.00

P2,000,000.00

P6,550,000.00

P600,000.00

P200,000.00

P800,000.00

P5000.000.00

P750,000.00

P5,750,000.00

P6,550,000.00

P0.00

G

H

2021

P13,450,000.00

P60,000.00

P45,000.00

P13,345,000.00

P7,605,000.00

P3,090,000.00

P1,900,000.00

2021

P1,500,000.00

P2,000,000.00

P50.000.00

P150,000.00

P500,000.00

P500,000.00

P450,000.00

P900,000.00

P1,750,000.00

P7,800,000.00

P990,000.00

P600,000.00

P1,590,000.00

P5,000,000.00

P1,210,000.00

P6,210,000.00

P7,800,000.00

P0.00

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning