Lok Company reports net sales of $5,856,480 for Year 2 and $8,679,690 for Year 3. End-of-year balances for total assets are Year 1, $1,686,000; Year 2, $1,800,000; and Year 3, $1,982,000. (1) Compute Lok's total asset turnover for Year 2 and Year 3. (2) Lok's competitor has a Total Asset Turnover of 3.0 during Year 3. Is Lok performing better or worse than its competitor on the basis of total asset turnover? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Compute Lok's total asset turnover for Year 2 and Year 3. Total asset turnover Choose Numerator: Choose Denominator: Total asset turnover %3D Cost of goods sold I Average total assets Total asset turnover Year 2 2$ 2 Year 3 $ < Required 1 Required 2 >

Lok Company reports net sales of $5,856,480 for Year 2 and $8,679,690 for Year 3. End-of-year balances for total assets are Year 1, $1,686,000; Year 2, $1,800,000; and Year 3, $1,982,000. (1) Compute Lok's total asset turnover for Year 2 and Year 3. (2) Lok's competitor has a Total Asset Turnover of 3.0 during Year 3. Is Lok performing better or worse than its competitor on the basis of total asset turnover? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Compute Lok's total asset turnover for Year 2 and Year 3. Total asset turnover Choose Numerator: Choose Denominator: Total asset turnover %3D Cost of goods sold I Average total assets Total asset turnover Year 2 2$ 2 Year 3 $ < Required 1 Required 2 >

Financial And Managerial Accounting

15th Edition

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:WARREN, Carl S.

Chapter9: Long-term Assets: Fixed And Intangible

Section: Chapter Questions

Problem 5MAD

Related questions

Question

100%

This is a 2 part question, can you please show your work on both photo

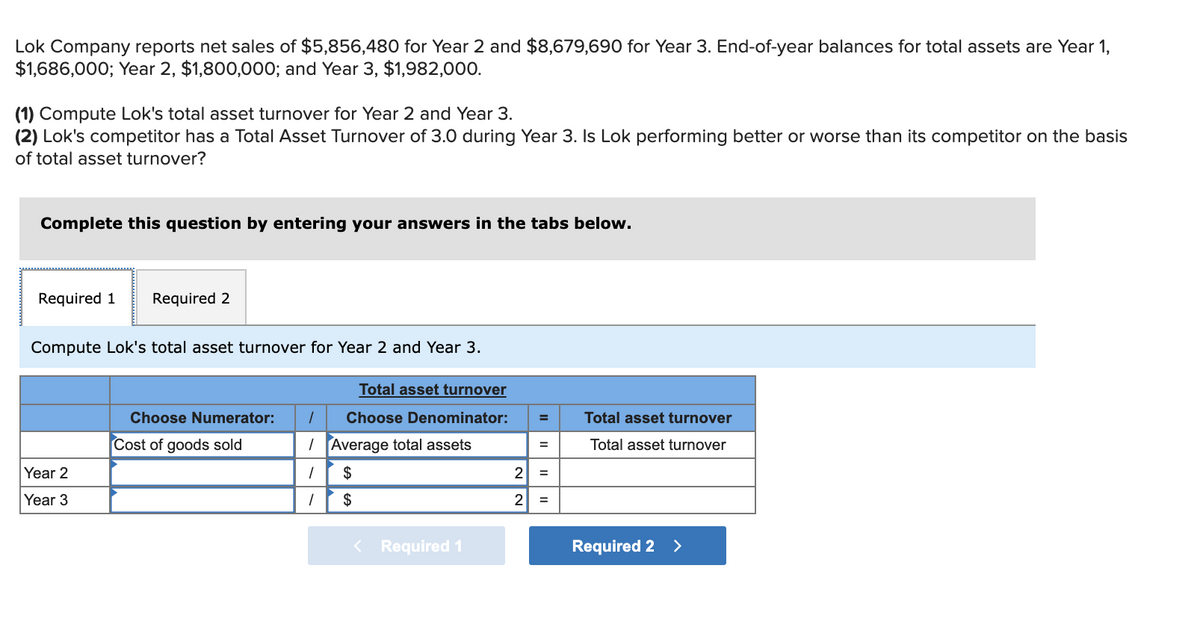

Transcribed Image Text:Lok Company reports net sales of $5,856,480 for Year 2 and $8,679,690 for Year 3. End-of-year balances for total assets are Year 1,

$1,686,000; Year 2, $1,800,000; and Year 3, $1,982,000.

(1) Compute Lok's total asset turnover for Year 2 and Year 3.

(2) Lok's competitor has a Total Asset Turnover of 3.0 during Year 3. Is Lok performing better or worse than its competitor on the basis

of total asset turnover?

Complete this question by entering your answers in the tabs below.

Required 1

Required 2

Compute Lok's total asset turnover for Year 2 and Year 3.

Total asset turnover

Choose Numerator:

Choose Denominator:

Total asset turnover

%3D

Cost of goods sold

I Average total assets

Total asset turnover

Year 2

$

2

%3D

Year 3

$

2

=

< Required 1

Required 2 >

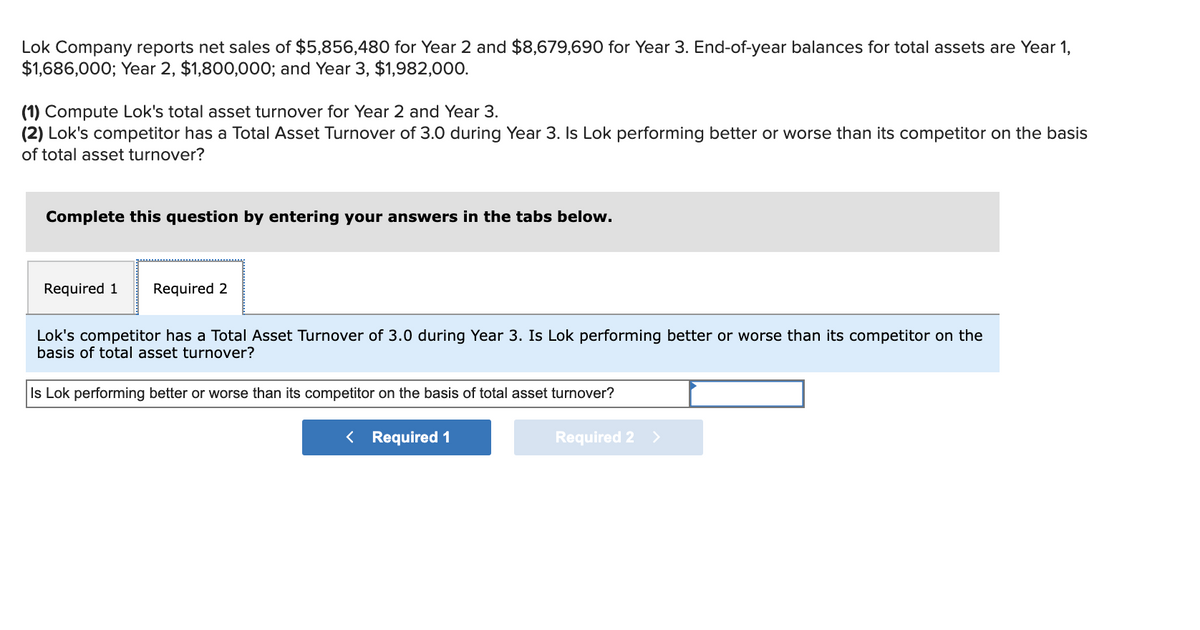

Transcribed Image Text:Lok Company reports net sales of $5,856,480 for Year 2 and $8,679,690 for Year 3. End-of-year balances for total assets are Year 1,

$1,686,000; Year 2, $1,800,000; and Year 3, $1,982,000.

(1) Compute Lok's total asset turnover for Year 2 and Year 3.

(2) Lok's competitor has a Total Asset Turnover of 3.0 during Year 3. Is Lok performing better or worse than its competitor on the basis

of total asset turnover?

Complete this question by entering your answers in the tabs below.

Required 1

Required 2

Lok's competitor has a Total Asset Turnover of 3.0 during Year 3. Is Lok performing better or worse than its competitor on the

basis of total asset turnover?

Is Lok performing better or worse than its competitor on the basis of total asset turnover?

< Required 1

Required 2 >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning