e that it will have operating and maintenance costs as shown in Part (a) and a MV of $0 at the end of four years. D w the data for both alternatives. w the interest and annuity table for discrete compounding when MARR = 10% per year. he challenger is year(s). (Round to the nearest whole number.) le with the ATCFs for the defender. (Round to the nearest dollar.) EOY ATCF 0 10 1 - X

e that it will have operating and maintenance costs as shown in Part (a) and a MV of $0 at the end of four years. D w the data for both alternatives. w the interest and annuity table for discrete compounding when MARR = 10% per year. he challenger is year(s). (Round to the nearest whole number.) le with the ATCFs for the defender. (Round to the nearest dollar.) EOY ATCF 0 10 1 - X

Essentials Of Business Analytics

1st Edition

ISBN:9781285187273

Author:Camm, Jeff.

Publisher:Camm, Jeff.

Chapter11: Monte Carlo Simulation

Section: Chapter Questions

Problem 3P

Related questions

Question

7

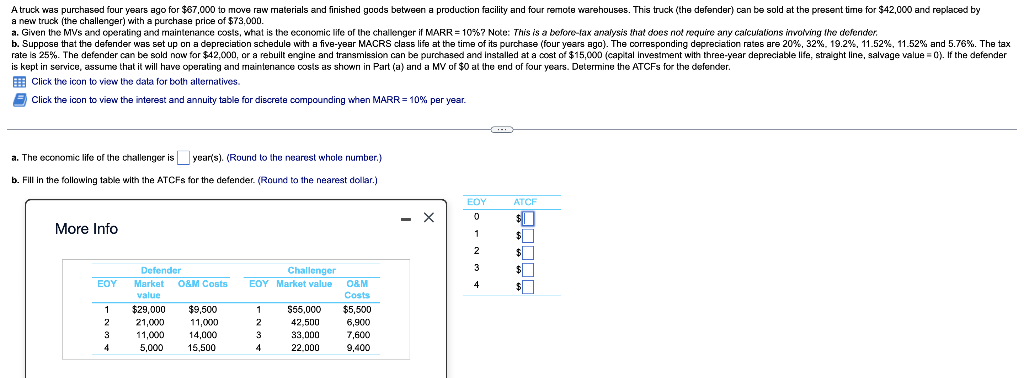

Transcribed Image Text:A truck was purchased four years ago for $67,000 to move raw materials and finished goods between a production facility and four remote warehouses. This truck (the defender) can be sold at the present time for $42,000 and replaced by

a new truck (the challenger) with a purchase price of $73,000.

a. Given the MVs and operating and maintenance costs, what is the economic life of the challenger if MARR = 10% ? Note: This is a before-fax analysis that does not require any calculations involving the defender.

b. Suppose that the defender was set up on a depreciation schedule with a five-year MACRS class life at the time of its purchase (four years ago). The corresponding depreciation rates are 20%, 32 %, 19.2%, 11.52 %, 11.52 % and 5.76%. The tax

rate is 25%. The defender can be sold now for $42,000, or a rebuilt engine and transmission can be purchased and installed at a cost of $15,000 (capital investment with three-year depreciable life, straight line, salvage value = 0). If the defender

is kept in service, assume that it will have operating and maintenance costs as shown in Part (a) and a MV of $0 at the end of four years. Determine the ATCFS for the defender.

Click the icon to view the data for both alternatives.

Click the icon to view the interest and annuity table for discrete compounding when MARR = 10% per year.

a. The economic life of the challenger is year(s). (Round to the nearest whole number.)

b. Fill in the following table with the ATCFS for the defender. (Round to the nearest dollar.)

EOY

ATCF

0

$|

More Info

1

$

2

$

3

Defender

$

Challenger

EOY Market value

EOY

O&M Costs

4

O&M

Costs

$

1

1 $55,000

$5,500

2

42,500

6,900

2

3

33,000

7,600

4

22,000

9,400

3

4

Market

value

$29,000 $9,500

21,000 11,000

14,000

11,000

5,000

15,500

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Essentials Of Business Analytics

Statistics

ISBN:

9781285187273

Author:

Camm, Jeff.

Publisher:

Cengage Learning,

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Essentials Of Business Analytics

Statistics

ISBN:

9781285187273

Author:

Camm, Jeff.

Publisher:

Cengage Learning,

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning