loyees of NAM JEWELS LIMITED are each ent each year. Unused sick leave may be carried taken first out of the current year's entitlement ard from the previous year (a LIFO basis). ber 2019 the average unused entitlement is 2 d che basis of experience that is expected to cor than five days of paid sick leave in 2020 and an of six and a half days each. 2020 to restructure its workforce (which was in hat all employees of the age of 55, but below etire immediately should they choose to do so

loyees of NAM JEWELS LIMITED are each ent each year. Unused sick leave may be carried taken first out of the current year's entitlement ard from the previous year (a LIFO basis). ber 2019 the average unused entitlement is 2 d che basis of experience that is expected to cor than five days of paid sick leave in 2020 and an of six and a half days each. 2020 to restructure its workforce (which was in hat all employees of the age of 55, but below etire immediately should they choose to do so

Chapter3: Social Security Taxes

Section: Chapter Questions

Problem 1MQ: _____1. Employees FICA tax rates A. Severance pay _____2. Form SS-4 B. By the 15th day of the...

Related questions

Question

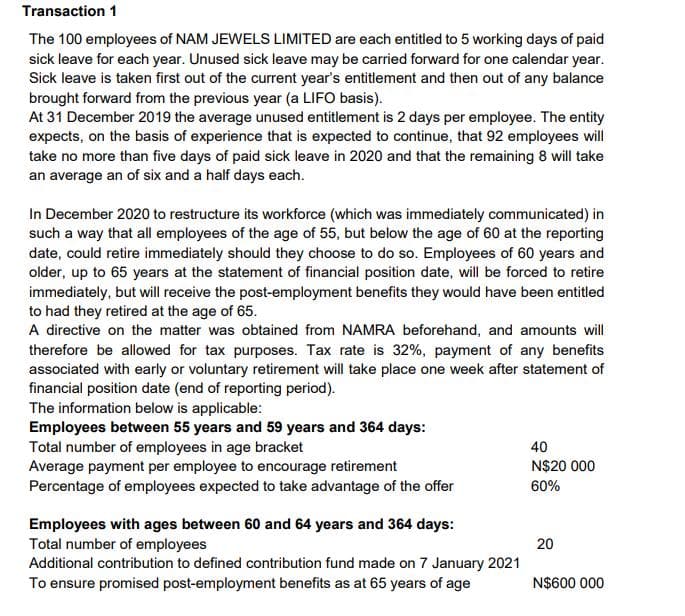

Transcribed Image Text:Transaction 1

The 100 employees of NAM JEWELS LIMITED are each entitled to 5 working days of paid

sick leave for each year. Unused sick leave may be carried forward for one calendar year.

Sick leave is taken first out of the current year's entitlement and then out of any balance

brought forward from the previous year (a LIFO basis).

At 31 December 2019 the average unused entitlement is 2 days per employee. The entity

expects, on the basis of experience that is expected to continue, that 92 employees will

take no more than five days of paid sick leave in 2020 and that the remaining 8 will take

an average an of six and a half days each.

In December 2020 to restructure its workforce (which was immediately communicated) in

such a way that all employees of the age of 55, but below the age of 60 at the reporting

date, could retire immediately should they choose to do so. Employees of 60 years and

older, up to 65 years at the statement of financial position date, will be forced to retire

immediately, but will receive the post-employment benefits they would have been entitled

to had they retired at the age of 65.

A directive on the matter was obtained from NAMRA beforehand, and amounts will

therefore be allowed for tax purposes. Tax rate is 32%, payment of any benefits

associated with early or voluntary retirement will take place one week after statement of

financial position date (end of reporting period).

The information below is applicable:

Employees between 55 years and 59 years and 364 days:

Total number of employees in age bracket

Average payment per employee to encourage retirement

Percentage of employees expected to take advantage of the offer

40

N$20 000

60%

Employees with ages between 60 and 64 years and 364 days:

Total number of employees

Additional contribution to defined contribution fund made on 7 January 2021

To ensure promised post-employment benefits as at 65 years of age

20

N$600 000

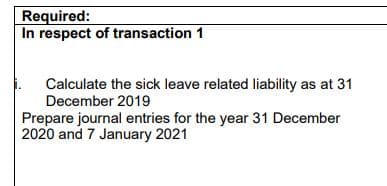

Transcribed Image Text:Required:

In respect of transaction 1

Calculate the sick leave related liability as at 31

December 2019

Prepare journal entries for the year 31 December

2020 and 7 January 2021

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning