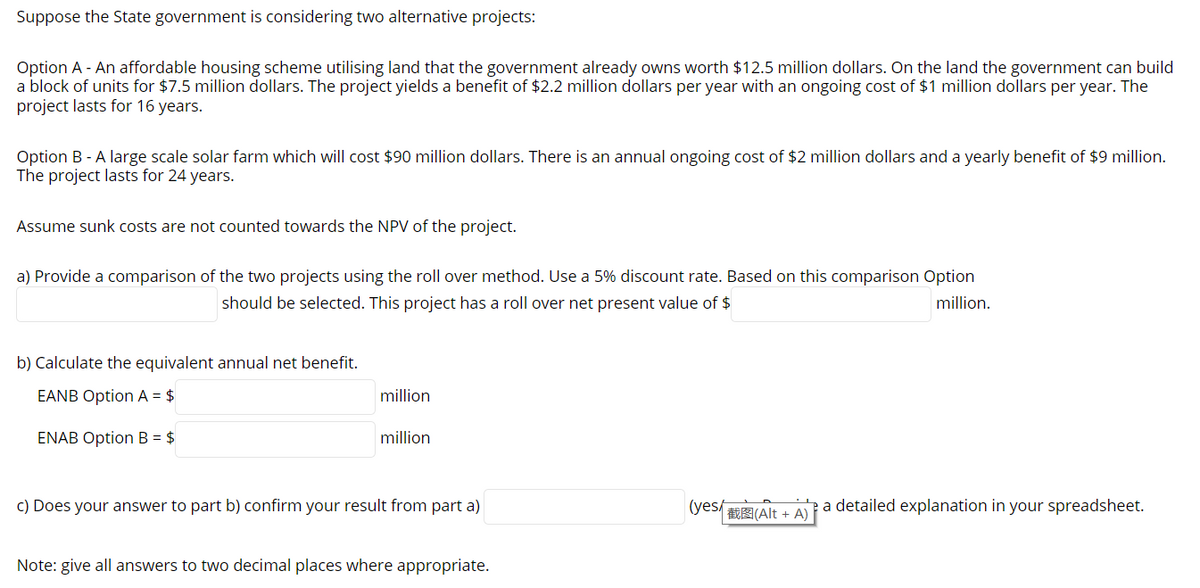

Suppose the State government is considering two alternative projects: Option A - An affordable housing scheme utilising land that the government already owns worth $12.5 million dollars. On the land the government can build a block of units for $7.5 million dollars. The project yields a benefit of $2.2 million dollars per year with an ongoing cost of $1 million dollars per year. The project lasts for 16 years. Option B - A large scale solar farm which will cost $90 million dollars. There is an annual ongoing cost of $2 million dollars and a yearly benefit of $9 million. The project lasts for 24 years. Assume sunk costs are not counted towards the NPV of the project. a) Provide a comparison of the two projects using the roll over method. Use a 5% discount rate. Based on this comparison Option should be selected. This project has a roll over net present value of $ million. b) Calculate the equivalent annual net benefit. EANB Option A = $ million ENAB Option B = $ million c) Does your answer to part b) confirm your result from part a) (yes/ 截图(Alt + A) a detailed explanation in your spreadsheet. Note: give all answers to two decimal places where appropriate.

Suppose the State government is considering two alternative projects: Option A - An affordable housing scheme utilising land that the government already owns worth $12.5 million dollars. On the land the government can build a block of units for $7.5 million dollars. The project yields a benefit of $2.2 million dollars per year with an ongoing cost of $1 million dollars per year. The project lasts for 16 years. Option B - A large scale solar farm which will cost $90 million dollars. There is an annual ongoing cost of $2 million dollars and a yearly benefit of $9 million. The project lasts for 24 years. Assume sunk costs are not counted towards the NPV of the project. a) Provide a comparison of the two projects using the roll over method. Use a 5% discount rate. Based on this comparison Option should be selected. This project has a roll over net present value of $ million. b) Calculate the equivalent annual net benefit. EANB Option A = $ million ENAB Option B = $ million c) Does your answer to part b) confirm your result from part a) (yes/ 截图(Alt + A) a detailed explanation in your spreadsheet. Note: give all answers to two decimal places where appropriate.

Chapter10: Capital Budgeting: Decision Criteria And Real Option

Section10.A: Mutually Exclusive Investments Having Unequal Lives

Problem 1P

Related questions

Question

3

Transcribed Image Text:Suppose the State government is considering two alternative projects:

Option A - An affordable housing scheme utilising land that the government already owns worth $12.5 million dollars. On the land the government can build

a block of units for $7.5 million dollars. The project yields a benefit of $2.2 million dollars per year with an ongoing cost of $1 million dollars per year. The

project lasts for 16 years.

Option B - A large scale solar farm which will cost $90 million dollars. There is an annual ongoing cost of $2 million dollars and a yearly benefit of $9 million.

The project lasts for 24 years.

Assume sunk costs are not counted towards the NPV of the project.

a) Provide a comparison of the two projects using the roll over method. Use a 5% discount rate. Based on this comparison Option

should be selected. This project has a roll over net present value of $

million.

b) Calculate the equivalent annual net benefit.

EANB Option A = $

million

ENAB Option B = $

million

c) Does your answer to part b) confirm your result from part a)

(yes (Alt + A)

a detailed explanation in your spreadsheet.

Note: give all answers to two decimal places where appropriate.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub