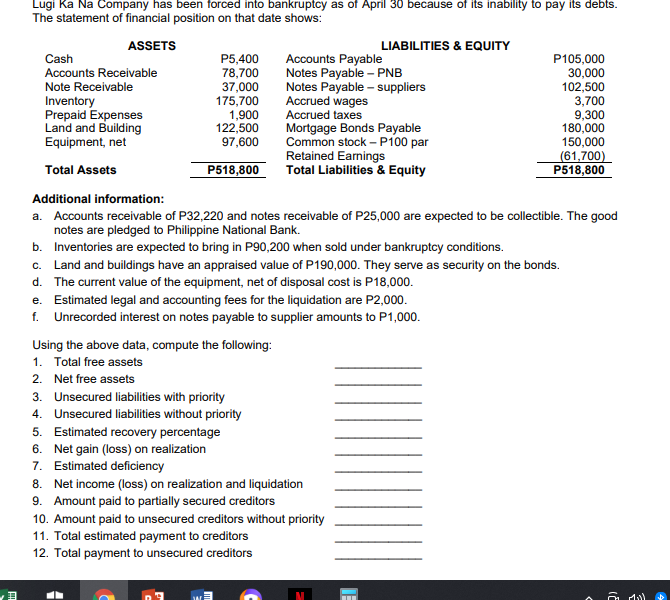

Lugi Ka Na Company has been forced into bankruptcy as of April 30 because of its inability to pay its debts. The statement of financial position on that date shows: ASSETS LIABILITIES & EQUITY Cash P5,400 78,700 37,000 175,700 1,900 122,500 97,600 Accounts Payable Notes Payable – PNB Notes Payable – suppliers Accrued wages P105,000 30,000 102,500 3,700 9,300 180,000 150,000 (61,700) P518,800 Accounts Receivable Note Receivable Inventory Prepaid Expenses Land and Building Equipment, net Accrued taxes Mortgage Bonds Payable Common stock – P100 par Retained Earnings Total Liabilities & Equity Total Assets P518,800 Additional information: a. Accounts receivable of P32,220 and notes receivable of P25,000 are expected to be collectible. The good notes are pledged to Philippine National Bank. b. Inventories are expected to bring in P90,200 when sold under bankruptcy conditions. c. Land and buildings have an appraised value of P190,000. They serve as security on the bonds. d. The current value of the equipment, net of disposal cost is P18,000. e. Estimated legal and accounting fees for the liquidation are P2,000. f. Unrecorded interest on notes payable to supplier amounts to P1,000. Using the above data, compute the following: 1. Total free assets 2. Net free assets 3. Unsecured liabilities with priority

Lugi Ka Na Company has been forced into bankruptcy as of April 30 because of its inability to pay its debts. The statement of financial position on that date shows: ASSETS LIABILITIES & EQUITY Cash P5,400 78,700 37,000 175,700 1,900 122,500 97,600 Accounts Payable Notes Payable – PNB Notes Payable – suppliers Accrued wages P105,000 30,000 102,500 3,700 9,300 180,000 150,000 (61,700) P518,800 Accounts Receivable Note Receivable Inventory Prepaid Expenses Land and Building Equipment, net Accrued taxes Mortgage Bonds Payable Common stock – P100 par Retained Earnings Total Liabilities & Equity Total Assets P518,800 Additional information: a. Accounts receivable of P32,220 and notes receivable of P25,000 are expected to be collectible. The good notes are pledged to Philippine National Bank. b. Inventories are expected to bring in P90,200 when sold under bankruptcy conditions. c. Land and buildings have an appraised value of P190,000. They serve as security on the bonds. d. The current value of the equipment, net of disposal cost is P18,000. e. Estimated legal and accounting fees for the liquidation are P2,000. f. Unrecorded interest on notes payable to supplier amounts to P1,000. Using the above data, compute the following: 1. Total free assets 2. Net free assets 3. Unsecured liabilities with priority

Chapter23: Corporate Restructuring

Section: Chapter Questions

Problem 21QTD

Related questions

Question

Transcribed Image Text:Lugi Ka Na Company has been forced into bankruptcy as of April 30 because of its inability to pay its debts.

The statement of financial position on that date shows:

ASSETS

LIABILITIES & EQUITY

P5,400

78,700

37,000

175,700

1,900

122,500

Accounts Payable

Notes Payable – PNB

Notes Payable – suppliers

Accrued wages

Accrued taxes

Mortgage Bonds Payable

Common stock – P100 par

Retained Earnings

Total Liabilities & Equity

P105,000

30,000

102,500

3,700

9,300

180,000

150,000

(61,700)

P518,800

Cash

Accounts Receivable

Note Receivable

Inventory

Prepaid Expenses

Land and Building

Equipment, net

97,600

Total Assets

P518,800

Additional information:

a. Accounts receivable of P32,220 and notes receivable of P25,000 are expected to be collectible. The good

notes are pledged to Philippine National Bank.

b. Inventories are expected to bring in P90,200 when sold under bankruptcy conditions.

c. Land and buildings have an appraised value of P190,000. They serve as security on the bonds.

d. The current value of the equipment, net of disposal cost is P18,000.

e. Estimated legal and accounting fees for the liquidation are P2,000.

f. Unrecorded interest on notes payable to supplier amounts to P1,000.

Using the above data, compute the following:

1. Total free assets

2. Net free assets

3. Unsecured liabilities with priority

4. Unsecured liabilities without priority

5. Estimated recovery percentage

6. Net gain (loss) on realization

7. Estimated deficiency

8. Net income (loss) on realization and liquidation

9. Amount paid to partially secured creditors

10. Amount paid to unsecured creditors without priority

11. Total estimated payment to creditors

12. Total payment to unsecured creditors

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning