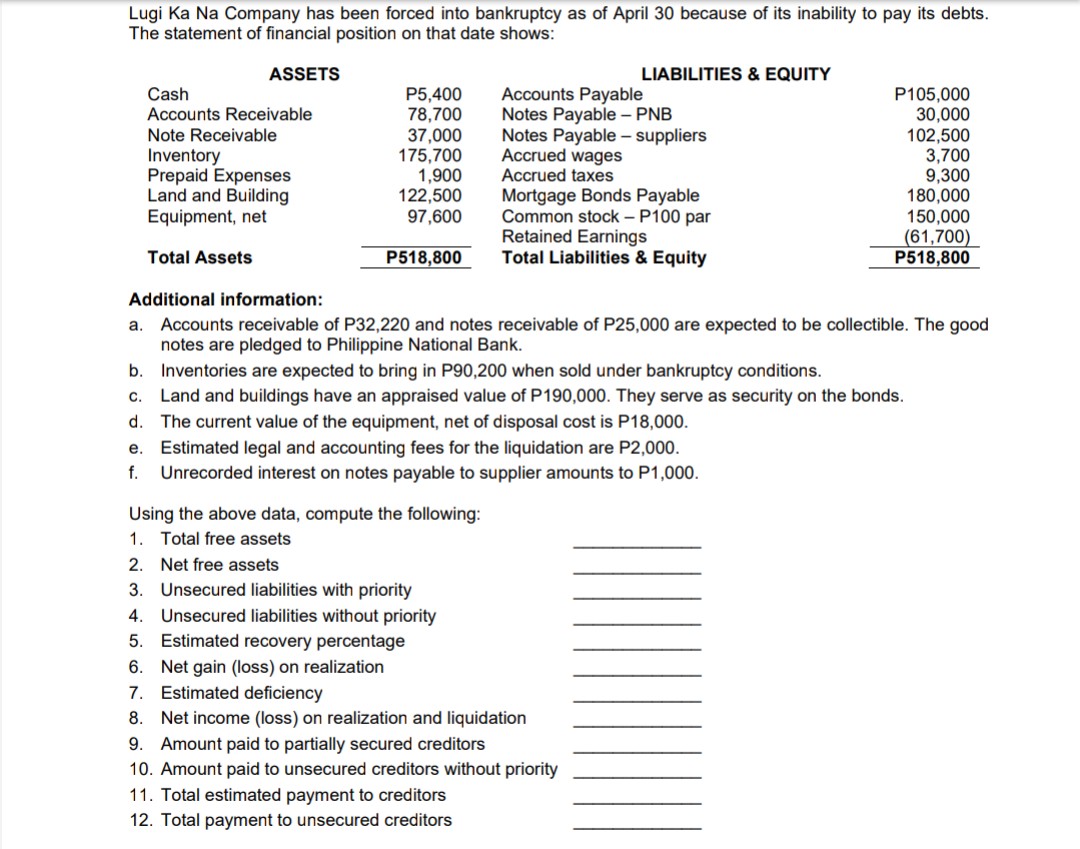

Lugi Ka Na Company has been forced into bankruptcy as of April 30 because of its inability to pay its debts. The statement of financial position on that date shows: ASSETS LIABILITIES & EQUITY Cash Accounts Receivable P5,400 78,700 37,000 175,700 1,900 122,500 97,600 Accounts Payable Notes Payable - PNB Notes Payable – suppliers Accrued wages Accrued taxes P105,000 30,000 102,500 3,700 9,300 180,000 150,000 (61,700) P518,800 Note Receivable Inventory Prepaid Expenses Land and Building Equipment, net Mortgage Bonds Payable Common stock - P100 par Retained Earnings Total Liabilities & Equity Total Assets P518,800 Additional information: a. Accounts receivable of P32,220 and notes receivable of P25,000 are expected to be collectible. The good notes are pledged to Philippine National Bank. b. Inventories are expected to bring in P90,200 when sold under bankruptcy conditions. c. Land and buildings have an appraised value of P190,000. They serve as security on the bonds. d. The current value of the equipment, net of disposal cost is P18,000. e. Estimated legal and accounting fees for the liquidation are P2,000. f. Unrecorded interest on notes payable to supplier amounts to P1,000. Using the above data, compute the following: 1. Total free assets 2. Net free assets 3. Unsecured liabilities with priority 4. Unsecured liabilities without priority 5. Estimated recovery percentage 6. Net gain (loss) on realization 7. Estimated deficiency 8. Net income (loss) on realization and liquidation 9. Amount paid to partially secured creditors 10. Amount paid to unsecured creditors without priority 11. Total estimated payment to creditors 12. Total payment to unsecured creditors

Bad Debts

At the end of the accounting period, a financial statement is prepared by every company, then at that time while preparing the financial statement, the company determines among its total receivable amount how much portion of receivables is collected by the company during that accounting period.

Accounts Receivable

The word “account receivable” means the payment is yet to be made for the work that is already done. Generally, each and every business sells its goods and services either in cash or in credit. So, when the goods are sold on credit account receivable arise which means the company is going to get the payment from its customer to whom the goods are sold on credit. Usually, the credit period may be for a very short period of time and in some rare cases it takes a year.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images