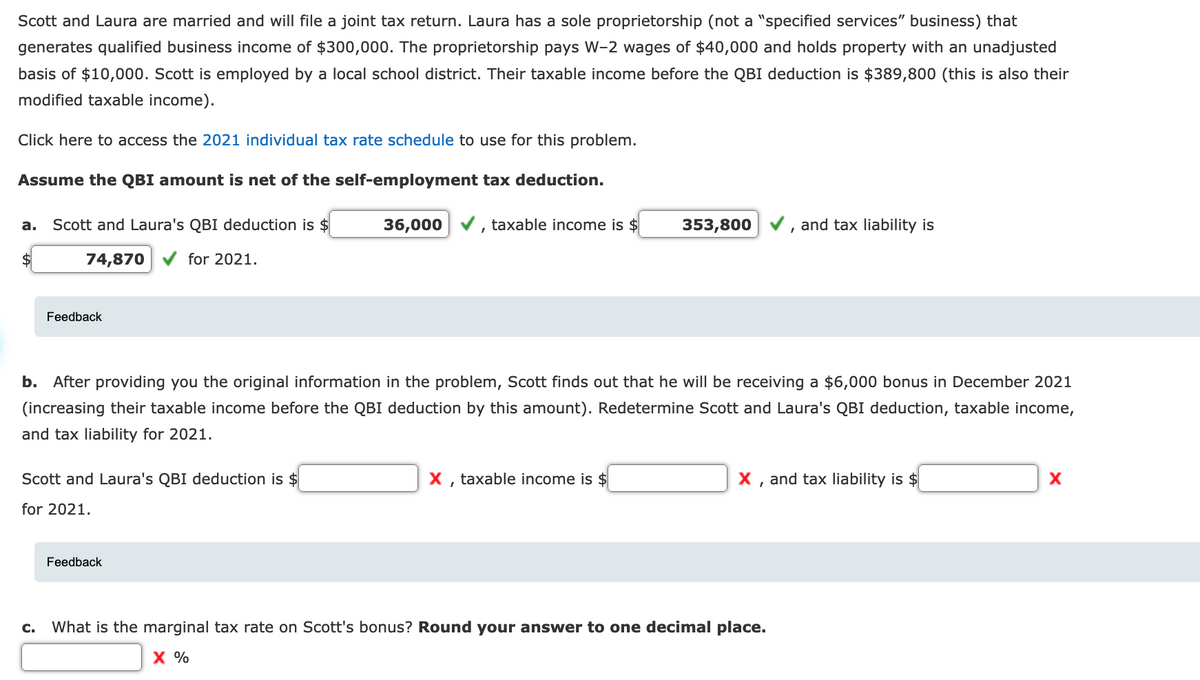

Scott and Laura are married and will file a joint tax return. Laura has a sole proprietorship (not a "specified services" business) that generates qualified business income of $300,000. The proprietorship pays W-2 wages of $40,000 and holds property with an unadjusted basis of $10,000. Scott is employed by a local school district. Their taxable income before the QBI deduction is $389,800 (this is also their modified taxable income). Click here to access the 2021 individual tax rate schedule to use for this problem. Assume the QBI amount is net of the self-employment tax deduction. a. Scott and Laura's QBI deduction is $ 36,000 v, taxable income is $ 353,800 , and tax liability is $ 74,870 V for 2021. Feedback b. After providing you the original information in the problem, Scott finds out that he will be receiving a $6,000 bonus in December 2021 (increasing their taxable income before the QBI deduction by this amount). Redetermine Scott and Laura's QBI deduction, taxable income, and tax liability for 2021. Scott and Laura's QBI deduction is $ X , taxable income is $ X, and tax liability is $ for 2021. Feedback c. What is the marginal tax rate on Scott's bonus? Round your answer to one decimal place. X %

Scott and Laura are married and will file a joint tax return. Laura has a sole proprietorship (not a "specified services" business) that generates qualified business income of $300,000. The proprietorship pays W-2 wages of $40,000 and holds property with an unadjusted basis of $10,000. Scott is employed by a local school district. Their taxable income before the QBI deduction is $389,800 (this is also their modified taxable income). Click here to access the 2021 individual tax rate schedule to use for this problem. Assume the QBI amount is net of the self-employment tax deduction. a. Scott and Laura's QBI deduction is $ 36,000 v, taxable income is $ 353,800 , and tax liability is $ 74,870 V for 2021. Feedback b. After providing you the original information in the problem, Scott finds out that he will be receiving a $6,000 bonus in December 2021 (increasing their taxable income before the QBI deduction by this amount). Redetermine Scott and Laura's QBI deduction, taxable income, and tax liability for 2021. Scott and Laura's QBI deduction is $ X , taxable income is $ X, and tax liability is $ for 2021. Feedback c. What is the marginal tax rate on Scott's bonus? Round your answer to one decimal place. X %

Chapter6: Business Expenses

Section: Chapter Questions

Problem 47P

Related questions

Question

PLEASE ONLY PROVIDE EXPLANATIONS AND ANSWERS FOR B AND C. I ALREADY KNOW A! THANK YOU.

Transcribed Image Text:Scott and Laura are married and will file a joint tax return. Laura has a sole proprietorship (not a "specified services" business) that

generates qualified business income of $300,000. The proprietorship pays W-2 wages of $40,000 and holds property with an unadjusted

basis of $10,000. Scott is employed by a local school district. Their taxable income before the QBI deduction is $389,800 (this is also their

modified taxable income).

Click here to access the 2021 individual tax rate schedule to use for this problem.

Assume the QBI amount is net of the self-employment tax deduction.

а.

Scott and Laura's QBI deduction is $

36,000

taxable income is $

353,800

and tax liability is

$

74,870

for 2021.

Feedback

b.

After providing you the original information in the problem, Scott finds out that he will be receiving a $6,000 bonus in December 2021

(increasing their taxable income before the QBI deduction by this amount). Redetermine Scott and Laura's QBI deduction, taxable income,

and tax liability for 2021.

Scott and Laura's QBI deduction is $

X, taxable income is $

X , and tax liability is $

for 2021.

Feedback

C.

What is the marginal tax rate on Scott's bonus? Round your answer to one decimal place.

X %

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT