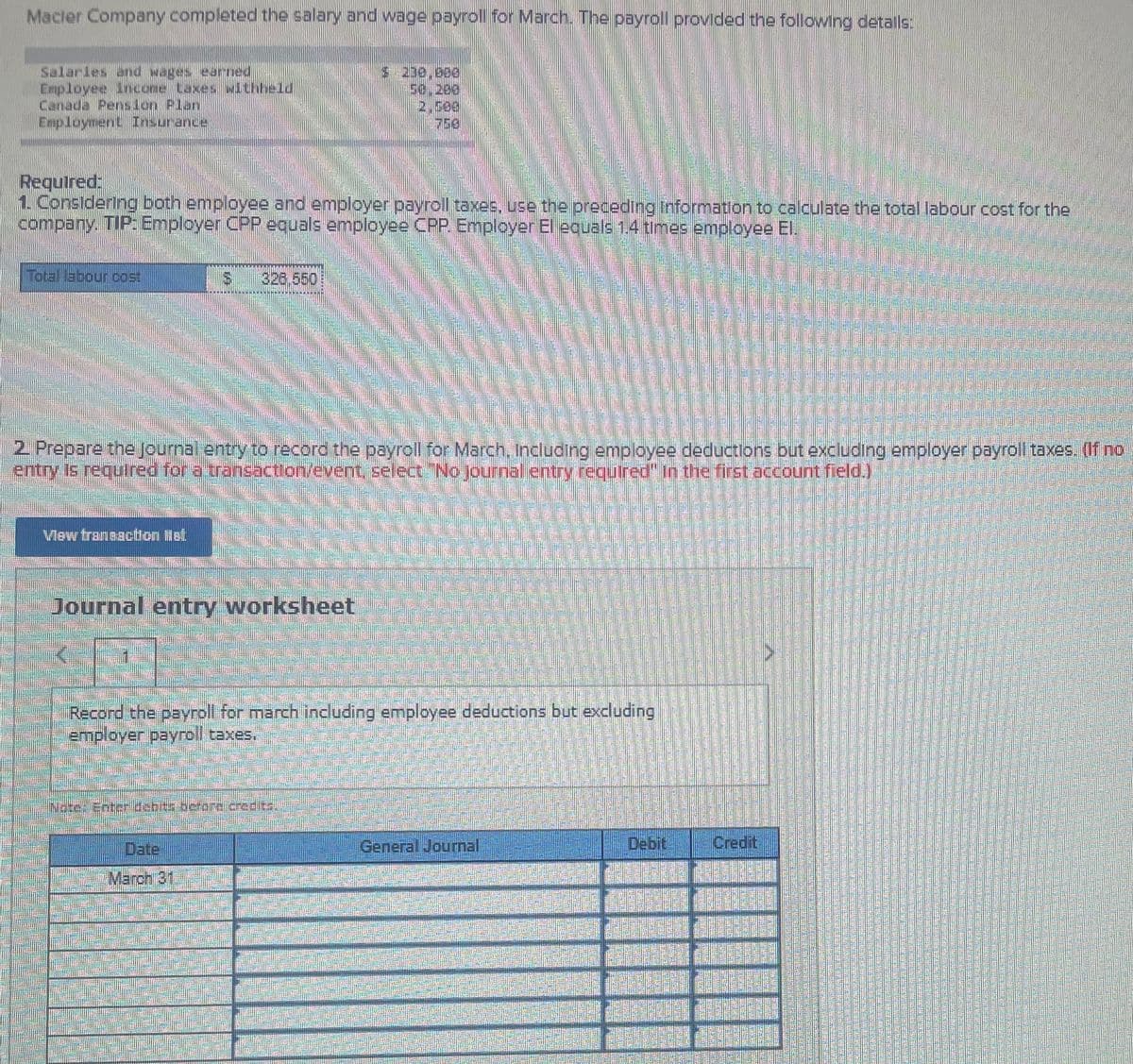

Macler Company completed the salary and wage payroll for March. The payroll provided the following detals: Salaries and wages earned Employee Income taxes withheld Canada Pension Plan Employment Insurance $ 230,000 se,200 2,500 750 equired: Considering both employee and employer payroll taxes, use the preceding Information to calculate the total labour cost for the ompany. TIP: Employer CPP equals employee CPP. Employer El equals 1.4 times employee El. Total labour cost 326,550

Macler Company completed the salary and wage payroll for March. The payroll provided the following detals: Salaries and wages earned Employee Income taxes withheld Canada Pension Plan Employment Insurance $ 230,000 se,200 2,500 750 equired: Considering both employee and employer payroll taxes, use the preceding Information to calculate the total labour cost for the ompany. TIP: Employer CPP equals employee CPP. Employer El equals 1.4 times employee El. Total labour cost 326,550

Principles of Cost Accounting

17th Edition

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Edward J. Vanderbeck, Maria R. Mitchell

Chapter3: Accounting For Labor

Section: Chapter Questions

Problem 12E: A weekly payroll summary made from labor time records shows the following data for Pima Company:...

Related questions

Question

100%

Need help with accounting

Transcribed Image Text:Macler Company completed the salary and wage payroll for March. The payroll provided the following detalls

s 200,000

2,5e

Required:

1 Considering both employee and employer payroll taxes. use the preceding Information to calculate the total labour cost for the

company. TIP: Employer CPRP equals employee CPP. Employer El equals 1.4 times employee El.

Total labour cost

326,550

2 Prepare the Journal entry to record the payroll for March, Including employee deductions but excluding employer payroll taxes. (If ro

entry Is requred for a transaction/event, select No journal entry requlred" In the first account field.)

Vlew trannacton ilel

Journal entry worksheet

Recond the payroll for march including employee deductions but excluding

employer payroll taxes.

INote: Enter debits berare credits

Date

General Journal

Debit.

Credit

T March 31,

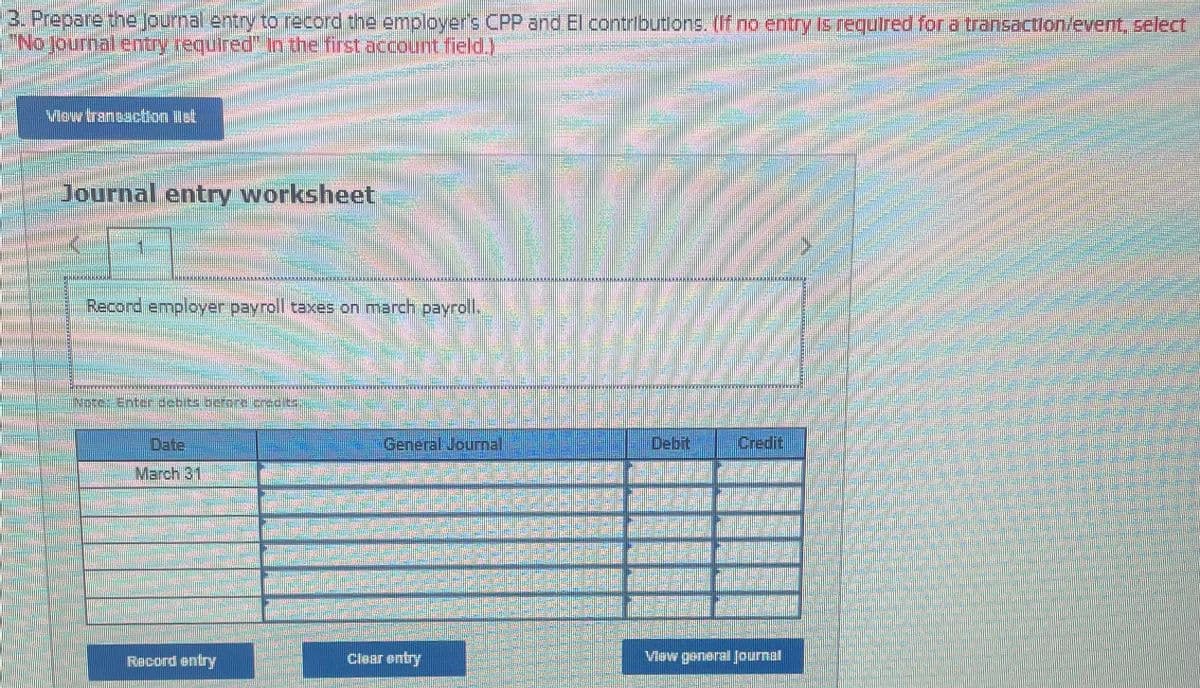

Transcribed Image Text:3. Prepare the journal entry to record the employer's CPP and El contributons. (If no entry is required for a transaction/event, select

"No.journal entry required" In the first account field.)

Vow tranuaction list

Journal entry worksheet

台灣券

Record employer payroll taxes on march payroll.

Date

General Jourmal.

Debit

Credit

March 31

Record entry

Clear entry

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning