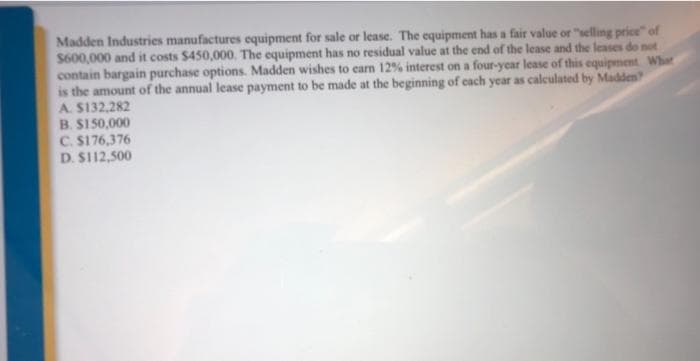

Madden Industries manufactures equipment for sale or lease. The equipment has a fair value or "selling price" of $600,000 and it costs $450,000. The equipment has no residual value at the end of the lease and the leases do not contain bargain purchase options. Madden wishes to earn 12% interest on a four-year lease of this equipment Wher is the amount of the annual lease payment to be made at the beginning of cach year as calculated by Madden A. $132,282 B. SI50,000 C. S176,376 D. SI12,500

Madden Industries manufactures equipment for sale or lease. The equipment has a fair value or "selling price" of $600,000 and it costs $450,000. The equipment has no residual value at the end of the lease and the leases do not contain bargain purchase options. Madden wishes to earn 12% interest on a four-year lease of this equipment Wher is the amount of the annual lease payment to be made at the beginning of cach year as calculated by Madden A. $132,282 B. SI50,000 C. S176,376 D. SI12,500

Chapter19: Lease And Intermediate-term Financing

Section: Chapter Questions

Problem 1P

Related questions

Question

Transcribed Image Text:Madden Industries manufactures equipment for sale or lease. The equipment has a fair value or "selling price" of

$600,000 and it costs $450,000. The equipment has no residual value at the end of the lease and the leases do not

contain bargain purchase options. Madden wishes to earm 12% interest on a four-year lease of this equipment Whet

is the amount of the annual lease payment to be made at the beginning of cach year as caleculated by Madden

A. $132,282

B. S150,000

C. S176,376

D. S112,500

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Business Its Legal Ethical & Global Environment

Accounting

ISBN:

9781305224414

Author:

JENNINGS

Publisher:

Cengage