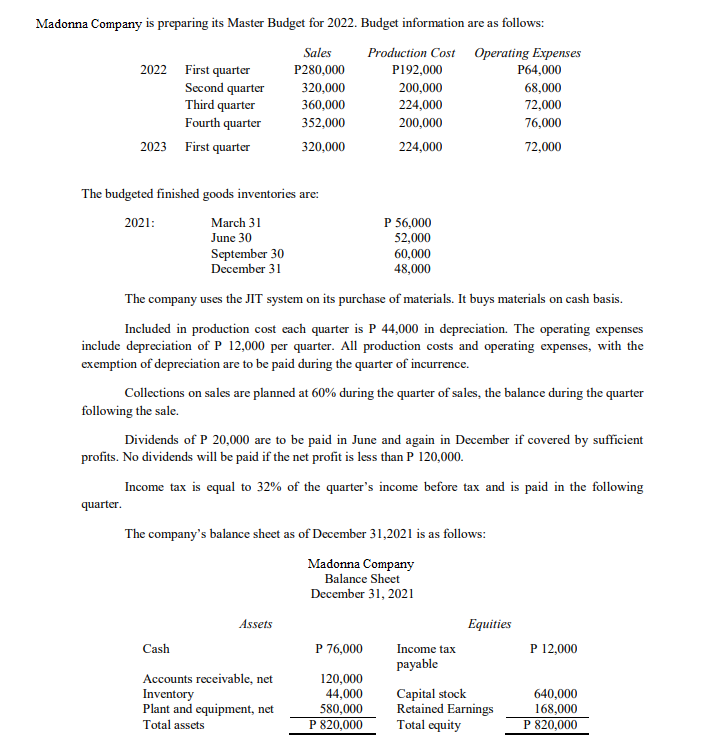

Madonna Company is preparing its Master Budget for 2022. Budget information are as follows: Sales Production Cost Operating Expenses P192,000 2022 First quarter Second quarter Third quarter Fourth quarter P280,000 P64,000 320,000 200,000 68,000 360,000 224,000 72,000 352,000 200,000 76,000 2023 First quarter 320,000 224,000 72,000 The budgeted finished goods inventories are: P 56,000 52,000 60,000 48,000 2021: March 31 June 30 September 30 December 31 The company uses the JIT system on its purchase of materials. It buys materials on cash basis. Included in production cost cach quarter is P 44,000 in depreciation. The operating expenses include depreciation of P 12,000 per quarter. All production costs and operating expenses, with the exemption of depreciation are to be paid during the quarter of incurrence. Collections on sales are planned at 60% during the quarter of sales, the balance during the quarter following the sale. Dividends of P 20,000 are to be paid in June and again in December if covered by sufficient profits. No dividends will be paid if the net profit is less than P 120,000. Income tax is equal to 32% of the quarter's income before tax and is paid in the following quarter. The company's balance sheet as of December 31,2021 is as follows: Madonna Company Balance Sheet December 31, 2021 Assets Equities Cash P 76,000 Income tax P 12,000 payable Accounts receivable, net 120,000 Inventory Plant and equipment, net Total assets Capital stock Retained Earnings Total equity 44,000 640,000 168,000 580,000 P 820,000 P 820,000

Madonna Company is preparing its Master Budget for 2022. Budget information are as follows: Sales Production Cost Operating Expenses P192,000 2022 First quarter Second quarter Third quarter Fourth quarter P280,000 P64,000 320,000 200,000 68,000 360,000 224,000 72,000 352,000 200,000 76,000 2023 First quarter 320,000 224,000 72,000 The budgeted finished goods inventories are: P 56,000 52,000 60,000 48,000 2021: March 31 June 30 September 30 December 31 The company uses the JIT system on its purchase of materials. It buys materials on cash basis. Included in production cost cach quarter is P 44,000 in depreciation. The operating expenses include depreciation of P 12,000 per quarter. All production costs and operating expenses, with the exemption of depreciation are to be paid during the quarter of incurrence. Collections on sales are planned at 60% during the quarter of sales, the balance during the quarter following the sale. Dividends of P 20,000 are to be paid in June and again in December if covered by sufficient profits. No dividends will be paid if the net profit is less than P 120,000. Income tax is equal to 32% of the quarter's income before tax and is paid in the following quarter. The company's balance sheet as of December 31,2021 is as follows: Madonna Company Balance Sheet December 31, 2021 Assets Equities Cash P 76,000 Income tax P 12,000 payable Accounts receivable, net 120,000 Inventory Plant and equipment, net Total assets Capital stock Retained Earnings Total equity 44,000 640,000 168,000 580,000 P 820,000 P 820,000

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter8: Budgeting

Section: Chapter Questions

Problem 1PB

Related questions

Question

- What is the budgeted balance of

retained earnings as of December 31, 2022? - What is the expected balance of the plant and equipment accounts as of December 31, 2022?

- If a budgeted balance sheet as of December 31, 2022 is to be prepared, how much will be the total assets?

Transcribed Image Text:Madonna Company is preparing its Master Budget for 2022. Budget information are as follows:

Sales

Production Cost Operating Expenses

2022 First quarter

P280,000

P192,000

P64,000

200,000

68,000

Second quarter

Third quarter

Fourth quarter

320,000

360,000

224,000

72,000

352,000

200,000

76,000

2023 First quarter

320,000

224,000

72,000

The budgeted finished goods inventories are:

2021:

March 31

P 56,000

52,000

June 30

September 30

December 31

60,000

48,000

The company uses the JIT system on its purchase of materials. It buys materials on cash basis.

Included in production cost each quarter is P 44,000 in depreciation. The operating expenses

include depreciation of P 12,000 per quarter. All production costs and operating expenses, with the

exemption of depreciation are to be paid during the quarter of incurrence.

Collections on sales are planned at 60% during the quarter of sales, the balance during the quarter

following the sale.

Dividends of P 20,000 are to be paid in June and again in December if covered by sufficient

profits. No dividends will be paid if the net profit is less than P 120,000.

Income tax is equal to 32% of the quarter's income before tax and is paid in the following

quarter.

The company's balance sheet as of December 31,2021 is as follows:

Madonna Company

Balance Sheet

December 31, 2021

Assets

Equities

Cash

P 76,000

Income tax

P 12,000

payable

Accounts receivable, net

Inventory

Plant and equipment, net

Total assets

120,000

44,000

580,000

P 820,000

Capital stock

Retained Earnings

Total equity

640,000

168,000

P 820,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning