Main Third Party Resource | LCS Learni X O WileyPLUS Third Party Resource | LCS Learni x + edugen.wileyplus.com/edugen/Iti/main.uni LUS S Kieso, Intermediate Accounting, 17e Help | System Announcements CALCULATOR PRINTER VERSION 1 BACK NEXT RCES Your answer is partially correct. Try again. Marigold Inc. owns and operates a number of hardware stores in the New England region. Recently, the company has decided to locate another store in a rapidly growing area of Maryland. The company is trying to decide whether to purchase or lease the building and related facilities. Purchase: The company can purchase the site, construct the building, and purchase all store fixtures. The cost would be $1,861,400. An immediate down payment of $406,400 is required, and the remaining $1,455,000 would be paid off over 5 years at $354,200 per year (including interest payments made at end of year). The property is expected to have a useful life of 12 years, and then it will be sold for $508,400. As the owner of the property, the company will have the following out-of-pocket expenses each period. Property taxes (to be paid at the end of each year) Insurance (to be paid at the beginning of each year) Other (primarily maintenance which occurs at the end of each year) $41,860 26,960 17,170 $85,990 Lease: First National Bank has agreed to purchase the site, construct the building, and install the appropriate fixtures for Marigold Inc. if Marigold will lease the completed facility for 12 years. The annual costs for the lease would be $266,320. Marigold would have no responsibility related to the facility over the 12 years. The terms of the lease are that Marigold would be required to make 12 annual payments (the first payment to be made at the time the store opens and then each following year). In addition, a deposit of $104,900 is required when the store is opened. This deposit will be returned at the end of the 12th year, assuming no unusual damage to the building structure or fixtures. Study Click here to view factor tables Compute the present value of lease vs purchase. (Currently, the cost of funds for Marigold Inc. is 11%.) (Round factor values to 5 decimal places, e.g. 1.25124 and final answer to 0 decimal places, e.g. 458,581.) Purchase Lease 212844 Present value 180395 Which of the two approaches should Marigold Inc. follow? Asivate Wnd "lease the facilities Marigold Inc. should 847 PM LINK TO TEXT 3/29/2020 LINK TO TEXT ere to search Fedugen/player/references/index.uni?mode%3Dhelp&xlinkobject=kieso9781119503682_hidden-sec-00848itemid=nopolice Future Value of 1 (Future Value of a Single Sum) FVFni = (1+ i)" (n) Periods 2% 3% 4% 5% 6% 1 1.02000 1.02500 1.03000 1.04000 1.05000 1.06000 1.12360 1.04040 1.05063 1.06090 1.08160 1.10250 1.06121 1.07689 1.09273 1.12486 1.19102 1.26248 1.33823 1.15763 4. 1.08243 1.10381 1.12551 1.16986 1.21551 1.10408 1.13141 1.15927 1.21665 1.27628 6. 1.12616 1.15969 1.19405 1.26532 1.34010 1.41852 1.14869 1.18869 1.22987 1.31593 1.40710 1.50363 1.17166 1.21840 1.26677 1.36857 1.47746 1.59385 1. 19509 1.24886 1.30477 1.42331 1.55133 1.68948 10 1.21899 1.28008 1.34392 1.48024 1.62889 1.79085 11 1.24337 1.31209 1.38423 1.53945 1.71034 1.89830 12 1.26824 1.34489 1.42576 1.60103 1.79586 2.01220 13 1.29361 1.37851 1.46853 1.66507 1.88565 2.13293 14 1.31948 1.41297 1.51259 1.73168 1.97993 2.26090 15 1.34587 1.44830 1.55797 1.80094 2.07893 2.39656 16 1.37279 1.48451 1.60471 1.87298 2.18287 2.54035 17 1.40024 1.52162 1.65285 1.94790 2.29202 2.69277 18 1.42825 1.55966 1.70243 2.02582 2.40662 2.85434 19 1.45681 1.75351 2.10685 2.52695 3.02560 1.59865 1.63862 Activate Wind 20 1.48595 1.80611 2.19112 2.65330 3.20714 ch 32 2.

Main Third Party Resource | LCS Learni X O WileyPLUS Third Party Resource | LCS Learni x + edugen.wileyplus.com/edugen/Iti/main.uni LUS S Kieso, Intermediate Accounting, 17e Help | System Announcements CALCULATOR PRINTER VERSION 1 BACK NEXT RCES Your answer is partially correct. Try again. Marigold Inc. owns and operates a number of hardware stores in the New England region. Recently, the company has decided to locate another store in a rapidly growing area of Maryland. The company is trying to decide whether to purchase or lease the building and related facilities. Purchase: The company can purchase the site, construct the building, and purchase all store fixtures. The cost would be $1,861,400. An immediate down payment of $406,400 is required, and the remaining $1,455,000 would be paid off over 5 years at $354,200 per year (including interest payments made at end of year). The property is expected to have a useful life of 12 years, and then it will be sold for $508,400. As the owner of the property, the company will have the following out-of-pocket expenses each period. Property taxes (to be paid at the end of each year) Insurance (to be paid at the beginning of each year) Other (primarily maintenance which occurs at the end of each year) $41,860 26,960 17,170 $85,990 Lease: First National Bank has agreed to purchase the site, construct the building, and install the appropriate fixtures for Marigold Inc. if Marigold will lease the completed facility for 12 years. The annual costs for the lease would be $266,320. Marigold would have no responsibility related to the facility over the 12 years. The terms of the lease are that Marigold would be required to make 12 annual payments (the first payment to be made at the time the store opens and then each following year). In addition, a deposit of $104,900 is required when the store is opened. This deposit will be returned at the end of the 12th year, assuming no unusual damage to the building structure or fixtures. Study Click here to view factor tables Compute the present value of lease vs purchase. (Currently, the cost of funds for Marigold Inc. is 11%.) (Round factor values to 5 decimal places, e.g. 1.25124 and final answer to 0 decimal places, e.g. 458,581.) Purchase Lease 212844 Present value 180395 Which of the two approaches should Marigold Inc. follow? Asivate Wnd "lease the facilities Marigold Inc. should 847 PM LINK TO TEXT 3/29/2020 LINK TO TEXT ere to search Fedugen/player/references/index.uni?mode%3Dhelp&xlinkobject=kieso9781119503682_hidden-sec-00848itemid=nopolice Future Value of 1 (Future Value of a Single Sum) FVFni = (1+ i)" (n) Periods 2% 3% 4% 5% 6% 1 1.02000 1.02500 1.03000 1.04000 1.05000 1.06000 1.12360 1.04040 1.05063 1.06090 1.08160 1.10250 1.06121 1.07689 1.09273 1.12486 1.19102 1.26248 1.33823 1.15763 4. 1.08243 1.10381 1.12551 1.16986 1.21551 1.10408 1.13141 1.15927 1.21665 1.27628 6. 1.12616 1.15969 1.19405 1.26532 1.34010 1.41852 1.14869 1.18869 1.22987 1.31593 1.40710 1.50363 1.17166 1.21840 1.26677 1.36857 1.47746 1.59385 1. 19509 1.24886 1.30477 1.42331 1.55133 1.68948 10 1.21899 1.28008 1.34392 1.48024 1.62889 1.79085 11 1.24337 1.31209 1.38423 1.53945 1.71034 1.89830 12 1.26824 1.34489 1.42576 1.60103 1.79586 2.01220 13 1.29361 1.37851 1.46853 1.66507 1.88565 2.13293 14 1.31948 1.41297 1.51259 1.73168 1.97993 2.26090 15 1.34587 1.44830 1.55797 1.80094 2.07893 2.39656 16 1.37279 1.48451 1.60471 1.87298 2.18287 2.54035 17 1.40024 1.52162 1.65285 1.94790 2.29202 2.69277 18 1.42825 1.55966 1.70243 2.02582 2.40662 2.85434 19 1.45681 1.75351 2.10685 2.52695 3.02560 1.59865 1.63862 Activate Wind 20 1.48595 1.80611 2.19112 2.65330 3.20714 ch 32 2.

Fundamentals Of Financial Management, Concise Edition (mindtap Course List)

10th Edition

ISBN:9781337902571

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Eugene F. Brigham, Joel F. Houston

Chapter4: Analysis Of Financial Statements

Section: Chapter Questions

Problem 3TCL: CONDUCTING A FINANCIAL RATIO ANALYSIS ON HP INC. Use online resources to work on this chapters...

Related questions

Question

Need your help please

Transcribed Image Text:Main

Third Party Resource | LCS Learni X

O WileyPLUS

Third Party Resource | LCS Learni x +

edugen.wileyplus.com/edugen/Iti/main.uni

LUS

S Kieso, Intermediate Accounting, 17e

Help | System Announcements

CALCULATOR

PRINTER VERSION

1 BACK

NEXT

RCES

Your answer is partially correct. Try again.

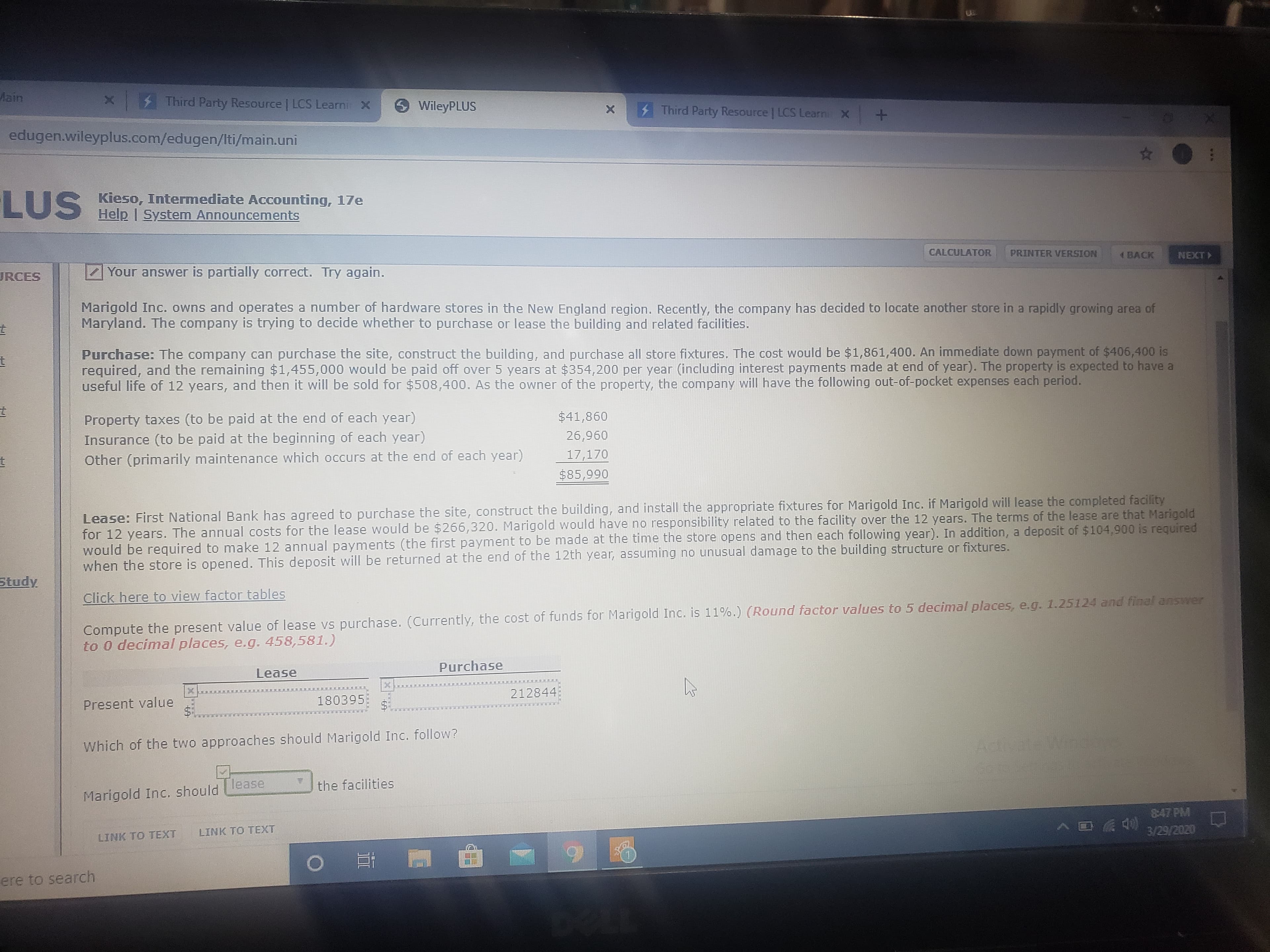

Marigold Inc. owns and operates a number of hardware stores in the New England region. Recently, the company has decided to locate another store in a rapidly growing area of

Maryland. The company is trying to decide whether to purchase or lease the building and related facilities.

Purchase: The company can purchase the site, construct the building, and purchase all store fixtures. The cost would be $1,861,400. An immediate down payment of $406,400 is

required, and the remaining $1,455,000 would be paid off over 5 years at $354,200 per year (including interest payments made at end of year). The property is expected to have a

useful life of 12 years, and then it will be sold for $508,400. As the owner of the property, the company will have the following out-of-pocket expenses each period.

Property taxes (to be paid at the end of each year)

Insurance (to be paid at the beginning of each year)

Other (primarily maintenance which occurs at the end of each year)

$41,860

26,960

17,170

$85,990

Lease: First National Bank has agreed to purchase the site, construct the building, and install the appropriate fixtures for Marigold Inc. if Marigold will lease the completed facility

for 12 years. The annual costs for the lease would be $266,320. Marigold would have no responsibility related to the facility over the 12 years. The terms of the lease are that Marigold

would be required to make 12 annual payments (the first payment to be made at the time the store opens and then each following year). In addition, a deposit of $104,900 is required

when the store is opened. This deposit will be returned at the end of the 12th year, assuming no unusual damage to the building structure or fixtures.

Study

Click here to view factor tables

Compute the present value of lease vs purchase. (Currently, the cost of funds for Marigold Inc. is 11%.) (Round factor values to 5 decimal places, e.g. 1.25124 and final answer

to 0 decimal places, e.g. 458,581.)

Purchase

Lease

212844

Present value

180395

Which of the two approaches should Marigold Inc. follow?

Asivate Wnd

"lease

the facilities

Marigold Inc. should

847 PM

LINK TO TEXT

3/29/2020

LINK TO TEXT

ere to search

Transcribed Image Text:Fedugen/player/references/index.uni?mode%3Dhelp&xlinkobject=kieso9781119503682_hidden-sec-00848itemid=nopolice

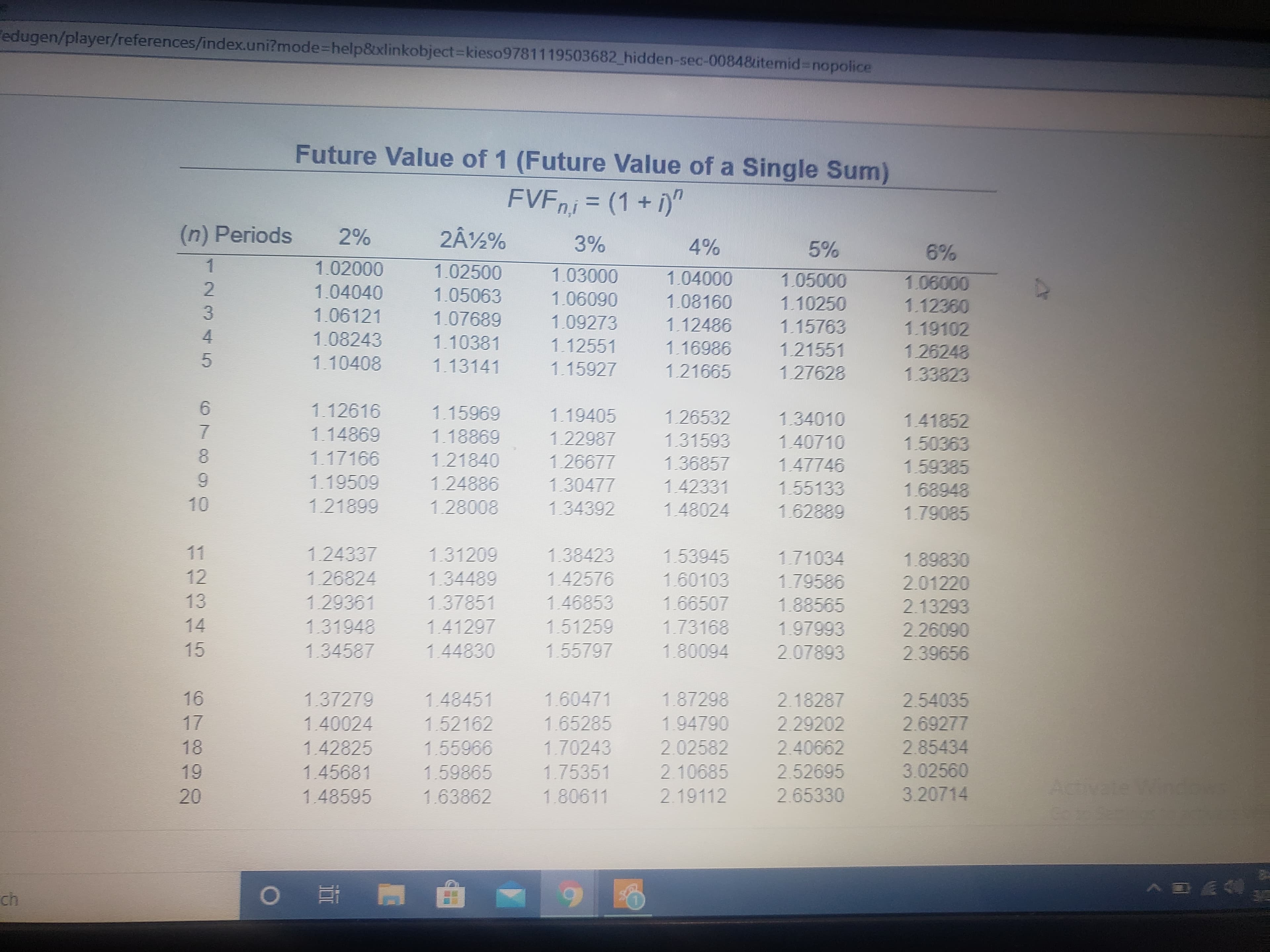

Future Value of 1 (Future Value of a Single Sum)

FVFni = (1+ i)"

(n) Periods

2%

3%

4%

5%

6%

1

1.02000

1.02500

1.03000

1.04000

1.05000

1.06000

1.12360

1.04040

1.05063

1.06090

1.08160

1.10250

1.06121

1.07689

1.09273

1.12486

1.19102

1.26248

1.33823

1.15763

4.

1.08243

1.10381

1.12551

1.16986

1.21551

1.10408

1.13141

1.15927

1.21665

1.27628

6.

1.12616

1.15969

1.19405

1.26532

1.34010

1.41852

1.14869

1.18869

1.22987

1.31593

1.40710

1.50363

1.17166

1.21840

1.26677

1.36857

1.47746

1.59385

1. 19509

1.24886

1.30477

1.42331

1.55133

1.68948

10

1.21899

1.28008

1.34392

1.48024

1.62889

1.79085

11

1.24337

1.31209

1.38423

1.53945

1.71034

1.89830

12

1.26824

1.34489

1.42576

1.60103

1.79586

2.01220

13

1.29361

1.37851

1.46853

1.66507

1.88565

2.13293

14

1.31948

1.41297

1.51259

1.73168

1.97993

2.26090

15

1.34587

1.44830

1.55797

1.80094

2.07893

2.39656

16

1.37279

1.48451

1.60471

1.87298

2.18287

2.54035

17

1.40024

1.52162

1.65285

1.94790

2.29202

2.69277

18

1.42825

1.55966

1.70243

2.02582

2.40662

2.85434

19

1.45681

1.75351

2.10685

2.52695

3.02560

1.59865

1.63862

Activate Wind

20

1.48595

1.80611

2.19112

2.65330

3.20714

ch

32

2.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting Information Systems

Finance

ISBN:

9781337552127

Author:

Ulric J. Gelinas, Richard B. Dull, Patrick Wheeler, Mary Callahan Hill

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning