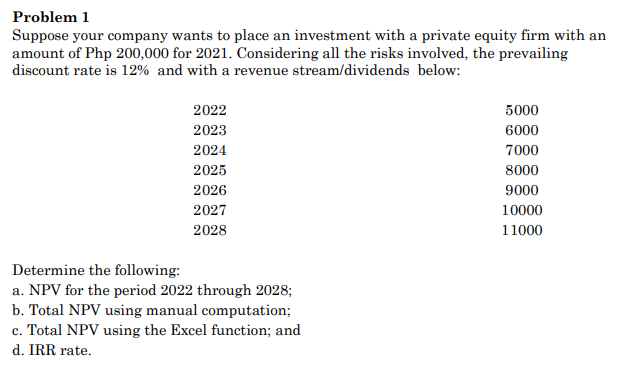

2027 10000 2028 11000 Determine the following: a. NPV for the period 2022 through 2028; b. Total NPV using manual computation; c. Total NPV using the Excel function; and d. IRR rate.

Q: A corporation had the following assets and liabilities at the beginning and end of this year. Assets...

A: An accounting equation is a mathematical representation of financial transactions. It shows as total...

Q: Capital balances of Chris, Oscar and Tim in the COT partnership are $120,000, $100,000 and $80,000 r...

A:

Q: A corporation had the following assets and liabilities at the beginning and end of this year. Assets...

A: Stockholders' equity: Stockholders' equity means the net assets available to shareholders after dedu...

Q: Problem 13-9 (IAA) At year-end, a storm surge damaged the warehouse of Braveheart Company. The entir...

A: Cost of goods sold is actual cost of goods that is being sold to the customers. It includes beginnin...

Q: Good Call is a delivery business that provides its services in cash and on credit. It has a large fl...

A: The Net profit/loss should be calculated by deducting all the expenses from the revenue which are re...

Q: Baden Company has gathered the following information. Units in beginning work in process Units start...

A: In order to determine the Unit cost of material, the Direct material cost is required to be divided ...

Q: On October 1. Ebony Ernst organızed Ernst Consulting: on October 3. the owner contributed $84,580 in...

A: Net income = Total Revenue - Total expenses

Q: Job cost sheets show the following information: Job January February March Completed Sold AA2 $2,600...

A: A job cost sheet is a list of a job's real expenses. The accounting division compiles the report, wh...

Q: Ey Freezer accepts a ote is for 180 days a 30 at 9%. Find the pr

A: To compute the net proceeds it is required to compute the maturity value.

Q: In a job-order costing system, indirect labor cost is usually recorded as a debit to: Work in Proces...

A: Introduction:- Job order costing system mainly used by organizations providing services according to...

Q: 1 3 4 6 7. 8 17 ..... Jun. 1) Jenna Aracel, the owner, invested $100,000 cash, office equipment with...

A: The journal entries are prepared to record day to day transactions in four column book as debit one ...

Q: Nowitzki Corporation sells sets of encyclopedias. Nowitzki sold 4,000 sets last year at ₱25,000 a se...

A: Degree of operating leverage (DOL): DOL reflects variable and fixed cost relationship of an organiz...

Q: Neumann-Morgenstern u osing L = 280, 000.

A: Since we answer only the first 3 subparts questions 1-3 will be answered here. Please reupload the q...

Q: Davis Corporation reported the following for the month of November: Total hourly wages of plant w...

A: The question is based on the concept of Cost Accounting.

Q: d. If a taxable temporary difference originates in 2022, it will cause taxable income for 2022 to be...

A: Disclaimer:- Hence it is a multipart question we can answer only first three part. If you want answe...

Q: Standard direct labor hours 30,000 Actual direct labor hours 29,000 Direct labor efficie...

A: Working notes

Q: For items 1-10, refer to the following: The owner of Dawn Winery decided to lend kegs of wine amount...

A: Solution Given Present value 50000 Time period 7 years Interest rate 4.625% per an...

Q: You make deposits of $300 each year for the next 17 years at 5 % compounded annually. How much is in...

A: Annual deposit (P) = $300 Interest rate (r) = 5% Period (n) = 17 Years

Q: Jordan Company has two divisions, which reported the following results for the most recent year. ...

A: Introduction:- The following formula used to calculate residual income as follows under:- Residual i...

Q: Q5- Amber Manufacturing provided the following information for last month: $20,000 6,000 9,000 Opera...

A: “Since you have asked multiple question, we will solve the first question for you. If you want any s...

Q: Required: 1. Compute payback period of the truck. Is the investment in new truck desirable if maximu...

A: Payaback Period = Cost of the truck ÷ Net Annual cashflows = $225,000 ÷ ...

Q: Handy Crafts manufactures to customers’ specifications. The company uses a job order cost system and...

A: Ending work in process inventory = Beginning work in process Inventory + Manufacturing costs - Cost ...

Q: Prepare budgetary entries, using general ledger control accounts only, for each of the following unr...

A: The question is based on the concept of Financial Accounting.

Q: Companies use capital investment analysis to evaluate long-term investments. Capital investment eval...

A: part A The statement is true. Towards making inveatment decision of mutually exclusive projects ,NP...

Q: Pearson Motors has a target capital structure of 40% debt and 60% common equity, with no preferred s...

A: WACC = (Weight of common stock * Cost of common equity) + [Weight of debt * YTM(1 - Tax rate)] where...

Q: Mrs. Camelia owns a cake business and employs five employees at a monthly salary of RM2,000 per empl...

A:

Q: Ising the dropdown buttons, select the Item that accurately describes the values that either etained...

A: Retained earnings refers to the amount which is left from the profit of company after paying all the...

Q: SUI JunOwe first quarter Second quarter 25-Dec-21 25-Sep-21 june 26,20 26-Sep-20 ASSETS t assets nd ...

A: Vertical analysis is a statement prepared to evaluate to the performance over two or more period. It...

Q: On October 1, Ebony Ernst organized Ernst Consulting: on October 3, the owner contributed $84,580 in...

A: In this question, we need to find out retained earning but to find out retained earnings we need to...

Q: QUESTION 1 a) ABC Company Sdn. Bhd. received an invoice of RM35,000 dated 24 May 2020 with trade dis...

A: In the course of purchase and sale transactions that take place as a result of the day to day activi...

Q: $ 8,500 $20,900 Direct materials used Direct labor Sales salaries $10,500 $ 1,870 $ 6,070 $ 9,230 $ ...

A: Conversion cost = Direct labor cost + Direct expense + Factory overhead Direct labor cost = $20,900...

Q: During 2019 , Lina Co. incurred the following costs: Testing in search for process alternatives $ 40...

A: “Since you have asked multiple questions, we will solve the first question for you. If you want any ...

Q: Which costs will change with a decrease in activity within the relevant range? Unit variable cost an...

A: Cost can be classified into two categories i.e fixed cost and variable cost. The fixed cost remains ...

Q: What are the main types of decisions made by the financial managers of a company?

A: FINANCIAL manager are managers responsible for important decisions in the company and responsible ...

Q: 3. How much is the monthly payment (repayment R)? 4. How much money is paid in total? (A. including ...

A: Here a car is purchased by making a downpayment and paying the balance amount in equal installments....

Q: 19. On January 5, 2020, Purpose Corporation purchased 70% of Showtime Company's P10 par ordinary sha...

A: 1. Purpose Corporation is the holding company and Showtime Company is the subsidiary company. 2. Sha...

Q: Proposals L and K each cost $500,000, have 6-year lives, and have expected total cash flows of $750,...

A:

Q: The following costs were incurred in May:

A: Conversion cost is the cost incurred to convert raw material into finished goods.

Q: Answer and explain Problem #2 Lester and Stephen formed a partnership with capital contributions o...

A: When partnership deed is silent for profit sharing ratio, the profits and losses are distributed equ...

Q: During July at Loeb Corporation, $83,000 of raw materials were requisitioned from the storeroom for ...

A: Journal entry paass when issue raw materials from storeroom to use in production. Separate entry pas...

Q: Butrico Manufacturing Corporation uses a standard cost system, records materials price variances whe...

A: Answer - Direct Materials Price Variance - Direct material price variance is the difference betwee...

Q: The allocation base for overhead is direct labor hours. Data for the year just ended: Estimated tota...

A: The predetermined overhead rate is calculated as estimated overhead cost divided by estimated base a...

Q: resent Value Index hen funds for capital investments are limited, projects can be ranked using a pre...

A: solution given Initial investment 170000 Annual cash flow 58000 Life 5 years R...

Q: Bonita Company sells tablet PCs combined with Internet service, which permits the tablet to connect ...

A: Journal entry is used to record a business during an accounting year showing double-entry accounting...

Q: Answer this please and also how does the salary for the 12thmonth in number 3 is 96000. Explain also...

A: The partnership comes into existence when two or more persons agree to do the business and further s...

Q: reported the following: Asset – Php400 Million; Liabilities – Php100 Million; Assuming Lumina Inc ha...

A: Book to market ratio = Book value per share/ Market value per share where, Book value per share = To...

Q: P3,000,000, and the allowance for inventory writedown before At year-end, Julie Company reported end...

A: Computation of the amount of loss on inventory writedown should be included in cost of goods sold is...

Q: APPLE INC BALANCE SHEET DECEMBER 25TH 2021 amount in $ first quarter Second quarter 25-Dec-21 25-Sep...

A: The Statement of Financial Position - The statement of financial position is the position of the ass...

Q: Kobe, Inc. had the following information relating to 2020. Budgeted factory overhead ₱ 74,800 Act...

A: Predetermined overhead rate = Budgeted factory overhead / Estimated labor hours Applied factory over...

Q: Average Rate of Return The average rate of return is another method that does not use present value ...

A: Step 2 solution in the question.

Step by step

Solved in 2 steps with 2 images

- Assume your organization wishes to make a Php 200,000 investment with a private equity firm in 2021. Taking into account all of the risks, the current discount rate is 12%, and the revenue stream/dividends are as follows: 2022 50002023 60002024 70002025 80002026 90002027 100002028 11000 Determine the following: DO IT IN EXCELa. NPV for the period 2022 through 2028;b. Total NPV using manual computation;c. Total NPV using the Excel function; andd. IRR rate.Assume your organization wishes to make a Php 200,000 investment with a private equity firm in 2021. Taking into account all of the risks, the current discount rate is 12%, and the revenue stream/dividends are as follows: 2022 50002023 60002024 70002025 80002026 90002027 100002028 11000 Determine the following:a. NPV for the period 2022 through 2028;b. Total NPV using manual computation;c. Total NPV using the Excel function; andd. IRR rate.A reputable company plans to place an investment with a private equity firm with an amount of Php 10M for 2023. Considering all the risks involved, the prevailing discount rate is 12% and with a revenue stream/dividends below: 2023 995,000.00 2024 1,380,000.00 2025 1,575,000.00 2026 1,930,000.00 2027 2,954,000.00 2028 3,408,644.00 2029 6,354,941.00 Find the NPV. Group of answer choices No choice given Php10,700,800 Php 12,570,638 Php 10,611,838 Php 9,800,338

- A reputable company plans to place an investment with a private equity firm with an amount of Php 10M for 2023. Considering all the risks involved, the prevailing discount rate is 12% and with a revenue stream/dividends below: 2019: 995,000.00 2020: 1.380,000.00 2021: 1.575,000.00 2022: 1,930,000.00 2023: 2,954,000.00 2024: 3.408,644.00 2025: 6,354.941.00 What is the NPV?A reputable company plans to place an investment with a private equity firm with an amount of Php 10M for 2023. Considering all the risks involved, the prevailing discount rate is 12% and with a revenue stream/dividends below: 2023 2024 2025 2026 2027 2028 2029 995,000.00 1,380,000.00 1,575,000.00 1,930,000.00 2,954,000.00 3,408,644.00 6,354,941.00 Find the NPV.Problem 2 ABM Enterprise would like to evaluate/analyze an investment proposal.Given the following:Investment amount - 450,000 (2022)Dividends / Revenue stream - 100,000 for the first year and an interval of 5,000 for thesucceeding yearsDiscount rate - 14% a. NPV for the perio 2023 through 2029;b. Total NPV using manual computation;c. Total NPV using the Excel function; andd. IRR rate.

- Maxwell Private equity investor is considering making an investment capital firm. The investor values the firm at $1.5 mn (present value of exit value) following $300,000 capital investment by the investor. Calculate the venture capital firm's pre- money valuation and investor's proportional ownership.Using information below, calculate value of one share of company X: 2021 2022 2023 2024 EPS growth rate (%) 15 12 10 6 Dividend per share (% of EPS) 20 30 40 50 The company has net profit after tax of $12.32 million and 4 million shares outstanding in 2020. The value of the company (that is the terminal value) at the end of 2024 is expected to be 6 times of earnings of 2024. The required return on equity is 12 percent.Calculate the risk-weighted asset for this amount. A Commercial Banking business line (15%) that reports positive profits in the last 3 years: $750,000.00 in 2017, $600,000.00 in 2018, $300,000.00 in 2019. For $550,000.00 MXN Select one: a.$82,500.00 MXN. b.$99,000.00 MXN. c.$28,500.00 MXN. d.$66,000.00 MXN.

- An entity has an investment which analyst think that there will be a 40% probability that the expected return will be 10%; 50% chance it will be 6% and 10% chance that the return will be 20 %. Calculate the expected returns Calculate the standard deviation An entity has a stock valued at $15 on December 31, 2019. On December 31, 2020, the stock was priced at $10 per share, During the period, directors declared and paid final dividends of $6 for each ordinary share held. What is the shareholders’ returnChoose the right letter 1. ABC Company decided to enter into a large venture. Thus, there is a need for additional funds. The financial manager intends to issue preferred stock with a perpetual annual dividend of Php 5 per share and a par value of Php 30. If the required return on this stock is currently 20%, what is the stock’s estimated (market) value? A. Php 150 B. Php 100 C. Php 50 D. Php 25 2. ABC Power Inc. is expected to pay cash dividends of Php 1.00 per share at the end of the year (D1 = Php 1.00). Each share sells for Php 20 and the required rate of return is 11%. The dividend is expected to grow at a constant rate forever. What is the growth rate for this stock? * A. 5% B. 6% C. 7% D. 8%**Solve in Excel Question 5&6** Chen Chocolate Company’s EPS in 2020 was $1.80, and in 2015 it was $1.25. The company’s payout ratio is 60%, and the stock is currently valued at $37.75. Flotation costs for new equity will be 12%. Net income in 2021 is expected to be $20 million. The company investment banker estimates that it could sell 15-year semiannual bonds with a coupon of 6.5%. The face value would be $1,000 and the flotation costs for a bond issue would be 1%. The market-value weights of the firm’s debt and equity are 30% and 70%, respectively. The firm faces a 25% tax rate. 1.Based on the five-year track record, what is Chen’s EPS growth rate? What will the dividend be in 2021?2.Calculate the firm’s cost of retained earnings and the cost of new common equity. 3.Calculate the break-point associated with retained earnings. 4.What is the firm’s after-tax cost of new debt? 5.What is the firm’s WACC with retained earnings? With new common equity? 6.Create a scatter chart that…