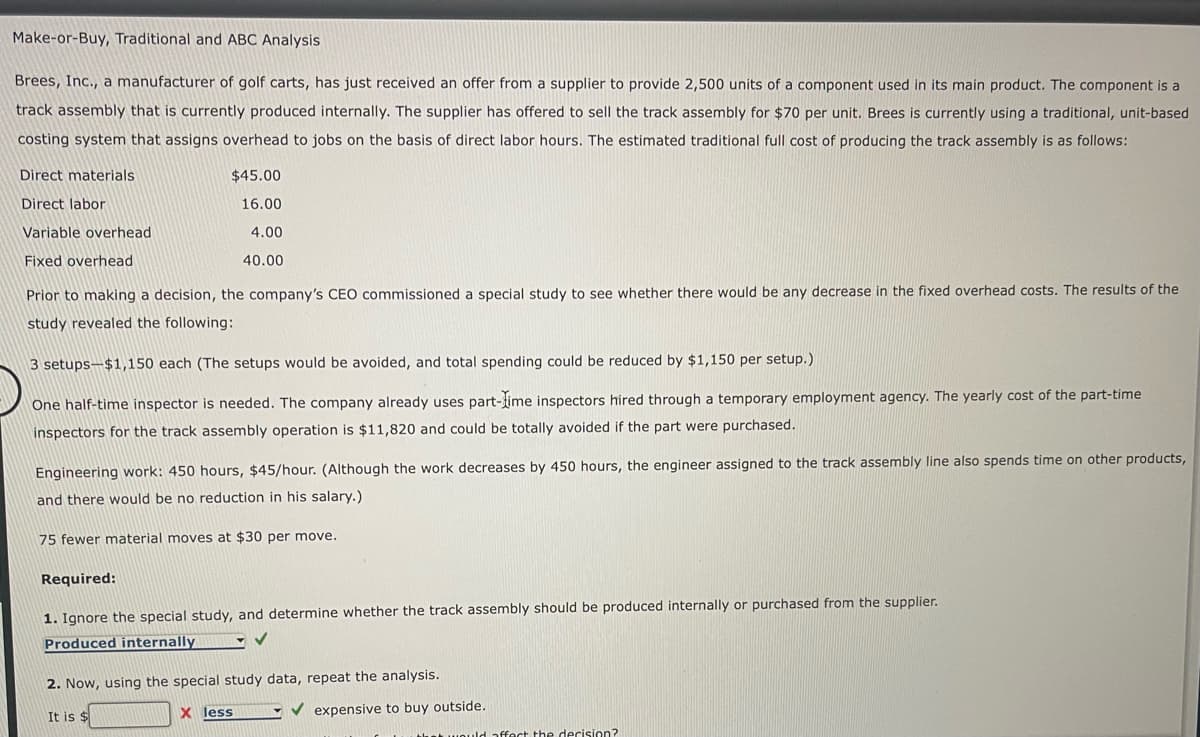

Make-or-Buy, Traditional and ABC Analysis Brees, Inc., a manufacturer of golf carts, has just received an offer from a supplier to provide 2,500 units of a component used in its main product. The component is a track assembly that is currently produced internally. The supplier has offered to sell the track assembly for $70 per unit. Brees is currently using a traditional, unit-based costing system that assigns overhead to jobs on the basis of direct labor hours. The estimated traditional full cost of producing the track assembly is as follows: Direct materials $45.00 16.00 Direct labor Variable overhead 4.00 Fixed overhead 40.00 Prior to making a decision, the company's CEO commissioned a special study to see whether there would be any decrease in the fixed overhead costs. The results of the study revealed the following: 3 setups-$1,150 each (The setups would be avoided, and total spending could be reduced by $1,150 per setup.) One half-time inspector is needed. The company already uses part-time inspectors hired through a temporary employment agency. The yearly cost of the part-time inspectors for the track assembly operation is $11,820 and could be totally avoided if the part were purchased. ssembly line also spends time on other products, Engineering work: 450 hours, $45/hour. (Although the work decreases by 450 hours, the engineer assigned to the trac and there would be no reduction in his salary.) 75 fewer material moves at $30 per move. Required: 1. Ignore the special study, and determine whether the track assembly should be produced internally or purchased from the supplier. Produced internally ✔ 2. Now, using the special study data, repeat the analysis. It is $ X less ✓expensive to buy outside. affect the decision?

Make-or-Buy, Traditional and ABC Analysis Brees, Inc., a manufacturer of golf carts, has just received an offer from a supplier to provide 2,500 units of a component used in its main product. The component is a track assembly that is currently produced internally. The supplier has offered to sell the track assembly for $70 per unit. Brees is currently using a traditional, unit-based costing system that assigns overhead to jobs on the basis of direct labor hours. The estimated traditional full cost of producing the track assembly is as follows: Direct materials $45.00 16.00 Direct labor Variable overhead 4.00 Fixed overhead 40.00 Prior to making a decision, the company's CEO commissioned a special study to see whether there would be any decrease in the fixed overhead costs. The results of the study revealed the following: 3 setups-$1,150 each (The setups would be avoided, and total spending could be reduced by $1,150 per setup.) One half-time inspector is needed. The company already uses part-time inspectors hired through a temporary employment agency. The yearly cost of the part-time inspectors for the track assembly operation is $11,820 and could be totally avoided if the part were purchased. ssembly line also spends time on other products, Engineering work: 450 hours, $45/hour. (Although the work decreases by 450 hours, the engineer assigned to the trac and there would be no reduction in his salary.) 75 fewer material moves at $30 per move. Required: 1. Ignore the special study, and determine whether the track assembly should be produced internally or purchased from the supplier. Produced internally ✔ 2. Now, using the special study data, repeat the analysis. It is $ X less ✓expensive to buy outside. affect the decision?

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter17: Activity Resource Usage Model And Tactical Decision Making

Section: Chapter Questions

Problem 10E: Brees, Inc., a manufacturer of golf carts, has just received an offer from a supplier to provide...

Related questions

Question

Answer the one with red "x"

Transcribed Image Text:Make-or-Buy, Traditional and ABC Analysis

Brees, Inc., a manufacturer of golf carts, has just received an offer from a supplier to provide 2,500 units of a component used in its main product. The component is a

track assembly that is currently produced internally. The supplier has offered to sell the track assembly for $70 per unit. Brees is currently using a traditional, unit-based

costing system that assigns overhead to jobs on the basis of direct labor hours. The estimated traditional full cost of producing the track assembly is as follows:

Direct materials

$45.00

16.00

Direct labor

Variable overhead

4.00

Fixed overhead

40.00

Prior to making a decision, the company's CEO commissioned a special study to see whether there would be any decrease in the fixed overhead costs. The results of the

study revealed the following:

3 setups $1,150 each (The setups would be avoided, and total spending could be reduced by $1,150 per setup.)

One half-time inspector is needed. The company already uses part-time inspectors hired through a temporary employment agency. The yearly cost of the part-time

inspectors for the track assembly operation is $11,820 and could be totally avoided if the part were purchased.

track assembly line also spends time on other products,

Engineering work: 450 hours, $45/hour. (Although the work decreases by 450 hours, the engineer assigned to the

and there would be no reduction in his salary.)

75 fewer material moves at $30 per move.

Required:

1. Ignore the special study, and determine whether the track assembly should be produced internally or purchased from the supplier.

Produced internally

✔

2. Now, using the special study data, repeat the analysis.

It is $

X less

✓expensive to buy outside.

affect the decision?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub