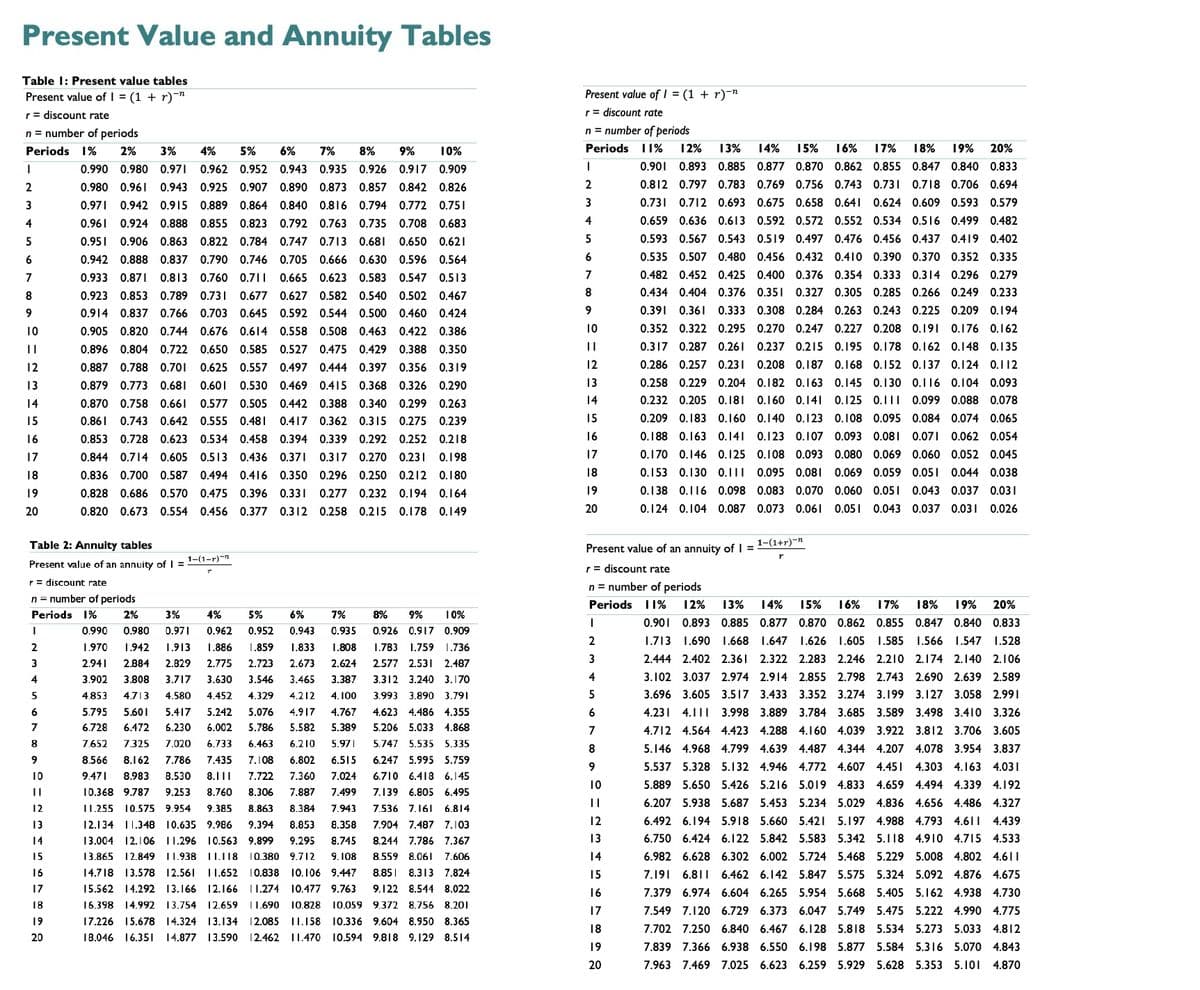

Present Value and Annuity Tables Table I: Present value tables Present value of I = (1 + r)¯" Present value of I = (1 + r)¯n r = discount rate r= discount rate n = number of periods n = number of periods Periods 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% Periods I1% 1 2% 13% 14% 1% 16% 17% 18% 19% 20% 0.990 0.980 0.971 0.962 0.952 0.943 0.935 0.926 0.917 0.909 0.901 0.893 0.885 0.877 0.870 0.862 0.855 0.847 0.840 0.833 0.980 0.961 0.943 0.925 0.907 0.890 0.873 0.857 0.842 0.826 2 0.812 0.797 0.783 0.769 0.756 0.743 0.731 0.718 0.706 0.694 3 0.971 0.942 0.915 0.889 0.864 0.840 0.816 0.794 0.772 0.751 3 0.731 0.712 0.693 0.675 0.658 0.641 0.624 0.609 0.593 0.579 4 0.961 0.924 0.888 0.855 0.823 0.792 0.763 0.735 0.708 0.683 4 0.659 0.636 0.613 0.592 0.572 0.552 0.534 0.516 0.499 0.482 0.951 0.906 0.863 0.822 0.784 0.747 0.713 0.681 0.650 0.621 5 0.593 0.567 0.543 0.519 0.497 0.476 0.456 0.437 0.419 0.402 6 0.942 0.888 0.837 0.790 0.746 0.705 0.666 0.630 0.596 0.564 6 0.535 0.507 0.480 0.456 0.432 0.410 0.390 0.370 0.352 0.335 7 0.933 0.871 0.813 0.760 0.71| 0.665 0.623 0.583 0.547 0.513 7 0.482 0.452 0.425 0.400 0.376 0.354 0.333 0.314 0.296 0.279 8 0.923 0.853 0.789 0.731 0.677 0.627 0.582 0.540 0.502 0.467 8. 0.434 0.404 0.376 0.351 0.327 0.305 0.285 0.266 0.249 0.233 9 0.914 0.837 0.766 0.703 0.645 0.592 0.544 0.500 0.460 0.424 9 0.391 0.361 0.333 0.308 0.284 0.263 0.243 0.225 0.209 0.194 10 0.905 0.820 0.744 0.676 0.614 0.558 0.508 0.463 0.422 0.386 10 0.352 0.322 0.295 0.270 0.247 0.227 0.208 0.191 0.176 0.162 0.896 0.804 0.722 0.650 0.585 0.527 0.475 0.429 0.388 0.350 || 0.317 0.287 0.261 0.237 0.215 0.195 0.178 0.162 0.148 0.135 12 0.887 0.788 0.701 0.625 0.557 0.497 0.444 0.397 0.356 0.319 12 0.286 0.257 0.231 0.208 0.187 0.168 0.152 0.137 0.124 0.112 13 0.879 0.773 0.681 0.601 0.530 0.469 0.415 0.368 0.326 0.290 13 0.258 0.229 0.204 0.182 0.163 0.145 0.130 0.116 0.104 0.093 14 0.870 0.758 0.661 0.577 0.505 0.442 0.388 0.340 0.299 0.263 14 0.232 0.205 0.181 0.160 0.141 0.125 0.11| 0.099 0.088 0.078 15 0.861 0.743 0.642 0.555 0.481 0.417 0.362 0.315 0.275 0.239 15 0.209 0.183 0.160 0.140 0.123 0.108 0.095 0.084 0.074 0.065 16 0.853 0.728 0.623 0.534 0.458 0.394 0.339 0.292 0.252 0.218 16 0.188 0.163 0.141 0.123 0.107 0.093 0.081 0.071 0.062 0.054 17 0.844 0.714 0.605 0.513 0.436 0.371 0.317 0.270 0.231 0.198 17 0.170 0.146 0.125 0.108 0.093 0.080 0.069 0.060 0.052 0.045 18 0.836 0.700 0.587 0.494 0.416 0.350 0.296 0.250 0.212 0.180 18 0.153 0.130 0.1|I 0.095 0.081 0.069 0.059 0.051 0.044 0.038 19 0.828 0.686 0.570 0.475 0.396 0.331 0.277 0.232 0.194 0.164 19 0.138 0.116 0.098 0.083 0.070 0.060 0.051 0.043 0.037 0.031 20 0.820 0.673 0.554 0.456 0.377 0.312 0.258 0.215 0.178 0.149 20 0.124 0.104 0.087 0.073 0.061 0.051 0.043 0.037 0.031 0.026 Table 2: Annuity tables Present value of an annuity of I = 1-(1+r)-n 1-(1-r)-n Present value of an annuity of = r = discount rate r = discount rate n = number of periods n = number of periods Periods I1% 12% 13% 14% 15% 16% 17% 18% 19% 20% Periods 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 0.901 0.893 0.885 0.877 0.870 0.862 0.855 0.847 0.840 0.833 0.990 0.980 0.971 0.962 0.952 0.943 0.935 0.926 0.917 0.909 2 1.713 1.690 1.668 1.647 1.626 1.605 1.585 1.566 1.547 1.528 2 1.970 1.942 1.913 1.886 1.859 1.833 1.808 1.783 1.759 1.736 3 2.444 2.402 2.361 2.322 2.283 2.246 2.210 2.174 2.140 2.106 3 2.941 2.884 2.829 2.775 2.723 2.673 2.624 2.577 2.531 2.487 4 3.902 3.808 3.717 3.630 3.546 3.465 3.387 3.312 3.240 3.170 4 3.102 3.037 2.974 2.914 2.855 2.798 2.743 2.690 2.639 2.589 4.853 4.713 4.580 4.452 4.329 4.212 4. 100 3.993 3.890 3.791 3.696 3.605 3.517 3.433 3.352 3.274 3.199 3.127 3.058 2.991 6 5.795 5.601 5.417 5.242 5.076 4.917 4.767 4.623 4.486 4.355 6 4.231 4.111 3.998 3.889 3.784 3.685 3.589 3.498 3.410 3.326 6.728 6.472 6.230 6.002 5.786 5.582 5.389 5.206 5.033 4.868 7 4.712 4.564 4.423 4.288 4.160 4.039 3.922 3.812 3.706 3.605 8 7.652 7.325 7.020 6.733 6.463 6.210 5.97| 5.747 5.535 5.335 8 5.146 4.968 4.799 4.639 4.487 4.344 4.207 4.078 3.954 3.837 9 8.566 8.162 7.786 7.435 7.108 6.802 6.515 6.247 5.995 5.759 5.537 5.328 5.132 4.946 4.772 4.607 4.45I 4.303 4.163 4.031 10 9.471 8.983 8.530 8.111 7.722 7.360 7.024 6.710 6.418 6.145 10 5.889 5.650 5.426 5.216 5.019 4.833 4.659 4.494 4.339 4.192 10.368 9.787 9.253 8.760 8.306 7.887 7.499 7.139 6.805 6.495 || 6.207 5.938 5.687 5.453 5.234 5.029 4.836 4.656 4.486 4.327 12 I1.255 10.575 9.954 9.385 8.863 8.384 7.943 7.536 7.161 6.814 13 12.134 |1.348 10.635 9.986 9.394 8.853 8.358 7.904 7.487 7.103 12 6.492 6.194 5.918 5.660 5.421 5.197 4.988 4.793 4.6|| 4.439 14 13.004 12.106 11.296 10.563 9.899 9.295 8.745 8.244 7.786 7.367 13 6.750 6.424 6.122 5.842 5.583 5.342 5.118 4.910 4.715 4.533 15 13.865 12.849 11.938 II.118 10.380 9.712 9. 108 8.559 8.06I 7.606 14 6.982 6.628 6.302 6.002 5.724 5.468 5.229 5.008 4.802 4.61| 16 14.718 13.578 12.561 11.652 10.838 10.106 9.447 8.85 8.313 7.824 15 7.191 6.811 6.462 6.142 5.847 5.575 5.324 5.092 4.876 4.675 17 15.562 14.292 13.166 12.166 I1.274 10.477 9.763 9.122 8.544 8.022 16 7.379 6.974 6.604 6.265 5.954 5.668 5.405 5.162 4.938 4.730 18 16.398 14.992 13.754 12.659 |1.690 10.828 10.059 9.372 8.756 8.201 17 7.549 7.120 6.729 6.373 6.047 5.749 5.475 5.222 4.990 4.775 19 17.226 15.678 14.324 13.134 12.085 11.158 10.336 9.604 8.950 8.365 18 7.702 7.250 6.840 6.467 6.128 5.818 5.534 5.273 5.033 4.812 20 18.046 16.351 14.877 13.590 12.462 |1.47O 10.594 9.818 9.129 8.514 19 7.839 7.366 6.938 6.550 6.198 5.877 5.584 5.316 5.070 4.843 20 7.963 7.469 7.025 6.623 6.259 5.929 5.628 5.353 5.101 4.870 Financial ratios Creditors days Working capital Cost of capital Gross margin (%) Economic order quantity (EOQ) Cost of equity Trade payables Gross profit x 365 Purchases × 100 2DC ke = Do(1+g) + g Po Revenue or H Operating margin (%) Trade creditors or Operating profit x 100 x 365 Cash management (1) Purchases ke = R, + B(Rm – R;) Revenue If 'Purchases' figure not available, use 'Cost of sales 2NF Z = Return on capital employed (%) Financial gearing (%) WACC Cash management (2) Ve ke: Ve+Va Va + ka (1 – t) Operating profit x 100 Long-term debt Shareholders equity + Long-term debt x 100 Ve+Va Long-term debt + Shareholders equity Return on equity (%) S = 3 Parity theory Interest cover (times) Operating profit Interest charges Profit after taxation x 100 Learning curve PPPT Shareholders equity (1+ir) Return on total assets (%) y = axb S1 = So (1+in) Earnings per share (EPS) Profit after taxation Variances x 100 IRPT Profit after taxation Total assets Number of ordinary shares in issue Sales price (1+if) Asset turnover Price I earnings ratio (PIE) (Actual selling price – Budgeted selling price) x Actual units sold Fo = So (1+in) Revenue Share price Financial arithmetic Total assets Sales volume Earnings per share Current ratio (Actual units sold – Budgeted quantity) x Budgeted contribution per unit Effective annual rate of interest Earnings yield Current assets Material price [1+"-1 Current liabilities Earnings per share Quick test (acid ratio) (Budgeted cost – Actual cost) x Actual quantity used Share price Present value of I Current assets - Inventory Dividend per share (DPS) Material usage [1+ r]-" Present value of an annuity of I Current liabilities Total dividends for the period (Budgeted quantity – Actual quantity) x Budgeted cost per unit Working capital turnover Number of ordinary shares in issue Labour rate Revenue Dividend cover 1-(1+r)-" Net working capital (Budgeted rate – Actual rate) x Actual time taken Profit after taxation Inventory turnover Labour efficiency Total dividends for the period (Budgeted time - Actual time taken) x Budgeted rate Cost of sales Dividend payout (%) Inventory Total dividends for the period Variable overhead rate Inventory days x 100 Profit after taxation (Budgeted rate – Actual rate) x Actual time taken Inventory x 365 or Cost of sales Variable overhead efficiency DPS Debtors days × 100 (Budgeted time - Actual time taken) x Budgeted rate EPS Dividend yield Trade receivables x 365 Fixed overhead expenditure Revenue Dividend per share (Budgeted fixed overhead – Actual fixed overhead) or Share price Trade debtors x 365 Revenue

The following information relates to a proposed four-year project which is being financially evaluated by the Board of Directors of Pampass Inc. (Pampass). Pampass is an unlisted company but shareholders include private investors, a venture capital company, an insurance company and a pension fund. The initial investment is $7.8 million, with scrap value of $0.2 million and the following net

|

Year |

2021 |

2022 |

2023 |

2024 |

|

Net operating cash flow ($m) |

2.40 |

3.00 |

3.20 |

3.16 |

The Board of Directors believes that this project will increase shareholder wealth if it achieves an accounting

Required:

- What is the payback period of the proposed project?

- What is the average rate of return (ARR) of the proposed project?

- Which of the following statements about investment appraisal methods is/are not correct?

- ARR must be greater than the

cost of equity if a project is to be accepted - Riskier projects should be evaluated with longer payback periods

- The ARR method does not consider the

time value of money

- Which of the following statements about Pampass is/are correct?

- Managerial reward schemes should not encourage the achievement of stakeholderobjectives

- Requiring investment projects to be evaluated via the ARR method is an example of dysfunctional behaviour encouraged by performance-related pay

- Pampass does not have an agency problem as the Board of Directors is acting to maximise shareholder wealth

- Which of the following statements is/are not correct?

- Introducing a share option scheme in Pampass would help bring directors’ objectives in line with shareholders’ objectives

- By linking their financial rewards to a target ARR, Pampass is encouraging its directors to focus on short-term profitability and discouraging them to make long-term capital investment decisions

- Directors’ remuneration in Pampass should be determined by its senior executive directors

![Financial ratios

Creditors days

Working capital

Cost of capital

Gross margin (%)

Economic order quantity (EOQ)

Cost of equity

Trade payables

Gross profit

x 365

Purchases

× 100

2DC

ke =

Do(1+g)

+ g

Po

Revenue

or

H

Operating margin (%)

Trade creditors

or

Operating profit

x 100

x 365

Cash management (1)

Purchases

ke = R, + B(Rm – R;)

Revenue

If 'Purchases' figure not available, use 'Cost of sales

2NF

Z =

Return on capital employed (%)

Financial gearing (%)

WACC

Cash management (2)

Ve

ke:

Ve+Va

Va

+ ka (1 – t)

Operating profit

x 100

Long-term debt

Shareholders equity + Long-term debt

x 100

Ve+Va

Long-term debt + Shareholders equity

Return on equity (%)

S = 3

Parity theory

Interest cover (times)

Operating profit

Interest charges

Profit after taxation

x 100

Learning curve

PPPT

Shareholders equity

(1+ir)

Return on total assets (%)

y = axb

S1 = So

(1+in)

Earnings per share (EPS)

Profit after taxation

Variances

x 100

IRPT

Profit after taxation

Total assets

Number of ordinary shares in issue

Sales price

(1+if)

Asset turnover

Price I earnings ratio (PIE)

(Actual selling price – Budgeted selling price) x Actual units sold

Fo = So

(1+in)

Revenue

Share price

Financial arithmetic

Total assets

Sales volume

Earnings per share

Current ratio

(Actual units sold – Budgeted quantity) x Budgeted contribution per unit

Effective annual rate of interest

Earnings yield

Current assets

Material price

[1+"-1

Current liabilities

Earnings per share

Quick test (acid ratio)

(Budgeted cost – Actual cost) x Actual quantity used

Share price

Present value of I

Current assets - Inventory

Dividend per share (DPS)

Material usage

[1+ r]-"

Present value of an annuity of I

Current liabilities

Total dividends for the period

(Budgeted quantity – Actual quantity) x Budgeted cost per unit

Working capital turnover

Number of ordinary shares in issue

Labour rate

Revenue

Dividend cover

1-(1+r)-"

Net working capital

(Budgeted rate – Actual rate) x Actual time taken

Profit after taxation

Inventory turnover

Labour efficiency

Total dividends for the period

(Budgeted time - Actual time taken) x Budgeted rate

Cost of sales

Dividend payout (%)

Inventory

Total dividends for the period

Variable overhead rate

Inventory days

x 100

Profit after taxation

(Budgeted rate – Actual rate) x Actual time taken

Inventory

x 365

or

Cost of sales

Variable overhead efficiency

DPS

Debtors days

× 100

(Budgeted time - Actual time taken) x Budgeted rate

EPS

Dividend yield

Trade receivables

x 365

Fixed overhead expenditure

Revenue

Dividend per share

(Budgeted fixed overhead – Actual fixed overhead)

or

Share price

Trade debtors

x 365

Revenue](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2F20e89e84-1f9d-4d0d-a210-ee26b38b2d2b%2F23d3833a-11d4-4015-99bf-d339bf08d54e%2Fjsn2cc_processed.jpeg&w=3840&q=75)

Trending now

This is a popular solution!

Step by step

Solved in 2 steps