Manager at FreeAir Lid, a leading manufacturer of fans used in air conditioning systems. The company is located in Liverpool, UK In the year ended 31 March 2019, manufacturing cost per unit comprised: The company produced and sold 45,000 fans during the year ended 31 March 2019. The selling price per unit was £300 Fixed overheads for the year ended 31 March 2019 were: Jessica Olusange, Chief Executive, has developed a new strategy for the business. The company has invested in a new manufacturing facility in Leicester, UK this investment means that fixed costs will increase by £1,450,000 from 1 April 2019. However, the move to the new manufacturing

Question 3

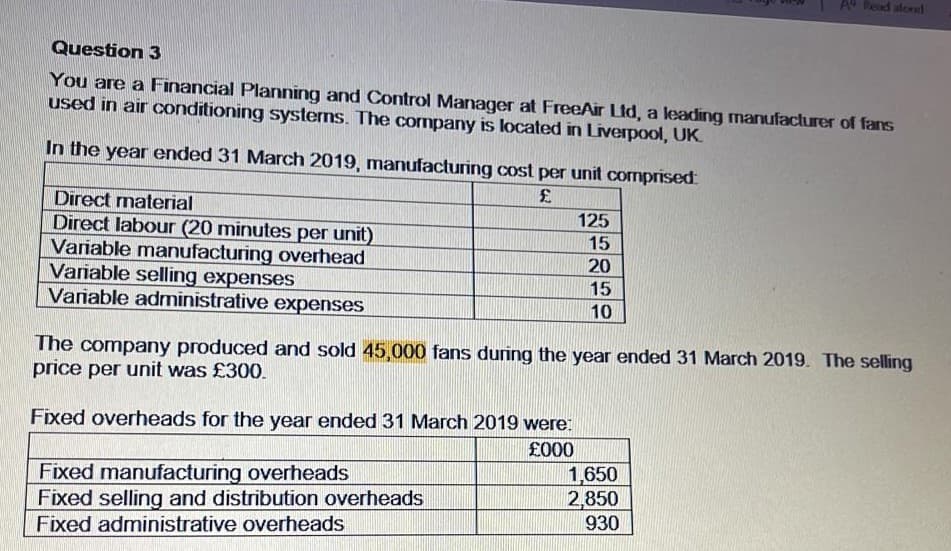

You are a Financial Planning and Control Manager at FreeAir Lid, a leading manufacturer of fans used in air conditioning systems. The company is located in Liverpool, UK In the year ended 31 March 2019,

The company produced and sold 45,000 fans during the year ended 31 March 2019. The selling price per unit was £300

Fixed overheads for the year ended 31 March 2019 were:

Jessica Olusange, Chief Executive, has developed a new strategy for the business. The company has invested in a new manufacturing facility in Leicester, UK this investment means that fixed costs will increase by £1,450,000 from 1 April 2019.

However, the move to the new manufacturing facility means that direct labour costs are expected to reduce by £2 per unit, variable manufacturing overheads will reduce by £0.50 per unit and variable administrative expenses will reduce by £2 per unit. Jessica believes that her new strategy will reduce the level of financial risk to which FreeAir Ltd is exposed.

From 1 April 2019, the selling price per unit of fans will be increased by 3 per cent. The company plans to produce and sell the same quantity of fans in the year ended 31 March 2020 as it did in the year ended 31 March 2019

Required:

(A)

Calculate the breakeven point in units and sales revenue for the year ended 31 March 2019

and the year ended 31 March 2020.

(B)

Calculate the margin of safety in units and sales revenue for the year ended 31 March 2019

and the year ended 31 March 2020.

(C)

Critically discuss the new strategy developed by Jessica. Use the results of your calculations in parts (a) and (b) to develop your response.

Step by step

Solved in 3 steps