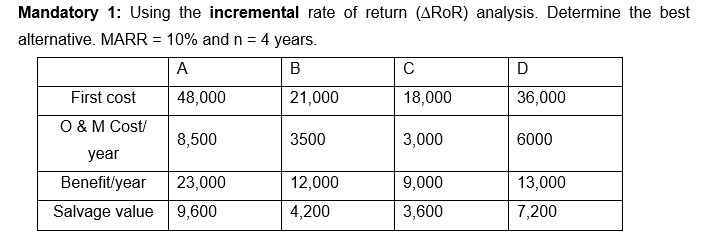

Mandatory 1: Using the incremental rate of return (AROR) analysis. Determine the best alternative. MARR = 10% and n = 4 years. A D First cost 48,000 21,000 18,000 36,000 O & M Cost/ 8,500 3500 3,000 6000 year Benefit/year 23,000 12,000 9,000 13,000 Salvage value 9,600 4,200 3,600 7,200

Q: Data for two alternatives are as follows: Alternatives A B Investment P35, 000 P50, 000 Annual…

A: NPV is the difference between the Present Value of Cash Inflows and Initial Investment. A project…

Q: v) For projects A and B determine the Net present value (NPV) and the internal rate of return (IRR).…

A: Net present value (NPV) and internal rate of return (IRR) are investment appraisal tools to evaluate…

Q: A firm has an opportunity to invest $100,000 in a project that will result revenue of $30,000 per…

A: Given: Initial investment is -$100,000 Revenue = $30,000 Maintenance = $8,000 Salvage value =…

Q: Data for two alternatives are as follows: A в INVESTMENT 35,000 50,000 ANNUAL BENEFITS 20,000 25,000…

A: IRR: In capital budgeting, the internal rate of return, or IRR, is a metric that is used to assess…

Q: 1. Consider the following alternatives: First cost 5000 10,000 Annual Maintenance 500 200…

A: Rate of return analysis is done to choose a project with a better return on the cost of the…

Q: 2.) Three mutually exclusive design alternatives are being considered. The estimated cash flows for…

A: Present value is the present worth of any sum of money to be received in the future at a specified…

Q: Determine the FW of the following engineering project when the MARR is 13% per year. Is the project…

A: Given:

Q: Newman Automobiles Manufacturing is considering two alternative investment proposals with the…

A: Payback Period = Initial Investment / Annual cashflow

Q: Alternatives A, B associated with a project have data as in the following figure, MARR=12% /year,…

A: Here, To Find: Alternative to select =?

Q: used. If the desired after-tax return on investment is 10% per year, which de should be chosen?…

A: The net present value is the difference between the present value of cash flow and initial…

Q: For projects A and B determine the payback period(PBP) and the Account rate of return (ARR). The…

A: Payback period and accounting rate of return are tools to evaluate potential investment projects of…

Q: 8. By taking n as 30years and using 6% both as MARR and discount rate, compare the below three…

A: Capital budgeting indicates the evaluation of the profitability of possible investments and projects…

Q: 7-65 Two mutually exclusive alternatives are being considered. Both have lives of ten years.…

A: Present worth can be calculated by using this equation Present worth(PW) = -first cost+A1-1(1+i)ni…

Q: You are evaluating projects 1 and 2. The projects have the following yearly operating profit.…

A: Definition: Net present value method: Net present value method is the method which is used to…

Q: Porter Company is analyzing two potential investments Project X $ 75,900 Initial investment Net cash…

A: Payback period = Initial investment/Annual cash inflows

Q: Three mutually exclusive design alternatives are being considered. The estimated cash flows for each…

A: Capital budgeting is the process by which a corporation examines potential large projects or…

Q: Some particulars for a project are as follows. Initial Capital Cost in year 0 ($Mn) Follow-up…

A: The overall cost of an asset across its life cycle, including original capital expenses, maintenance…

Q: You have a opportunity to make a investment that has $10.000,000 landing, 1.500.000 machine,…

A: We'll calculate the Net Present Value of the project. NPV=Present value of cash inflow-Present value…

Q: Three mutually exclusive design alternatives are being considered. The estimated cash flows for each…

A: Here, Useful Life of all investment is 10 years MARR is 20% Details of Alternative A: Capital…

Q: A project with 10-year life requires an initial investment of $30000. The annual cost of the project…

A: Initial investment (I) = $30000 CF1 to CF4 = $17500 - $6300 = $11200 CF5 = $17500 - $6300 - $8000 =…

Q: In comparing alternatives, I and J by the present worth method, the equation that yields the present…

A: Present worth will be the difference between total present worth of cash inflows and total present…

Q: Three mutually excdusive design altematives are being considered. The estimated cash flows for each…

A: Before investing in new projects, companies evaluate the profitability of the project by using…

Q: Apply incremental B/C analysis at an interest rate of 8% per year to determine which alternative…

A: The relation between the cost of the project and the benefits from the project is known as…

Q: Compare alternatives A and B with the equivalent worth method of your choice if the MARR is 15% per…

A: Equivalent annual worth analysis is one of the most used analysis techniques for the evaluation of…

Q: Consider the three small mutually exclusive investment alternatives in the table below. The feasible…

A: As per bartlebyguidelines, "Since you have posted a question with multiple sub-parts, we will solve…

Q: Using excel: show equations A investment of $400,000 in a machine produces before-tax net revenue…

A: The straight line depreciation technique reduces the value of an asset consistently over time until…

Q: Compare the alternatives C and D on the basis of a present worth analysis using an interest rate of…

A: The calculation is:

Q: An investment has an initial cost of $3.2 million. This investment will be depreciated by $900,000 a…

A: The average accounting return or average rate of return is an accounting metric which helps in…

Q: A small company wants to invest in Project A or B. The cash flows for both are shown below.…

A: Payback period and discounted payback periods are the methods to evaluate the profitability of a…

Q: Use incremental analysis to evaluate the 2 alternatives. Assume a seven year life and a MARR of 15%.…

A: When evaluating capital investment projects, a company should conduct NPV analysis. NPV calculates…

Q: 1. Compare the following alternatives using the Net Present Worth (NPW) method. Rate 5% per year.…

A: Annual rate = 5%

Q: Three mutually exclusive design alternatives are being considered. The estimated cash flows for each…

A: MARR = 20℅ Cash flows: Year Project A Project B Project C Reference 0 -28000 -55000 -40000…

Q: Evaluate the two alternatives A and B and decide the economic justified alternative using: Present…

A: As you have asked a multiple subpart question, we will answer the first three subparts for you. To…

Q: A firm must decide between two designs A and B. Their effective income rate is 50%. If the desired…

A: Explanation : NPV method is a capital budgeting technique which help in decision making of project…

Q: The most possible values of an investment project are as follows: First cost, $ 300,000 Annual…

A: Payback period with time value ot discounted payback period is calculated by calculating cumulative…

Q: For the following table, asume a MARR of 9% per year and a useful life for each alternative of six…

A: The rate which the investor is expected to generate on its investment refers to the internal rate of…

Q: &takeAssignmentSessionLocator=D&inpro... to ... Determine the average rate of return for a project…

A: Average rate of return on project means how much net income is generated by investing a particular…

Q: A project requires an investment cost of P 600 000 with 5 – year useful life, no salvage value, and…

A: To find the net cash inflows, we will have to do the calculations step by step. We will use the…

Q: 8. By taking n as 30years and using 6% both as MARR and discount rate, compare the below three…

A: Net Present Value(NPV) is excess of PV of inflows over PV of outflows related to investment proposal…

Q: Initial cost Annual cash inflows Annual cash outflows Cost to rebuild (end of year 4) Salvage value…

A: Net present value is the present value of future cash flows.

Q: man investment project, the initial cost of investment is $400,000. The annual revenues are expected…

A: We will have to use different tools of capital budgeting here. Simple payback and the internal rate…

Q: 2. Data for two alternatives are as follows: Alternative A Investment P 35,000 Annual Benefits…

A: The IRR help in evaluating the profitability of the potential investment. It provides insight into…

Q: Compare the following investment alternatives using PW analysis and an annual interest rate of %12,…

A: Effective interest rate is the one which caters the compounding periods during a payment plan. It is…

Q: For this question, use the following information: A B D E Initial Investment $ 4,000 $ 6,500 $ 5,000…

A: MARR = 12% Alternative C: Initial Investment = 5000 Annual Benefit = 1000 Salvage Value = 300 N = 10…

Q: Details for two project proposals are shown below: Initial Cost Project Life (years) MARR (% per…

A: Since you have posted a question with multiple sub-parts, we will solve the first three sub-parts…

Q: [CLO-6] A project will have an initial cost of $1.1 million with an annual maintenance cost of…

A: The Benefit-Cost Analysis (B-C Analysis) is a method of evaluating long-term or government projects.…

Please don't uses excel. Please

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

- Calculate the APR of the following investment, entered as a percentage (Example: if your answer is 14.5%, enter 14.5 and not 0.145) Year Number Cashflow 0 -11000 1 3000 2 3500 3 2900 4 2800Determine the B/C ratio for the following project.First Cost = P100, 000Project life, years = 5Salvage value = P10, 000Annual benefits = P60, 000Annual O and M = P22, 000Interest rate= 15%Assuming monetary benefits of an IS at $85,000 per year (5% inflation), one-time sunk developmental costs of $110,000, recurring expenses of $40,000 (same inflation), a discount rate of 10%, and a 5 year time frame: Determine the NPV of the costs and benefits, ROI, and B/E point. Show all formulas and work for full credit.

- Whats the paybck period & discounted payback period for a project with costof 2OO,OOO that generates an annualcash infloww of 3O,OOO for the first 2years, 4O,OOO per year for years 3to5, & 5O,OOO per year for years 6through9?Compute the (a) net present value, (b) internal rate of return (IRR), (c) modified internal rate of return (MIRR), and (d) discounted payback period (DPB) for each of the following projects. The firm’s required rate of return is 13 percent. Year Project AB Project LM Project UV 0 $(90,000) $(100,000) $ (96,500) 1 39,000 0 (55,000) 2 39,000 0 100,000 3 39,000 147,500 100,000 Which project(s) should be purchased if they are independent? Which project(s) should be purchased if they are mutually exclusive?Approximately, what is the value of the total Present worth (where Ptotal= PA + PG) if G (arithmetic gradient) =160, n=2 years, A=240 and i= 2.5% per year? Select one: a. 738 b. 511 c. 615 d. 825 not use excel

- Which alternative should be selected using the incremental rate of return analysis, if MARR =11.0%? Do- nothing A B C D First Cost 0 $10,000 $4000 $10,000 $7000 Annual benefit 0 1,806 828 1,880 1,067 Life 10 Years ROR 12.5% 16.0% 13.5% 8.5% a. B, because its ROR is the highest b. Something other than C, because C costs the most initially c. C, because the C-B increment has a ROR of 11.78% and the A-B increment has a ROR of 10.5% d. C because C has the highest annual benefitLipsion Ltd company is thinking about investing in one of two potential new productsfor sale. The projections are as follows: year revenue/ product s revenue/ product v0 (150,000) outlay (150000) outlay1 14000 150002 24000 253333 44000 520004 84000 63333 Calculate NPV of both products (to 1 d.p.) assuming a discount rate of 7%Kk201. An asset produces $150 in two years, and $250 in four years, and the current price has been calculated toreflect a rate of return of 9% annually. Using the definition that convexity = second derivative of pricedivided by price, find the convexity of this asset evaluated at the annual yield rate of 9%.

- Para Co. is reviewing the following data relating to an energy saving investment proposal: Cost P50,000 (nondepreciable) Residual value at the end of 5 years 10,000 Present value of an annuity of 1 at 12% for 5 years 3.60 Present value of 1 due in 5 years at 12% 0.57 39. What would be the annual savings needed to make the investment realize a 12% yield assuming that Para will realize the residual value at the end of year 5?Project the OCFs for the next three years considering incomes of $165k, $170K and $180 respectively, and a depreciation of $15K, $16K and $18K respectively. Consider a tax of 25%. (Use the following format: "$11.111; $11.111; $11.111) Answer. $65.588;$69.325;$76.800 Then, calculate the NPV (of the three years projected, don't include the current one) if your investment is $150K and the cost of opportunity is 10% (use the following format: $11.111) Answer $24.619 Decide if you invest or not in this project (use the following format: "Yes" or "No") Answer NoI need the process pleaseCalculate the geometric (average) return over the 5-year investment period. Year Price 0 19 1 22 2 20 3 23 4 25 5 27 Round your answer to 4 decimal places. For example, if your answer is 3.205%, then please write down 0.0321.