Many economists believe that a more effective way to supplement the income of the poor is through a negative income tax. Under this scheme, everyone reports his or her income to the government; individuals and families earning a higher income will pay a tax based on that income, while low-income individuals and families receive a subsidy, or negative tax. Assume that the only qualification required to receive a tax credit is low income.

Many economists believe that a more effective way to supplement the income of the poor is through a negative income tax. Under this scheme, everyone reports his or her income to the government; individuals and families earning a higher income will pay a tax based on that income, while low-income individuals and families receive a subsidy, or negative tax. Assume that the only qualification required to receive a tax credit is low income.

Microeconomics: Principles & Policy

14th Edition

ISBN:9781337794992

Author:William J. Baumol, Alan S. Blinder, John L. Solow

Publisher:William J. Baumol, Alan S. Blinder, John L. Solow

Chapter20: Poverty, Inequality, And Discrimination

Section: Chapter Questions

Problem 5DQ

Related questions

Question

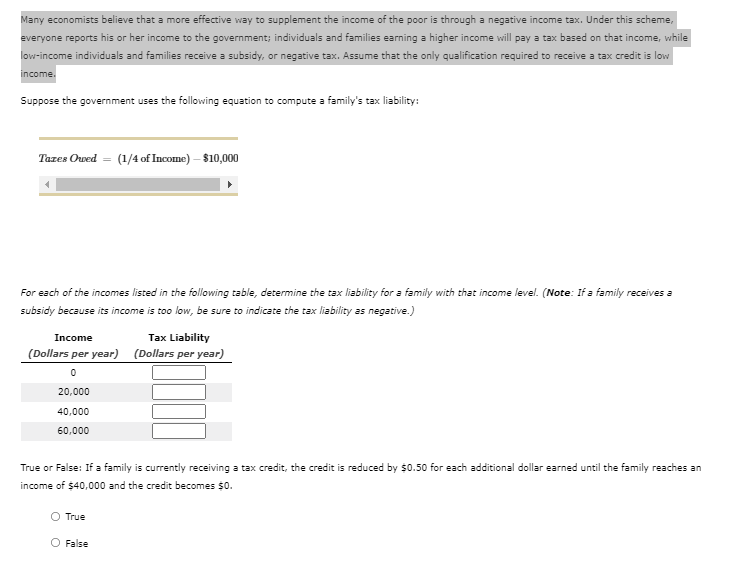

Many economists believe that a more effective way to supplement the income of the poor is through a negative income tax. Under this scheme, everyone reports his or her income to the government; individuals and families earning a higher income will pay a tax based on that income, while low-income individuals and families receive a subsidy, or negative tax. Assume that the only qualification required to receive a tax credit is low income.

Transcribed Image Text:Many economists believe that a more effective way to supplement the income of the poor is through a negative income tax. Under this scheme,

everyone reports his or her income to the government; individuals and families earning a higher income will pay a tax based on that income, while

low-income individuals and families receive a subsidy, or negative tax. Assume that the only qualification required to receive a tax credit is low

income.

Suppose the government uses the following equation to compute a family's tax liability:

Tazes Owed =

(1/4 of Income) – $10,000

For each of the incomes listed in the following table, determine the tax liability for a family with that income level. (Note: If a family receives a

subsidy because its income is too low, be sure to indicate the tax liability as negative.)

Income

Tax Liability

(Dollars per year) (Dollars per year)

20,000

40,000

60,000

True or False: If a family is currently receiving a tax credit, the credit is reduced by $0.50 for each additional dollar earned until the family reaches an

income of $40,000 and the credit becomes $0.

True

O False

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Microeconomics: Principles & Policy

Economics

ISBN:

9781337794992

Author:

William J. Baumol, Alan S. Blinder, John L. Solow

Publisher:

Cengage Learning

Microeconomics: Principles & Policy

Economics

ISBN:

9781337794992

Author:

William J. Baumol, Alan S. Blinder, John L. Solow

Publisher:

Cengage Learning

Microeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506893

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Macroeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506756

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning