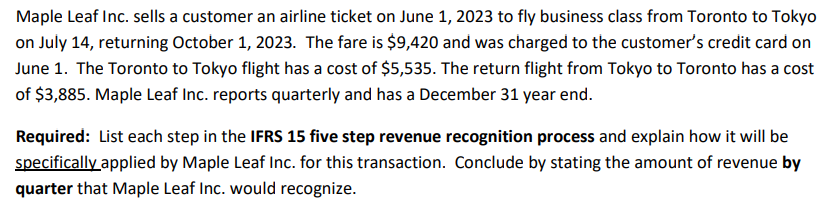

Maple Leaf Inc. sells a customer an airline ticket on June 1, 2023 to fly business class from Toronto to Tokyo on July 14, returning October 1, 2023. The fare is $9,420 and was charged to the customer's credit card on June 1. The Toronto to Tokyo flight has a cost of $5,535. The return flight from Tokyo to Toronto has a cost of $3,885. Maple Leaf Inc. reports quarterly and has a December 31 year end. Required: List each step in the IFRS 15 five step revenue recognition process and explain how it will be specifically applied by Maple Leaf Inc. for this transaction. Conclude by stating the amount of revenue by quarter that Maple Leaf Inc. would recognize.

Maple Leaf Inc. sells a customer an airline ticket on June 1, 2023 to fly business class from Toronto to Tokyo on July 14, returning October 1, 2023. The fare is $9,420 and was charged to the customer's credit card on June 1. The Toronto to Tokyo flight has a cost of $5,535. The return flight from Tokyo to Toronto has a cost of $3,885. Maple Leaf Inc. reports quarterly and has a December 31 year end. Required: List each step in the IFRS 15 five step revenue recognition process and explain how it will be specifically applied by Maple Leaf Inc. for this transaction. Conclude by stating the amount of revenue by quarter that Maple Leaf Inc. would recognize.

Chapter16: Accounting Periods And Methods

Section: Chapter Questions

Problem 33P

Related questions

Question

M1

Transcribed Image Text:Maple Leaf Inc. sells a customer an airline ticket on June 1, 2023 to fly business class from Toronto to Tokyo

on July 14, returning October 1, 2023. The fare is $9,420 and was charged to the customer's credit card on

June 1. The Toronto to Tokyo flight has a cost of $5,535. The return flight from Tokyo to Toronto has a cost

of $3,885. Maple Leaf Inc. reports quarterly and has a December 31 year end.

Required: List each step in the IFRS 15 five step revenue recognition process and explain how it will be

specifically applied by Maple Leaf Inc. for this transaction. Conclude by stating the amount of revenue by

quarter that Maple Leaf Inc. would recognize.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College