mapter 16 e net income reported on the income statement for the current year was $183,000. Depreciation recorded on equipment and a wilding amounted to $76,500 for the year. Balances of the current asset and current liability accounts at the begining and end of the ar are as follows: End of Year Beginning of Year sh 65,000 54,500 counts receivable (net) 75,000 72,500 ventories 175,600 165,500 epaid Expenses 8,500 9,200 75,450 counts Payable (merchandise creditors) laries Payable I 70,650 8,600 11,500 Prepare the Cash Flows from Operating Activities section of the statement of cash flows, using the indirect method. If the direct method had been used, would the net cash flow from operating activities have been the same? Explain. $ $

mapter 16 e net income reported on the income statement for the current year was $183,000. Depreciation recorded on equipment and a wilding amounted to $76,500 for the year. Balances of the current asset and current liability accounts at the begining and end of the ar are as follows: End of Year Beginning of Year sh 65,000 54,500 counts receivable (net) 75,000 72,500 ventories 175,600 165,500 epaid Expenses 8,500 9,200 75,450 counts Payable (merchandise creditors) laries Payable I 70,650 8,600 11,500 Prepare the Cash Flows from Operating Activities section of the statement of cash flows, using the indirect method. If the direct method had been used, would the net cash flow from operating activities have been the same? Explain. $ $

Corporate Financial Accounting

14th Edition

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter13: Statement Of Cash Flows

Section: Chapter Questions

Problem 13.2BE: Adjustments to net incomeindirect method Ripley Corporations accumulated depreciationequipment...

Related questions

Question

Transcribed Image Text:Chapter 16

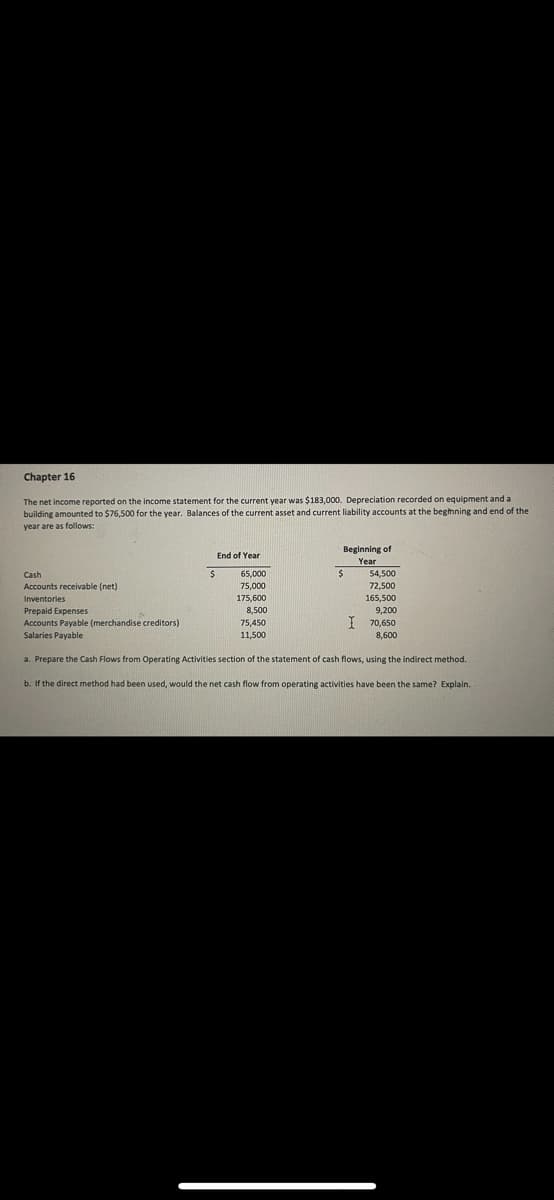

The net income reported on the income statement for the current year was $183,000. Depreciation recorded on equipment and al

building amounted to $76,500 for the year. Balances of the current asset and current liability accounts at the beginning and end of the

year are as follows:

End of Year

Beginning of

Year

Cash

65,000

54,500

Accounts receivable (net)

75,000

72,500

Inventories

175,600

165,500

Prepaid Expenses

8,500

9,200

Accounts Payable (merchandise creditors)

75,450

70,650

8,600

Salaries Payable

11,500

a. Prepare the Cash Flows from Operating Activities section of the statement of cash flows, using the indirect method.

b. If the direct method had been used, would the net cash flow from operating activities have been the same? Explain.

$

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College