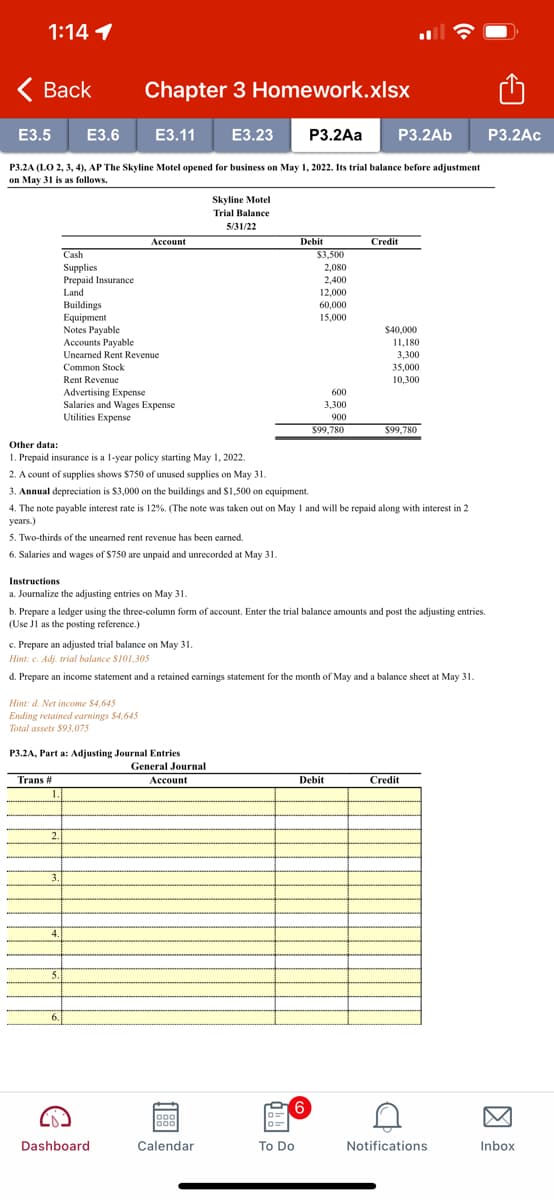

P3.2A (LO 2, 3, 4), AP The Skyline Motel opened for business on May 1, 2022. Its trial balance before adjustment on May 31 is as follows. Skyline Motel Trial Balance 5/31/22 Ассount Debit Credit Cash $3,500 Supplies Prepaid Insurance 2,080 2,400 Land 12,000 Buildings Equipment Notes Payable Accounts Payable Uncarned Rent Revenue 60,000 15,000 $40,000 I1,180 3,300 35,000 10,300 Common Stock Rent Revenue Advertising Expense Salaries and Wages Expense Utilities Expense 600 3,300 900 $99,780 $99,780 Other data: 1. Prepaid insurance is a l-year policy starting May 1, 2022. 2. A count of supplies shows $750 of unused supplies on May 31. 3. Annual depreciation is $3,000 on the buildings and S1,500 on equipment. 4. The note payable interest rate is 12%. (The note was taken out on May 1 and will be repaid along with interest in 2 уears.) 5. Two-thirds of the unearned rent revenue has been carned. 6. Salaries and wages of S750 are unpaid and unrecorded at May 31. Instructions a. Journalize the adjusting entries on May 31. b. Prepare a ledger using the three-column form of account. Enter the trial balance amounts and post the adjusting entries. (Use Ji as the posting reference.) c. Prepare an adjusted trial balance on May 31. Hint: e. Adj. trial balance S101.305 d. Prepare an income statement and a retained earnings statement for the month of May and a balance sheet at May 31. Hint: d. Net income $4,645 Ending retained earnings $4,645 Total assets $93,075 P3.2A, Part a: Adjusting Journal Entries General Journal Trans # Account Debit Credit 1. 2. 3. 4. 5. 6.

P3.2A (LO 2, 3, 4), AP The Skyline Motel opened for business on May 1, 2022. Its trial balance before adjustment on May 31 is as follows. Skyline Motel Trial Balance 5/31/22 Ассount Debit Credit Cash $3,500 Supplies Prepaid Insurance 2,080 2,400 Land 12,000 Buildings Equipment Notes Payable Accounts Payable Uncarned Rent Revenue 60,000 15,000 $40,000 I1,180 3,300 35,000 10,300 Common Stock Rent Revenue Advertising Expense Salaries and Wages Expense Utilities Expense 600 3,300 900 $99,780 $99,780 Other data: 1. Prepaid insurance is a l-year policy starting May 1, 2022. 2. A count of supplies shows $750 of unused supplies on May 31. 3. Annual depreciation is $3,000 on the buildings and S1,500 on equipment. 4. The note payable interest rate is 12%. (The note was taken out on May 1 and will be repaid along with interest in 2 уears.) 5. Two-thirds of the unearned rent revenue has been carned. 6. Salaries and wages of S750 are unpaid and unrecorded at May 31. Instructions a. Journalize the adjusting entries on May 31. b. Prepare a ledger using the three-column form of account. Enter the trial balance amounts and post the adjusting entries. (Use Ji as the posting reference.) c. Prepare an adjusted trial balance on May 31. Hint: e. Adj. trial balance S101.305 d. Prepare an income statement and a retained earnings statement for the month of May and a balance sheet at May 31. Hint: d. Net income $4,645 Ending retained earnings $4,645 Total assets $93,075 P3.2A, Part a: Adjusting Journal Entries General Journal Trans # Account Debit Credit 1. 2. 3. 4. 5. 6.

Related questions

Question

Transcribed Image Text:1:14 1

Back

Chapter 3 Homework.xlsx

ЕЗ.5

E3.6

ЕЗ.11

E3.23

P3.2Aa

P3.2Ab

P3.2Ac

P3.2A (LO 2, 3, 4), AP The Skyline Motel opened for business on May 1, 2022. Its trial balance before adjustment

on May 31 is as follows.

Skyline Motel

Trial Balance

5/31/22

Account

Debit

Credit

Cash

S3,500

Supplies

Prepaid Insurance

2,080

2,400

12,000

Land

Buildings

Equipment

Notes Payable

Accounts Payable

Unearned Rent Revenue

Common Stock

Rent Revenue

60,000

15,000

S40,000

I1,180

3,300

35,000

10,300

Advertising Expense

Salaries and Wages Expense

Utilities Expense

600

3,300

900

$99,780

$99,780

Other data:

1. Prepaid insurance is a l-year policy starting May 1, 2022.

2. A count of supplies shows $750 of unused supplies on May 31.

3. Annual depreciation is $3,000 on the buildings and S1,500 on equipment.

4. The note payable interest rate is 12%. (The note was taken out on May 1 and will be repaid along with interest in 2

years.)

5. Two-thirds of the unearned rent revenue has been earned.

6. Salaries and wages of $750 are unpaid and unrecorded at May 31.

Instructions

a. Journalize the adjusting entries on May 31.

b. Prepare a ledger using the three-column form of account. Enter the trial balance amounts and post the adjusting entries.

(Use Jl as the posting reference.)

c. Prepare an adjusted trial balance on May 31.

Hint: c. Adj. trial balance S101,305

d. Prepare an income statement and a retained carnings statement for the month of May and a balance sheet at May 31.

Hint: d. Net income $4,645

Ending retained earnings $4,645

Total assets $93,075

P3.2A, Part a: Adjusting Journal Entries

General Journal

Trans #

Асcount

Debit

Credit

1.

2.

3.

4.

5.

6.

6.

Dashboard

Calendar

To Do

Notifications

Inbox

因

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.