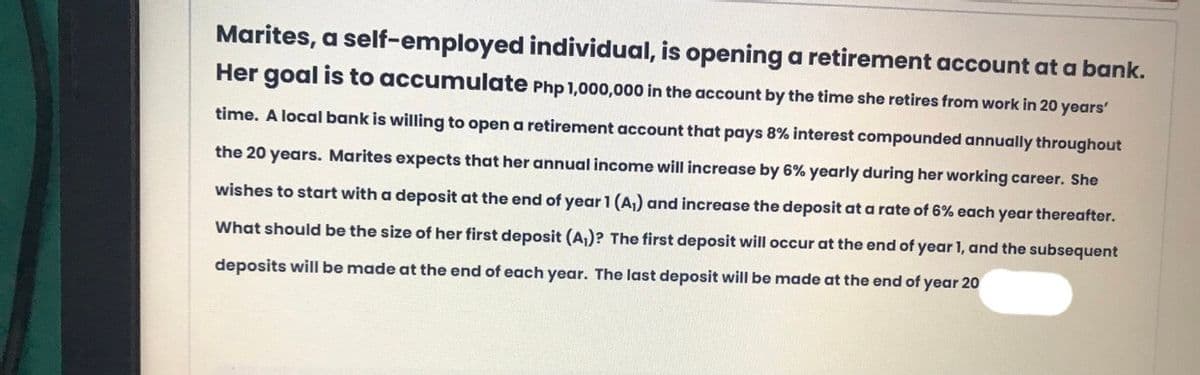

Marites, a self-employed individual, is opening a retirement account at a bank. Her goal is to accumulate Php 1,000,000 in the account by the time she retires from work in 20 years' time. A local bank is willing to open a retirement account that pays 8% interest compounded annually throughout the 20 years. Marites expects that her annual income will increase by 6% yearly during her working career. She wishes to start with a deposit at the end of year 1 (A,) and increase the deposit at a rate of 6% each year thereafter. What should be the size of her first deposit (A,)? The first deposit will occur at the end of year 1, and the subsequent deposits will be made at the end of each year. The last deposit will be made at the end of year 20

Marites, a self-employed individual, is opening a retirement account at a bank. Her goal is to accumulate Php 1,000,000 in the account by the time she retires from work in 20 years' time. A local bank is willing to open a retirement account that pays 8% interest compounded annually throughout the 20 years. Marites expects that her annual income will increase by 6% yearly during her working career. She wishes to start with a deposit at the end of year 1 (A,) and increase the deposit at a rate of 6% each year thereafter. What should be the size of her first deposit (A,)? The first deposit will occur at the end of year 1, and the subsequent deposits will be made at the end of each year. The last deposit will be made at the end of year 20

Chapter5: The Time Value Of Money

Section: Chapter Questions

Problem 42P

Related questions

Question

Transcribed Image Text:Marites, a self-employed individual, is opening a retirement account at a bank.

Her goal is to accumulate Php 1,000,000 in the account by the time she retires from work in 20 years'

time. A local bank is willing to open a retirement account that pays 8% interest compounded annually throughout

the 20 years. Marites expects that her annual income will increase by 6% yearly during her working career. She

wishes to start with a deposit at the end of year 1 (A,) and increase the deposit at a rate of 6% each year thereafter.

What should be the size of her first deposit (A,)? The first deposit will occur at the end of year 1, and the subsequent

deposits will be made at the end of each year. The last deposit will be made at the end of year 20

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning