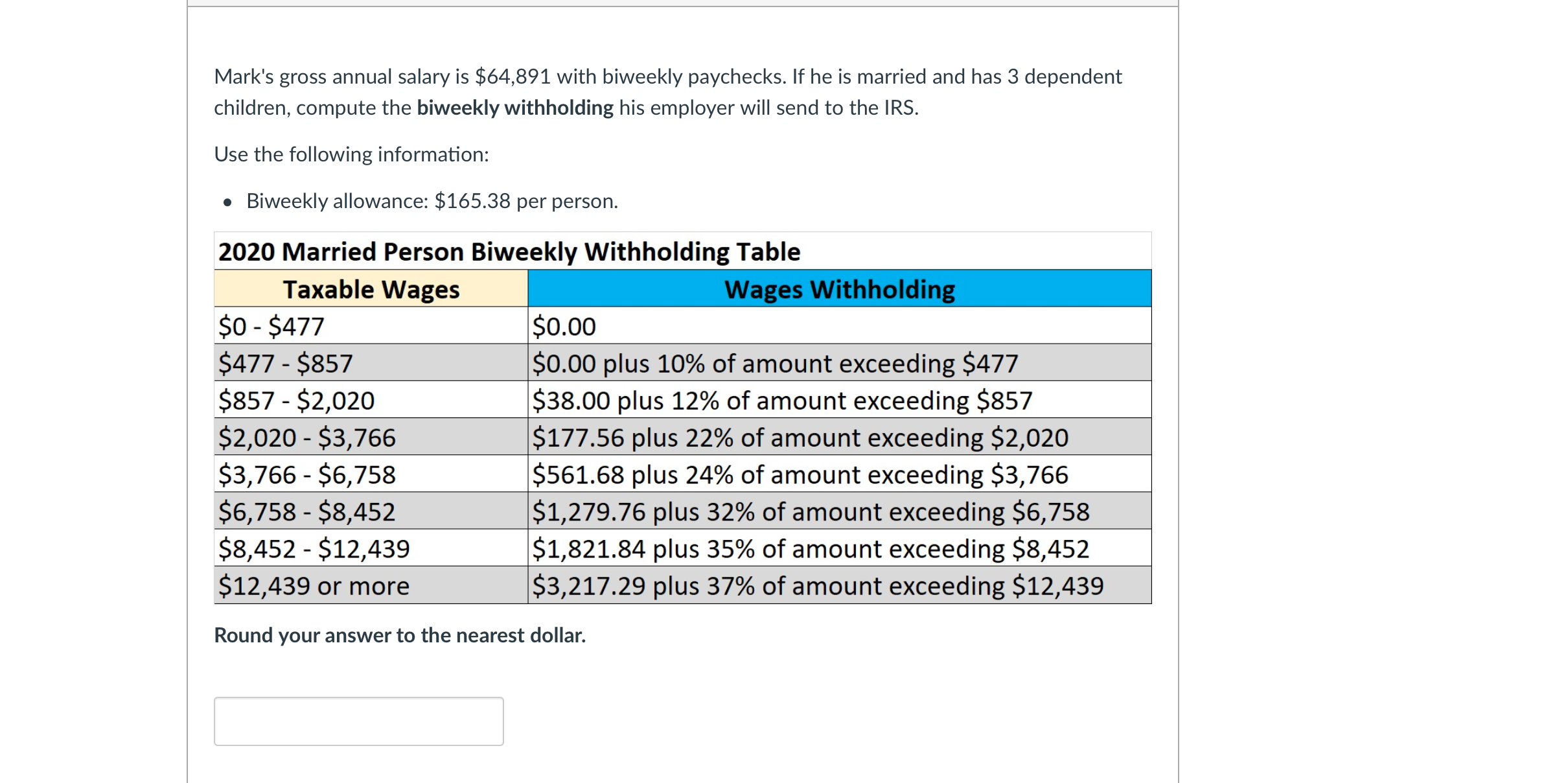

Mark's gross annual salary is $64,891 with biweekly paychecks. If he is married and has 3 dependent children, compute the biweekly withholding his employer will send to the IRS. Use the following information: • Biweekly allowance: $165.38 per person.

Mark's gross annual salary is $64,891 with biweekly paychecks. If he is married and has 3 dependent children, compute the biweekly withholding his employer will send to the IRS. Use the following information: • Biweekly allowance: $165.38 per person.

Chapter13: Tax Credits And Payment Procedures

Section: Chapter Questions

Problem 35P

Related questions

Question

Transcribed Image Text:Mark's gross annual salary is $64,891 with biweekly paychecks. If he is married and has 3 dependent

children, compute the biweekly withholding his employer will send to the IRS.

Use the following information:

• Biweekly allowance: $165.38 per person.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT