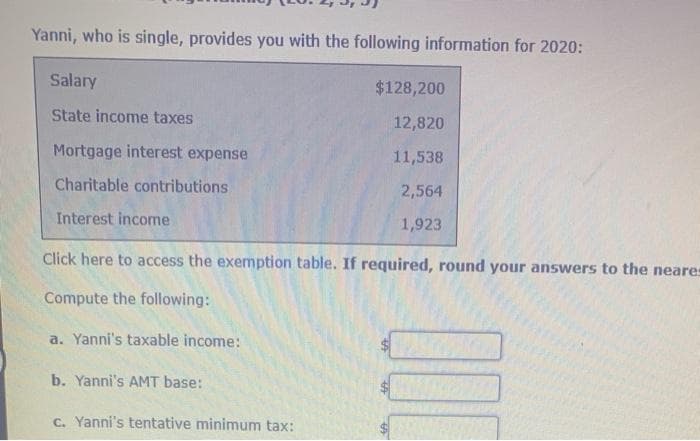

Yanni, who is single, provides you with the following information for 2020: Salary $128,200 State income taxes 12,820 Mortgage interest expense 11,538 Charitable contributions 2,564 Interest income 1,923 Click here to access the exemption table. If required, round your answers Compute the following: a. Yanni's taxable income: b. Yanni's AMT base: C. Yanni's tentative minimum tax:

Yanni, who is single, provides you with the following information for 2020: Salary $128,200 State income taxes 12,820 Mortgage interest expense 11,538 Charitable contributions 2,564 Interest income 1,923 Click here to access the exemption table. If required, round your answers Compute the following: a. Yanni's taxable income: b. Yanni's AMT base: C. Yanni's tentative minimum tax:

Chapter12: Alternative Minimum Tax

Section: Chapter Questions

Problem 24CE

Related questions

Question

100%

Transcribed Image Text:Yanni, who is single, provides you with the following information for 2020:

Salary

$128,200

State income taxes

12,820

Mortgage interest expense

11,538

Charitable contributions

2,564

Interest income

1,923

Click here to access the exemption table. If required, round your answers to the neares

Compute the following:

a. Yanni's taxable income:

b. Yanni's AMT base:

c. Yanni's tentative minimum tax:

%24

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT