Mark's Meals produces frozen meals, which it sells for $9 each. The company uses the FIFO inventory costing method, and it computes a new monthly fixed manufacturing overhead rate based on the actual number of meals produced that month. All costs and production levels are exactly as planned. The following data are from the company's first two months in business (Click the icon to view the data) Read the requirements Requirement 1. Compute the product cost per meal produced under absorption costing and under variable costing. Do this first for January and then for February January February Variable Absorption costing costing 1 Total product cost ■ 70 Requirement 2a. Prepare separate monthly income statements for January and for February, using absorption costing T Less: Less: Less: Mark's Meals Income Statement (Absorption Costing) Month Ended Less Absorption costing January 31 Requirement 2b. Prepare Mark's Meals' January and February income statements using variable costing Mark's Meals Contribution Margin Income Statement (Variable Costing) Month Ended Variable costing February 28 January 31 February 28 Data table Sales... Production... January 1,600 meals 2,000 meals $3 Variable manufacturing expense per meal $1 Sales commission expense per meal. Total fixed manufacturing overhead........... $800 Total fixed marketing and administrative expenses.. $600 Print Done February 1,800 meals 1.600 meals $3 $1 $800 $600

Mark's Meals produces frozen meals, which it sells for $9 each. The company uses the FIFO inventory costing method, and it computes a new monthly fixed manufacturing overhead rate based on the actual number of meals produced that month. All costs and production levels are exactly as planned. The following data are from the company's first two months in business (Click the icon to view the data) Read the requirements Requirement 1. Compute the product cost per meal produced under absorption costing and under variable costing. Do this first for January and then for February January February Variable Absorption costing costing 1 Total product cost ■ 70 Requirement 2a. Prepare separate monthly income statements for January and for February, using absorption costing T Less: Less: Less: Mark's Meals Income Statement (Absorption Costing) Month Ended Less Absorption costing January 31 Requirement 2b. Prepare Mark's Meals' January and February income statements using variable costing Mark's Meals Contribution Margin Income Statement (Variable Costing) Month Ended Variable costing February 28 January 31 February 28 Data table Sales... Production... January 1,600 meals 2,000 meals $3 Variable manufacturing expense per meal $1 Sales commission expense per meal. Total fixed manufacturing overhead........... $800 Total fixed marketing and administrative expenses.. $600 Print Done February 1,800 meals 1.600 meals $3 $1 $800 $600

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter18: Pricing And Profitability Analysis

Section: Chapter Questions

Problem 3CE: Pattison Products, Inc., began operations in October and manufactured 40,000 units during the month...

Related questions

Question

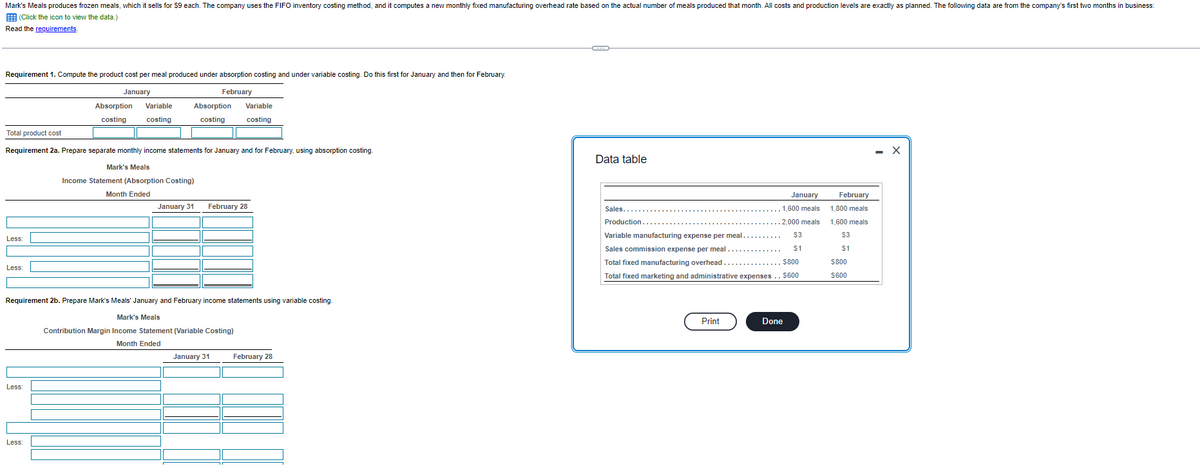

Transcribed Image Text:Mark's Meals produces frozen meals, which it sells for $9 each. The company uses the FIFO inventory costing method, and it computes a new monthly fixed manufacturing overhead rate based on the actual number of meals produced that month. All costs and production levels are exactly as planned. The following data are from the company's first two months in business:

(Click the icon to view the data.)

Read the requirements.

Requirement 1. Compute the product cost per meal produced under absorption costing and under variable costing. Do this first for January and then for February.

February

January

Less

Less:

Absorption

costing

Total product cost

Requirement 2a. Prepare separate monthly income statements for January and for February, using absorption costing.

Less:

Variable

costing

Less:

Absorption

costing

Mark's Meals

Income Statement (Absorption Costing)

Month Ended

Variable

costing

Requirement 2b. Prepare Mark's Meals' January and February income statements using variable costing.

Mark's Meals

Contribution Margin Income Statement (Variable Costing)

Month Ended

January 31 February 28

January 31

February 28

Data table

Sales....

Production..

January

1,600 meals

2.000 meals

$3

$1

Variable manufacturing expense per meal.

Sales commission expense per meal..

Total fixed manufacturing overhead

$800

Total fixed marketing and administrative expenses .. $600

Print

Done

February

1,800 meals

1,600 meals

$3

$1

$800

$600

- X

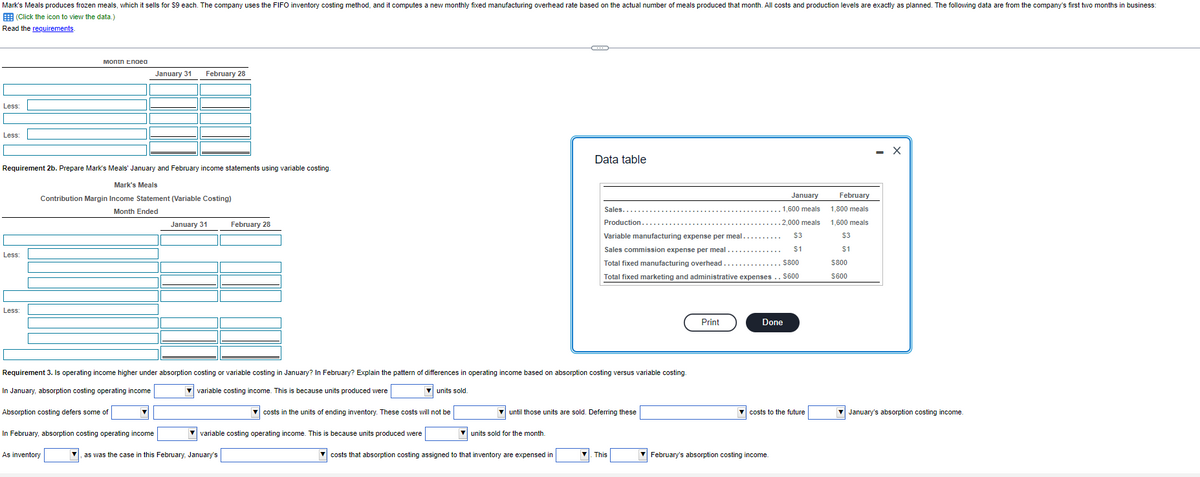

Transcribed Image Text:Mark's Meals produces frozen meals, which it sells for $9 each. The company uses the FIFO inventory costing method, and it computes a new monthly fixed manufacturing overhead rate based on the actual number of meals produced that month. All costs and production levels are exactly as planned. The following data are from the company's first two months in business:

(Click the icon to view the data.)

Read the requirements.

Less

Less:

Less:

Requirement 2b. Prepare Mark's Meals' January and February income statements using variable costing.

Less:

Montn Endea

Mark's Meals

Contribution Margin Income Statement (Variable Costing)

Month Ended

January 31 February 28

As inventory

▼

In February, absorption costing operating income

January 31

February 28

Requirement 3. Is operating income higher under absorption costing or variable costing in January? In February? Explain the pattern of differences in operating income based on absorption costing versus variable costing.

In January, absorption costing operating income

▼variable costing income. This is because units produced were

▼ units sold.

Absorption costing defers some of

▼costs in the units of ending inventory. These costs will not be

variable costing operating income. This is because units produced were

as was the case in this February, January's

G

Data table

costs that absorption costing assigned to that inventory are expensed in

Sales...

Production..

Variable manufacturing expense per meal..

Sales commission expense per meal

until those units are sold. Deferring these

units sold for the month.

Total fixed manufacturing overhead

$800

Total fixed marketing and administrative expenses.. $600

This

Print

January

1.600 meals

2.000 meals

Done

$3

$1

▼ February's absorption costing income.

costs to the future

February

1,800 meals

1,600 meals

$3

$1

$800

$600

January's absorption costing income.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 5 steps with 3 images

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,