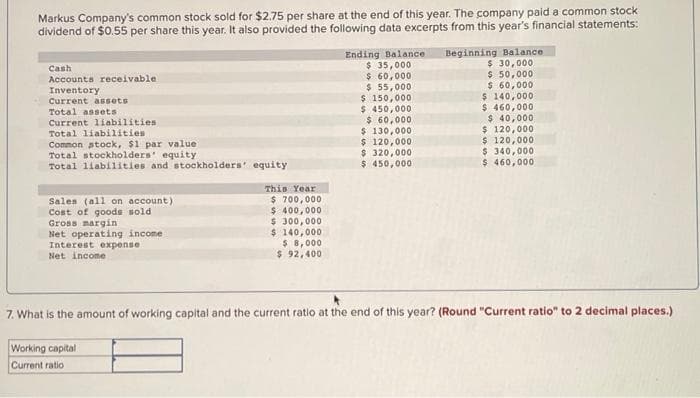

Markus Company's common stock sold for $2.75 per share at the end of this year. The company paid a common stock dividend of $0.55 per share this year. It also provided the following data excerpts from this year's financial statements: Ending Balance $ 35,000 ६ 60,000 $ 55,000 $ 150,000 $ 450,000 $ 60,000 $ 130,000 $ 120,000 $ 320,000 ६ 450,000 Beginning Balance $ 30,000 $ 50,000 $ 60,000 $ 140,000 $ 460,000 $ 40,000 $ 120,000 ६ 120,000 $ 340,000 $ 460,00০ Cash Accounts receivable Inventory Current assets Total assets Current liabilities Total liabilities Common atock, $1 par value Total stockholders' equity Total liabilities and stockholders' equity Sales (all on account) Cost of goods sold Gross margin Net operating income Interest expense Net income This Year $ 700,000 $ 400,000 $ 300,000 $ 140,000 $ 8,000 $ 92,400 7. What is the amount of working capital and the current ratio at the end of this year? (Round "Current ratio" to 2 decimal places.) Working capital Current ratio

Markus Company's common stock sold for $2.75 per share at the end of this year. The company paid a common stock dividend of $0.55 per share this year. It also provided the following data excerpts from this year's financial statements: Ending Balance $ 35,000 ६ 60,000 $ 55,000 $ 150,000 $ 450,000 $ 60,000 $ 130,000 $ 120,000 $ 320,000 ६ 450,000 Beginning Balance $ 30,000 $ 50,000 $ 60,000 $ 140,000 $ 460,000 $ 40,000 $ 120,000 ६ 120,000 $ 340,000 $ 460,00০ Cash Accounts receivable Inventory Current assets Total assets Current liabilities Total liabilities Common atock, $1 par value Total stockholders' equity Total liabilities and stockholders' equity Sales (all on account) Cost of goods sold Gross margin Net operating income Interest expense Net income This Year $ 700,000 $ 400,000 $ 300,000 $ 140,000 $ 8,000 $ 92,400 7. What is the amount of working capital and the current ratio at the end of this year? (Round "Current ratio" to 2 decimal places.) Working capital Current ratio

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter14: Statement Of Cash Flows

Section: Chapter Questions

Problem 32BEB: During 20X2, Evans Company had the following transactions: a. Cash dividends of 6,000 were paid. b....

Related questions

Question

Transcribed Image Text:Markus Company's common stock sold for $2.75 per share at the end of this year. The company paid a common stock

dividend of $0.55 per share this year. It also provided the following data excerpts from this year's financial statements:

Ending Balance

$ 35,000

$ 60,000

$ 55,000

$ 150,000

$ 450,000

$ 60,000

$ 130,000

$ 120,000

$ 320,000

६ 450, 000

Beginning Balance

$ 30,000

$ 50,000

$ 60,000

$ 140,000

$ 460,000

$ 40,0০০

$ 120,000

$ 120,000

$ 340,000

$ 460,000

Cash

Accounts receivable

Inventory

Current assets

Total assets

Current liabilities

Total liabilities

Common stock, $1 par value

Total stockholders' equity

Total liabilities and stockholders' equity

Sales (all on account)

Cost of goods sold

Gross margin

Net operating income

Interest expense

Net income

This Year

३ 700,000

$ 400,000

$ 300,000

$ 140,000

$ 8,000

$ 92,400

7. What is the amount of working capital and the current ratio at the end of this year? (Round "Current ratio" to 2 decimal places.)

Working capital

Current ratio

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning