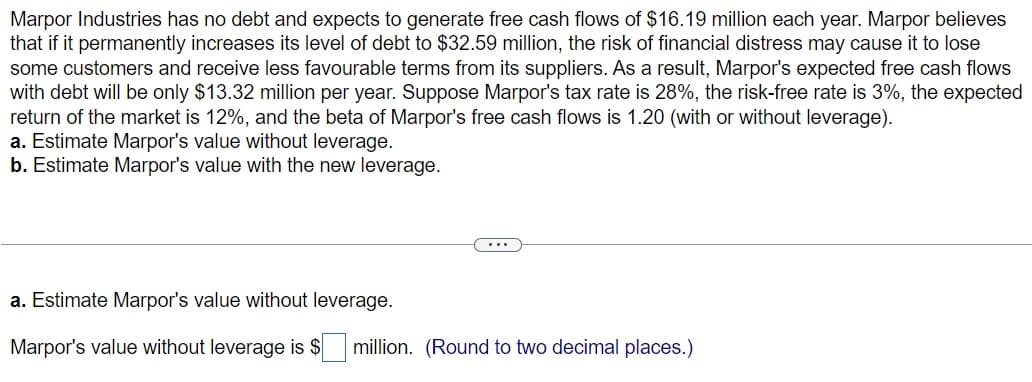

Marpor Industries has no debt and expects to generate free cash flows of $16.19 million each year. Marpor believes that if it permanently increases its level of debt to $32.59 million, the risk of financial distress may cause it to lose some customers and receive less favourable terms from its suppliers. As a result, Marpor's expected free cash flows with debt will be only $13.32 million per year. Suppose Marpor's tax rate is 28%, the risk-free rate is 3%, the expected return of the market is 12%, and the beta of Marpor's free cash flows is 1.20 (with or without leverage). a. Estimate Marpor's value without leverage. b. Estimate Marpor's value with the new leverage.

Marpor Industries has no debt and expects to generate free cash flows of $16.19 million each year. Marpor believes that if it permanently increases its level of debt to $32.59 million, the risk of financial distress may cause it to lose some customers and receive less favourable terms from its suppliers. As a result, Marpor's expected free cash flows with debt will be only $13.32 million per year. Suppose Marpor's tax rate is 28%, the risk-free rate is 3%, the expected return of the market is 12%, and the beta of Marpor's free cash flows is 1.20 (with or without leverage). a. Estimate Marpor's value without leverage. b. Estimate Marpor's value with the new leverage.

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter17: Dynamic Capital Structures And Corporate Valuation

Section: Chapter Questions

Problem 3P

Related questions

Question

Vijay

Transcribed Image Text:Marpor Industries has no debt and expects to generate free cash flows of $16.19 million each year. Marpor believes

that if it permanently increases its level of debt to $32.59 million, the risk of financial distress may cause it to lose

some customers and receive less favourable terms from its suppliers. As a result, Marpor's expected free cash flows

with debt will be only $13.32 million per year. Suppose Marpor's tax rate is 28%, the risk-free rate is 3%, the expected

return of the market is 12%, and the beta of Marpor's free cash flows is 1.20 (with or without leverage).

a. Estimate Marpor's value without leverage.

b. Estimate Marpor's value with the new leverage.

a. Estimate Marpor's value without leverage.

Marpor's value without leverage is $ million. (Round to two decimal places.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 3 images

Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT