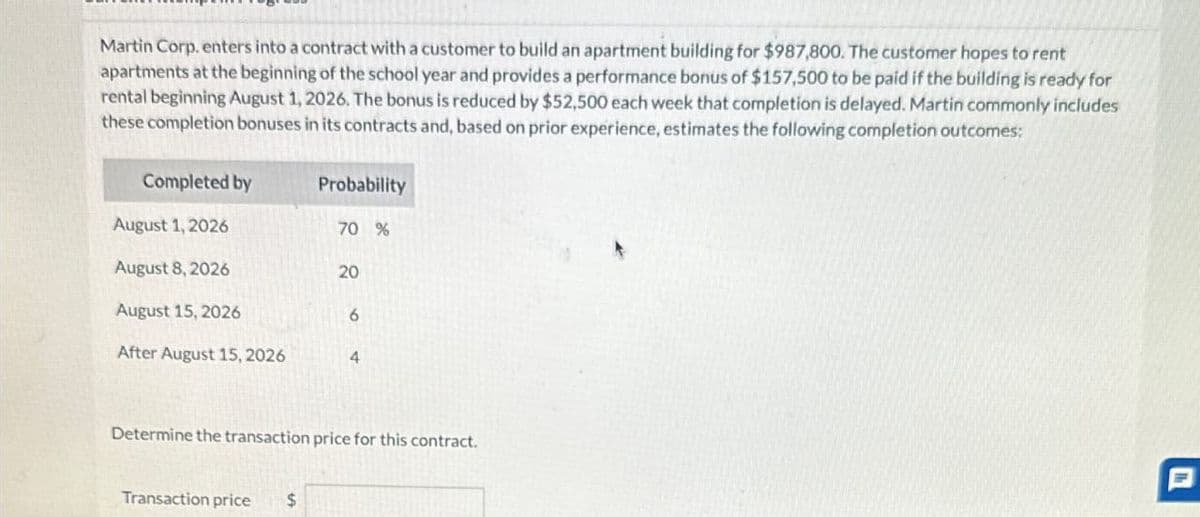

Martin Corp. enters into a contract with a customer to build an apartment building for $987,800. The customer hopes to rent apartments at the beginning of the school year and provides a performance bonus of $157,500 to be paid if the building is ready for rental beginning August 1, 2026. The bonus is reduced by $52,500 each week that completion is delayed. Martin commonly includes these completion bonuses in its contracts and, based on prior experience, estimates the following completion outcomes: Completed by August 1, 2026 Probability 70 % August 8, 2026 20 August 15, 2026 6 After August 15, 2026 4 Determine the transaction price for this contract. Transaction price $ P

Martin Corp. enters into a contract with a customer to build an apartment building for $987,800. The customer hopes to rent apartments at the beginning of the school year and provides a performance bonus of $157,500 to be paid if the building is ready for rental beginning August 1, 2026. The bonus is reduced by $52,500 each week that completion is delayed. Martin commonly includes these completion bonuses in its contracts and, based on prior experience, estimates the following completion outcomes: Completed by August 1, 2026 Probability 70 % August 8, 2026 20 August 15, 2026 6 After August 15, 2026 4 Determine the transaction price for this contract. Transaction price $ P

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter17: Advanced Issues In Revenue Recognition

Section: Chapter Questions

Problem 6P

Related questions

Question

Give me step by step solution and explanation

Transcribed Image Text:Martin Corp. enters into a contract with a customer to build an apartment building for $987,800. The customer hopes to rent

apartments at the beginning of the school year and provides a performance bonus of $157,500 to be paid if the building is ready for

rental beginning August 1, 2026. The bonus is reduced by $52,500 each week that completion is delayed. Martin commonly includes

these completion bonuses in its contracts and, based on prior experience, estimates the following completion outcomes:

Completed by

August 1, 2026

Probability

70 %

August 8, 2026

20

August 15, 2026

6

After August 15, 2026

4

Determine the transaction price for this contract.

Transaction price

$

P

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT