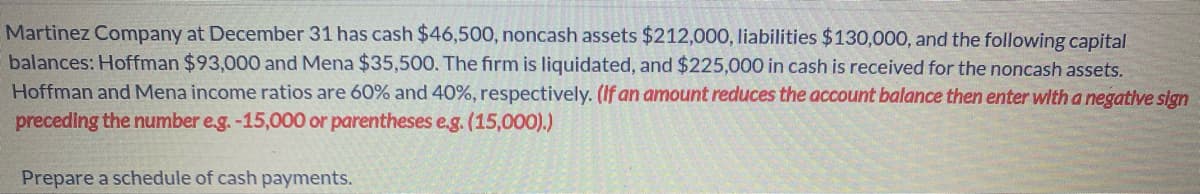

Martinez Company at December 31 has cash $46,500, noncash assets $212,000, liabilities $130,000, and the following capital palances: Hoffman $93,000 and Mena $35,500. The firm is liquidated, and $225,000 in cash is received for the noncash assets. Hoffman and Mena income ratios are 60% and 40%, respectively. (If an amount reduces the account balance then enter with a negative sig preceding the number e.g.-15,000 or parentheses e.g. (15,000).)

Martinez Company at December 31 has cash $46,500, noncash assets $212,000, liabilities $130,000, and the following capital palances: Hoffman $93,000 and Mena $35,500. The firm is liquidated, and $225,000 in cash is received for the noncash assets. Hoffman and Mena income ratios are 60% and 40%, respectively. (If an amount reduces the account balance then enter with a negative sig preceding the number e.g.-15,000 or parentheses e.g. (15,000).)

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter16: Accounting For Accounts Receivable

Section: Chapter Questions

Problem 1CP: Martel Co. has 320,000 in Accounts Receivable on December 31, 20-1, the end of its first year of...

Related questions

Question

Transcribed Image Text:MARTINEZCOMPANY

Schedule of Cash Payments

Item

Cash

Noncash Assets

Liat

Balances before liquidation

24

24

24

Sale of noncash assets and allocation of losses

New balances

Pay liabilities

New balances

Cash distribution

Final balances

2$

Transcribed Image Text:Martinez Company at December 31 has cash $46,500, noncash assets $212,000, liabilities $130,000, and the following capital

balances: Hoffman $93,000 and Mena $35,500. The firm is liquidated, and $225,000 in cash is received for the noncash assets.

Hoffman and Mena income ratios are 60% and 40%, respectively. (If an amount reduces the account balance then enter with a negative sign

preceding the number e.g. -15,000 or parentheses e.g. (15,000).)

Prepare a schedule of cash payments.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning