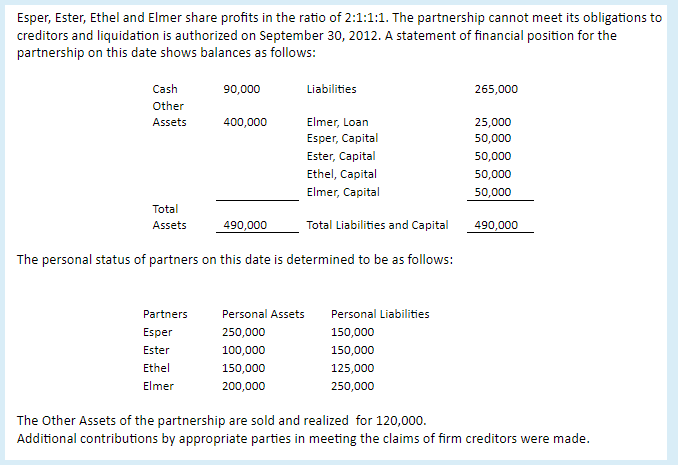

Esper, Ester, Ethel and Elmer share profits in the ratio of 2:1:1:1. The partnership cannot meet its obligations to creditors and liquidation is authorized on September 30, 2012. A statement of financial position for the partnership on this date shows balances as follows: Cash 90,000 Liabilities 265,000 Other Assets 400,000 Elmer, Loan 25,000 Esper, Capital 50,000 Ester, Capital 50,000 Ethel, Capital 50,000 Elmer, Capital 50,000 Total Assets 490,000 Total Liabilities and Capital 490,000 The personal status of partners on this date is determined to be as follows: Partners Personal Assets Personal Liabilities Esper 250,000 150,000 Ester 100,000 150,000 Ethel 150,000 125,000 Elmer 200,000 250,000 The Other Assets of the partnership are sold and realized for 120,000. Additional contributions by appropriate parties in meeting the claims of firm creditors were made.

Esper, Ester, Ethel and Elmer share profits in the ratio of 2:1:1:1. The partnership cannot meet its obligations to creditors and liquidation is authorized on September 30, 2012. A statement of financial position for the partnership on this date shows balances as follows: Cash 90,000 Liabilities 265,000 Other Assets 400,000 Elmer, Loan 25,000 Esper, Capital 50,000 Ester, Capital 50,000 Ethel, Capital 50,000 Elmer, Capital 50,000 Total Assets 490,000 Total Liabilities and Capital 490,000 The personal status of partners on this date is determined to be as follows: Partners Personal Assets Personal Liabilities Esper 250,000 150,000 Ester 100,000 150,000 Ethel 150,000 125,000 Elmer 200,000 250,000 The Other Assets of the partnership are sold and realized for 120,000. Additional contributions by appropriate parties in meeting the claims of firm creditors were made.

Chapter4: Gross Income: Concepts And Inclusions

Section: Chapter Questions

Problem 43P

Related questions

Question

The amount that will be paid to the personal creditors of Esper would be

Transcribed Image Text:Esper, Ester, Ethel and Elmer share profits in the ratio of 2:1:1:1. The partnership cannot meet its obligations to

creditors and liquidation is authorized on September 30, 2012. A statement of financial position for the

partnership on this date shows balances as follows:

Cash

90,000

Liabilities

265,000

Other

Assets

400,000

Elmer, Loan

25,000

Esper, Capital

50,000

Ester, Capital

50,000

Ethel, Capital

50,000

Elmer, Capital

50,000

Total

Assets

490,000

Total Liabilities and Capital

490,000

The personal status of partners on this date is determined to be as follows:

Partners

Personal Assets

Personal Liabilities

Esper

250,000

150,000

Ester

100,000

150,000

Ethel

150,000

125,000

Elmer

200,000

250,000

The Other Assets of the partnership are sold and realized for 120,000.

Additional contributions by appropriate parties in meeting the claims of firm creditors were made.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College