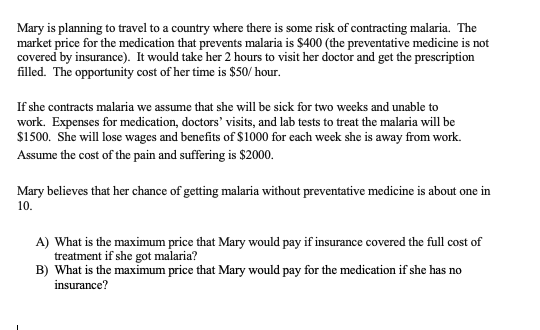

Mary is planning to travel to a country where there is some risk of contracting malaria. The market price for the medication that prevents malaria is $400 (the preventative medicine is not covered by insurance). It would take her 2 hours to visit her doctor and get the prescription filled. The opportunity cost of her time is $50/ hour. If she contracts malaria we assume that she will be sick for two weeks and unable to work. Expenses for medication, doctors' visits, and lab tests to treat the malaria will be $1500. She will lose wages and benefits of $1000 for each week she is away from work. Assume the cost of the pain and suffering is $2000. Mary believes that her chance of getting malaria without preventative medicine is about one in 10. A) What is the maximum price that Mary would pay if insurance covered the full cost of treatment if she got malaria? B) What is the maximum price that Mary would pay for the medication if she has no insurance?

Mary is planning to travel to a country where there is some risk of contracting malaria. The market price for the medication that prevents malaria is $400 (the preventative medicine is not covered by insurance). It would take her 2 hours to visit her doctor and get the prescription filled. The opportunity cost of her time is $50/ hour. If she contracts malaria we assume that she will be sick for two weeks and unable to work. Expenses for medication, doctors' visits, and lab tests to treat the malaria will be $1500. She will lose wages and benefits of $1000 for each week she is away from work. Assume the cost of the pain and suffering is $2000. Mary believes that her chance of getting malaria without preventative medicine is about one in 10. A) What is the maximum price that Mary would pay if insurance covered the full cost of treatment if she got malaria? B) What is the maximum price that Mary would pay for the medication if she has no insurance?

Managerial Economics: A Problem Solving Approach

5th Edition

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Chapter2: The One Lesson Of Business

Section: Chapter Questions

Problem 2.3IP

Related questions

Question

Transcribed Image Text:Mary is planning to travel to a country where there is some risk of contracting malaria. The

market price for the medication that prevents malaria is $400 (the preventative medicine is not

covered by insurance). It would take her 2 hours to visit her doctor and get the prescription

filled. The opportunity cost of her time is $50/ hour.

If she contracts malaria we assume that she will be sick for two weeks and unable to

work. Expenses for medication, doctors' visits, and lab tests to treat the malaria will be

$1500. She will lose wages and benefits of $1000 for each week she is away from work.

Assume the cost of the pain and suffering is $2000.

Mary believes that her chance of getting malaria without preventative medicine is about one in

10.

A) What is the maximum price that Mary would pay if insurance covered the full cost of

treatment if she got malaria?

B) What is the maximum price that Mary would pay for the medication if she has no

insurance?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning