Mary Poppins plans to start a company and offers to sell 30,000 ordinary shares at a price of $2 per share, to investors. The terms of the share offer are as follows: Dates Terms $1.00 is payable upon application, due by 31st August. August 1st to 31st September 1st to 30th Allotment will be made on the 1st September. $0.50 is then due, by 30th September. December 1st to 31st A call will then be made on December 1st, for all outstanding money. The call money is due by 31st December. Assume that during the application period, applications were received for 40,000 shares and that all money requested from investors was collected by all the appropriate due dates above. By the 30th September, the total amount of cash that Mary had collected from investors was: Select one: a. $45,000 O b. $30,000 O c. $55,000 O d. $15,000

Mary Poppins plans to start a company and offers to sell 30,000 ordinary shares at a price of $2 per share, to investors. The terms of the share offer are as follows: Dates Terms $1.00 is payable upon application, due by 31st August. August 1st to 31st September 1st to 30th Allotment will be made on the 1st September. $0.50 is then due, by 30th September. December 1st to 31st A call will then be made on December 1st, for all outstanding money. The call money is due by 31st December. Assume that during the application period, applications were received for 40,000 shares and that all money requested from investors was collected by all the appropriate due dates above. By the 30th September, the total amount of cash that Mary had collected from investors was: Select one: a. $45,000 O b. $30,000 O c. $55,000 O d. $15,000

Chapter14: Corporation Accounting

Section: Chapter Questions

Problem 15EB: Nutritious Pet Food Companys board of directors declares a 2-for-1 stock split on June 30 when the...

Related questions

Question

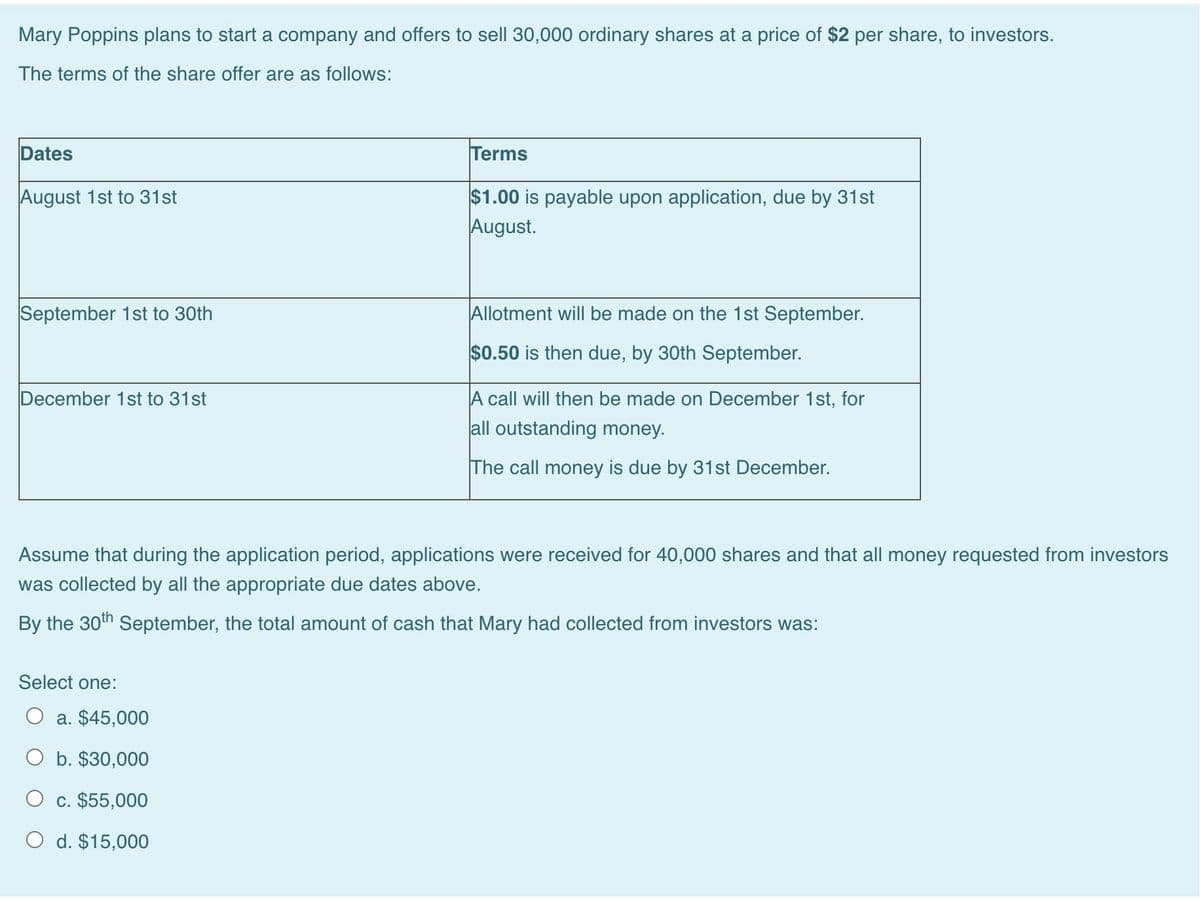

Transcribed Image Text:Mary Poppins plans to start a company and offers to sell 30,000 ordinary shares at a price of $2 per share, to investors.

The terms of the share offer are as follows:

Dates

Terms

$1.00 is payable upon application, due by 31st

August.

August 1st to 31st

September 1st to 30th

Allotment will be made on the 1st September.

$0.50 is then due, by 30th September.

December 1st to 31st

A call will then be made on December 1st, for

all outstanding money.

The call money is due by 31st December.

Assume that during the application period, applications were received for 40,000 shares and that all money requested from investors

was collected by all the appropriate due dates above.

By the 30th September, the total amount of cash that Mary had collected from investors was:

Select one:

O a. $45,000

O b. $30,000

O c. $55,000

O d. $15,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning