or each employee listed, use the percentage method to calculate federal income tax withholding for an employee who has submitted a pre-2020 Form W-4.Refer to ublication 15-T. IOTE: For simplicity, all calculations throughout this exercise, both intermediate and final, should be rounded to two decimal places at each calculation.

or each employee listed, use the percentage method to calculate federal income tax withholding for an employee who has submitted a pre-2020 Form W-4.Refer to ublication 15-T. IOTE: For simplicity, all calculations throughout this exercise, both intermediate and final, should be rounded to two decimal places at each calculation.

Century 21 Accounting General Journal

11th Edition

ISBN:9781337680059

Author:Gilbertson

Publisher:Gilbertson

Chapter13: Accounting For Payroll And Payroll Taxes

Section13.3: Reporting Withholding And Payroll Taxes

Problem 1WT

Related questions

Question

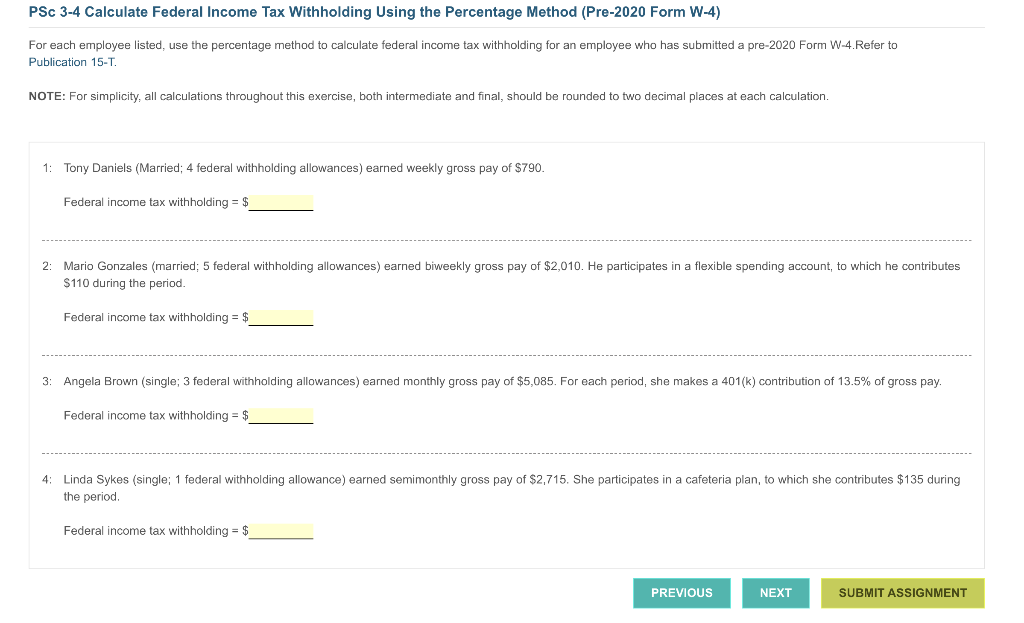

Transcribed Image Text:PSc 3-4 Calculate Federal Income Tax Withholding Using the Percentage Method (Pre-2020 Form W-4)

For each employee listed, use the percentage method to calculate federal income tax withholding for an employee who has submitted a pre-2020 Form W-4.Refer to

Publication 15-T.

NOTE: For simplicity, all calculations throughout this exercise, both intermediate and final, should be rounded to two decimal places at each calculation.

1:

Tony Daniels (Married; 4 federal withholding allowances) earned weekly gross pay of $790.

Federal income tax withholding = $

2: Mario Gonzales (married; 5 federal withholding allowances) earned biweekly gross pay of $2,010. He participates in a flexible spending account, to which he contributes

$110 during the period.

Federal income tax withholding = $

3: Angela Brown (single; 3 federal withholding allowances) earned monthly gross pay of $5,085. For each period, she makes a 401(k) contribution of 13.5% of gross pay.

Federal income tax withholding = $

4: Linda Sykes (single; 1 federal withholding allowance) earned semimonthly gross pay of $2,715. She participates in a cafeteria plan, to which she contributes $135 during

the period.

Federal income tax withholding = $

PREVIOUS

NEXT

SUBMIT ASSIGNMENT

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps

Recommended textbooks for you

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning