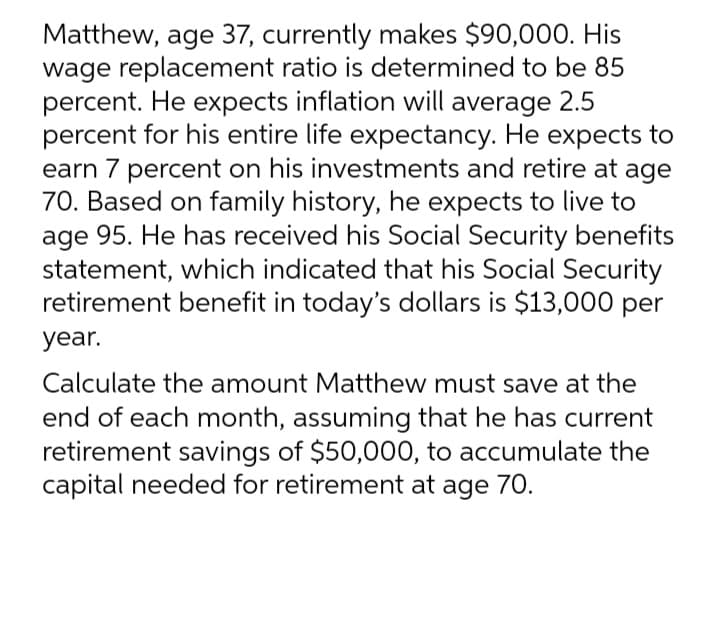

Matthew, age 37, currently makes $90,000. His wage replacement ratio is determined to be 85 percent. He expects inflation will average 2.5 percent for his entire life expectancy. He expects to earn 7 percent on his investments and retire at age 70. Based on family history, he expects to live to age 95. He has received his Social Security benefits statement, which indicated that his Social Security retirement benefit in today's dollars is $13,000 per year. Calculate the amount Matthew must save at the end of each month, assuming that he has current retirement savings of $50,000, to accumulate the capital needed for retirement at age 70.

Matthew, age 37, currently makes $90,000. His wage replacement ratio is determined to be 85 percent. He expects inflation will average 2.5 percent for his entire life expectancy. He expects to earn 7 percent on his investments and retire at age 70. Based on family history, he expects to live to age 95. He has received his Social Security benefits statement, which indicated that his Social Security retirement benefit in today's dollars is $13,000 per year. Calculate the amount Matthew must save at the end of each month, assuming that he has current retirement savings of $50,000, to accumulate the capital needed for retirement at age 70.

Chapter5: The Time Value Of Money

Section: Chapter Questions

Problem 42P

Related questions

Question

M6

Transcribed Image Text:Matthew, age 37, currently makes $90,000. His

wage replacement ratio is determined to be 85

percent. He expects inflation will average 2.5

percent for his entire life expectancy. He expects to

earn 7 percent on his investments and retire at age

70. Based on family history, he expects to live to

age 95. He has received his Social Security benefits

statement, which indicated that his Social Security

retirement benefit in today's dollars is $13,000 per

year.

Calculate the amount Matthew must save at the

end of each month, assuming that he has current

retirement savings of $50,000, to accumulate the

capital needed for retirement at age 70.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning