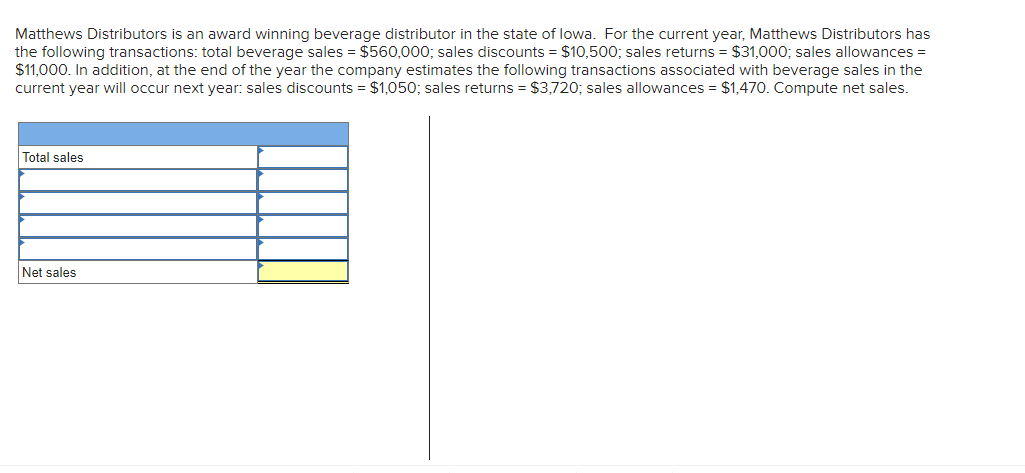

Matthews Distributors is an award winning beverage distributor in the state of lowa. For the current year, Matthews Distributors has the following transactions: total beverage sales = $560,000; sales discounts = $10,500; sales returns = $31,000; sales allowances = $11,000. In addition, at the end of the year the company estimates the following transactions associated with beverage sales in the current year will occur next year: sales discounts = $1,050; sales returns = $3,720; sales allowances = $1,470. Compute net sales. Total sales Net sales

Matthews Distributors is an award winning beverage distributor in the state of lowa. For the current year, Matthews Distributors has the following transactions: total beverage sales = $560,000; sales discounts = $10,500; sales returns = $31,000; sales allowances = $11,000. In addition, at the end of the year the company estimates the following transactions associated with beverage sales in the current year will occur next year: sales discounts = $1,050; sales returns = $3,720; sales allowances = $1,470. Compute net sales. Total sales Net sales

Principles of Cost Accounting

17th Edition

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Edward J. Vanderbeck, Maria R. Mitchell

Chapter10: Cost Analysis For Management Decision Making

Section: Chapter Questions

Problem 18E

Related questions

Question

100%

thank you!

Transcribed Image Text:Matthews Distributors is an award winning beverage distributor in the state of lowa. For the current year, Matthews Distributors has

the following transactions: total beverage sales = $560,000; sales discounts = $10,500; sales returns = $31,000; sales allowances =

$11,000. In addition, at the end of the year the company estimates the following transactions associated with beverage sales in the

current year will occur next year: sales discounts = $1,050; sales returns = $3,720; sales allowances = $1,470. Compute net sales.

Total sales

Net sales

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College