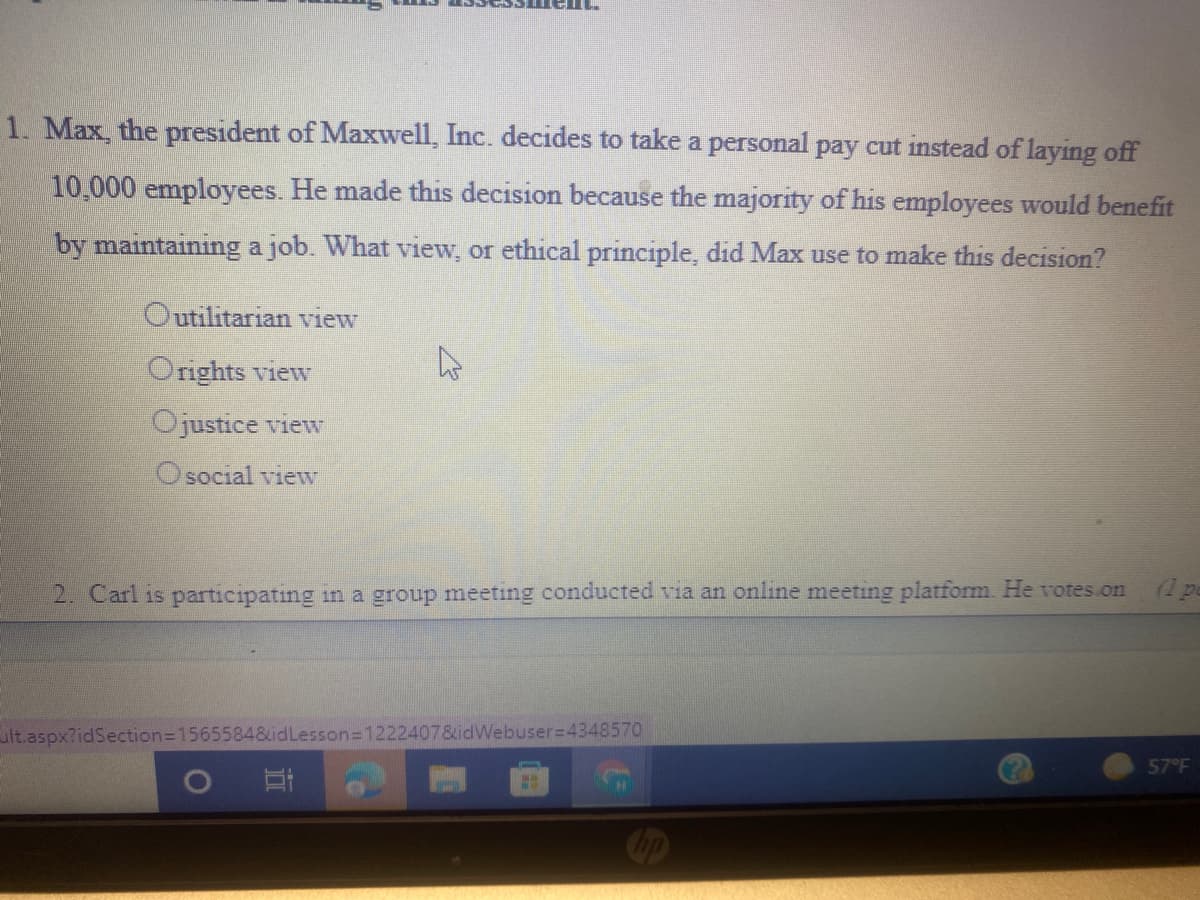

Max, the president of Maxwell, Inc. decides to take a personal pay cut instead of laying off 10,000 employees. He made this decision because the majority of his employees would benefit by maintaining a job. What view, or ethical principle, did Max use to make this decision? Outilitarian view Orights view Ojustice view O social view

Q: Question 2 Direct costs: are incurred to benefit a particular accounting period. are incurred due to...

A: Direct cost are those cost which can be directly link to the manufacturing of goods or rendering of ...

Q: On October 1. Ebony Ernst organızed Ernst Consulting: on October 3. the owner contributed $84,580 in...

A: Net income = Total Revenue - Total expenses

Q: GIVE 3 JUSTIFICATIONS AND ELABORATE YOUR ANSWER

A: Code of Ethics is a set of ethics set for professional to do his/her dulty in more efficient manner

Q: Blankenship Company, maker of wood shelving, incurred the following cost during current year. Is the...

A: Solution 1: Product costs are those costs which are incurred in the process of manufacturing directl...

Q: One of the three conditions for an asset is that the business __________ the asset.

A: Definition of Asset: An asset may be a resource controlled or owned by a person, corporation, or any...

Q: In 2014, Nana Company purchased property with natural resources for P12,400,000. The property was re...

A: Answer - Step 1 - Computation of depletion rate - 2015 Particulars Amount Cost of land P 1...

Q: A corporation had the following assets and liabilities at the beginning and end of this year. Assets...

A: An accounting equation is a mathematical representation of financial transactions. It shows as total...

Q: (Paint) Work in process, October 1* 20 $ 460,000 $ 120,000 Started during October 2017 80 Completed ...

A: The equivalent units are calculated on the basis of percentage of the work completed during the peri...

Q: Bonita Company sells tablet PCs combined with Internet service, which permits the tablet to connect ...

A: Unearned Revenue: Money received by a person or corporation in exchange for a service or product tha...

Q: ve and Abel are partners in Suave Swimsuits. Profits and losses are shared in the ratio of 022, when...

A: Suave Swimsuits have 3 partners Adam ,Eve and Abil who share their profits and losses in the ratio o...

Q: Chips Co., maker of computers, incurred the following cost during the year. Is the following cost it...

A: Variable cost is an amount that changes in proportion to the units produced and sold from the manufa...

Q: Required information Use the following information to answer questions. (Algo) [The following inform...

A:

Q: 1. Honizon Co. was incorporated in 20x1. The following were the Jan. 31 Received full payment for 12...

A: journal entry is the process of recording business transactions in a debit and credit side during a ...

Q: Retained earnings not paid out to shareholders in the form of dividends are: Select one: a. Re-inves...

A: Retained earnings are part of net income of the company that is not given to the shareholders as par...

Q: Fill in the blank for part A and B. A. Higher margin businesses ________________________ than lowe...

A: Net Margin or net profit margin:- It is the measure of how net profit or net income is generated as ...

Q: June Co. is evaluating a project requiring a capital expenditure of $620,000. The project has an est...

A: (a) Average rate of return = Average net income/Average investment x 100 = 37,500/310,000...

Q: Which of the following is not an asset? a.cash b.inventory c.owner's equity d.investments

A: Assets are those that provide economic benefits and that help to generate cash in the future.

Q: he shareholders’ equity section of Corporation’s statement of financial position as of December 31, ...

A: Unappropriated retained earnings comprise of company's retained earnings portion which are not class...

Q: Several years ago Ms. Allen invested in growth stocks, which she hoped would increase in value over ...

A: Market cap—or market capitalization—refers to the total value of all a company's shares of stock. It...

Q: Explain how the consideration to be paid should be accounted for in our consolidated financial state...

A: solution concept The accounting for the consideration to be paid is little complex and shall be acco...

Q: 1 The list below shows select accounts for Reading Readiness Company as of January 31, 20X1. 2 (Acco...

A: Income Statement of the business shows all incomes and expenses of the business and also calculates ...

Q: Sun Studio in Irvine plans to initiate an activity-based costing system with two activities: Offerin...

A: Indirect cost: It implies to the expense that is incurred in relation to multiple activities and is ...

Q: When closing overapplied manufacturing overhead to Cost of Goods Sold, which of the following would ...

A: When closing overapplied manufacturing overhead to Cost of Goods Sold, Gross profit will increase. ...

Q: On September 1, 2021, Oriole Corporation issued $610,000 of 10-year, 3% bonds at 96. Interest is pay...

A: The market rate of interest is higher than the coupon rate if the issue price is less than the face ...

Q: What is the liability for the outstanding premiums at year-end? *

A: 4 Boxtops to be redeem for one bowl and with an additional 5 php

Q: For each transaction, (1) analyze the transaction using the accounting equation, (2) record the tran...

A: Bookkeeping: Bookkeeping alludes to the most common way of checking the monetary exchanges of an ass...

Q: THIS QUESTION REQUIRES AN ESSAY STYLE ANSWER Timing is very important when preparing the end of fina...

A: Services: Services (theoretical) are act or use for which a shopper, firm, or government will pay. E...

Q: Harrelon Company manufactures pira sauce through two production departnents: Cooking and Canning In ...

A: The question says , Harrelson company has two production departments : Cooking Canning There are d...

Q: The shareholders’ equity section of Corporation’s statement of financial position as of December 31,...

A: STATEMENT OF CHANGES IN EQUITY 2020-21 AMOUNT 1 Shares Outsandin...

Q: Carmen Camry operates a consulting firm called Help Today, which began operations on August 1. On Au...

A: The balance sheet represents the financial position of the company that includes the assets, liabili...

Q: Bowen Company manufactures one product, it does not maintain any beginning or ending inventories, an...

A: Hi student Since there are multiple subparts, we will answer only first three subparts.

Q: The following information pertains to Luna Company as at September 30, 2020: a. Notes payable – bank...

A: The balance sheet is a statement on the financial position of an enterprise at a given date. It is c...

Q: In 2018, SoundSmart Company started its production, specialising in manufacturing motorcycle helmets...

A: When a product is being manufactured, there are different costs associated with it. These costs can ...

Q: Blankenship Company, maker of wood shelving, incurred the following cost during the current year. Is...

A: Salary of Blankenship's chief executive officer. Period cost Explanation - Chief executive officer'...

Q: Required information Problem 3-3A (Static) Preparing adjusting entries, adjusted trial balance, and ...

A: SOLUTION CALCULATION OF NET INCOME - PARTICULARS AMOUNT AMOUNT REVENUES: TUTION FEES EARN...

Q: Required Information Problem 3-3A (Statie) Preparing adjusting entrles, odjusted trlal balance, and ...

A: 1. Balance Sheet - This Statement shows the balance of assets liabilities and Equity as of the balan...

Q: Problem 7-14 (IAA) On December 31, 2021, Oregon Bank recorded an investment of P5.000,000 in a loan ...

A: SOLUTION WORKING NOTE- TOTAL PRESENT VALUE OF CASH FLOWS- PRESENT VALUE OF PRINCIPLE (5000000*0.7...

Q: ISY Inc. produces at 9 variable cost and 4 fixed cost a product that is selling at 20. Currently, th...

A: There are two type of costs being incurred. One is fixed costs, which will not change with change in...

Q: Oslo Company produces large quantities of a standardized product. The following information is avail...

A:

Q: 29. Lion Company purchased inventory from Dove Corporation for P120,000 on October 4, 2020, and reso...

A: SOLUTION FORMULA GROSS PROFIT = SALES - COGS.

Q: Sage sells its specialty combination gas/wood-fired grills to local restaurants. Each grill is sold ...

A: Financial transactions are initially recorded in the form of journal entries by the company.

Q: What is the premium expense for the current year? * Sisiw Company offers a pottery bowl if they send...

A: Premium expenses for the current year will be estimated total cost of estimated redemption of the bo...

Q: During 2019 (its first year of operations) and 2020, Fieri Foods used the FIFO inventory costing met...

A: The income statement is one of the important financial statement of the business which is prepared t...

Q: Discuss and give examples of some of the indicators that affect asset classes

A: Asset classes:- An asset class is basically a collection of investments with some comparable feature...

Q: SnowGlo Company manufactures snowboards. The managemen calculate the fixed and variable costs associ...

A: Disclaimer: “Since you have posted a question with multiple sub-parts, we will solve first three sub...

Q: __ cost of inventory is incurred due to non availability of material a. Stock-out cost b. Ordering c...

A: Stock out Cost:- It is the loss of revenue due to stock not available when customer demand it. In si...

Q: Poodle Grooming Parlour has overheads of £11,000 per month. Each month 2,000 direct labour hours ar...

A: As per the given question, we have to calculate the total cost and amount to be charged from the cus...

Q: P6-2. LMVL Co., a publicly listed company, reported earnings for the year amounting to Php25 Million...

A: P:E Ratio = Market value per share / Earnings per share where, Earnings per share = (Net income - Pr...

Q: The capital accounts of Scott and Tucker at the end of the fiscal year 2019 are as follows: Scott, C...

A: Lets understand the basics. Partnership is an agreement between two or more person who works togethe...

Q: Use the following information for Exercises 16-18 below. [The following information applies to the q...

A: Net income = Consulting fees earned - Rent expense - Salaries expense - Telephone expense - Miscella...

Ethics have an important place in the organisation and for all the managers and employees in the organisation. Ethics says that how people should behave and their actions.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

- According to the 2011 National Business Ethics Survey conducted by the Ethics Resource Center, Generational Differences in Workplace Ethics,83 a relatively high percentage of Millennials consider certain behaviors in the workplace ethical when compared with their earlier counterparts.These include: • Use social networking to find out about the company’s competitors (37%),• “Friend” a client or customer on a social network (36%),• Upload personal photos on a company network (26%),• Keep copies of confidential documents (22%),• Work less to compensate for cuts in benefits or pay (18%),• Buy personal items using a company credit card (15%),• Blog or tweet negatively about a company (14%), and• Take a copy of work software home for personal use (13%). The report further concludes that younger workers are significantly more willing to ignore the presence of misconduct if they think that behavior will help save jobs. a. Choose one or more behaviors and explain why Millennials might view a.…Public relations specialists create and maintain a favorable public image for the organization they represent. They design media releases to shape public perception of their organization and to increase awareness of its work and goals. The median annual wage for public relations specialists was $55,680 in May 2014.SOURCE: United States. Department of Labor. "Public Relations Specialist." Occupational Outlook Handbook. 17 Dec. 2015. Web. 8 March 2016. A public relations specialist earns $35,500 salary each year. He/she wants to spend no more than three times his/her salary on a house. What is the maximum price of a home that he/she can afford? If a 20% down payment is required, what is the amount financed? If he/she buys a home for the maximum he/she can afford, what is the monthly mortgage payment for a 25 year fixed interest loan at 3.15% compounded monthly?17. If you are fired, it is acceptable to: A. Make threats against employees B. Damage company property C. Be angry D. Refuse to return company property 18. Making every opportunity a learning opportunity is referred to as: A. Informal learning B. Professional development C. Training D. Employee appraisals 19. When confronted by a coworker who has discovered your job search: A. Explain the details of why you're leaving B. Keep your explanation simple C. Share your desire for more money or responsibility D. Explain the status of your job search 20. Experiencing excessive workplace stress: A. All of these B. Is a valid reason to change jobs C. Is a sign of weakness D. Should be ignored

- 13. With an increase in ________, employee training is important in many companies. A. Technology B. Employees C. Workplace discrimination D. Upper management 14. Training is usually: A. Paid for by the employee B. Provided and paid for by the company C. Free to all participants D. Paid for by a professional trainer 15. An entrepreneur is someone who: A. All of these B. Would rather work for others C. Doesn't mind lower pay as long as he or she can work for him- or her-self D. Assumes the risk of succeeding or failing in business 16. Continue expanding your knowledge: A. Only in areas that interest you B. Only in areas relating to your current job C. In as many areas as possible D. In only areas your boss recommends9. If you are leaving your job and the situation is unfavorable, it is acceptable to: A. None of these B. Both Take company property and Bad-mouth your boss C. Bad-mouth your boss D. Take company property 10. Promotional advantages and opportunities arise from: A. All of these B. Attending company parties C. Allowing others to attend development sessions D. Development sessions 11. The following are common reasons to change jobs EXCEPT a(n): A. None of these are exceptions B. Opportunity for a higher salary C. Perceived increase in stress D. Desire for improved work hours 12. A letter of resignation should include: A. All of these B. A positive statement about your employer C. Why you are quitting D. Your final date of employmentEthics Case Gina DeMarc, a partner in a large CPA firm, has been approached by Bruce Jonas, a manager, with the following recommendation for incentive bonuses for staff members. Jonas recommends that the firm continue to pay each staff member a straight annual salary (which has been traditionally the only payment made) plus a bonus based on the staff member’s ability to achieve a 10% reduction in time spent on each client’s work. The firm would also pay a 5% finder’s fee for any new client the staff member brings into the firm. Jonas believes this will motivate the staff to work more efficiently, to sell the firm to new clients, and to service more clients in any given time period. This should also generate more revenue for the firm. Required How would you advise Gina DeMarc? What ethical issues should she consider

- Recently, the owner of KFC Franchise decided to change how she compensated her top manager. Last year, the manager received a fixed salary of GHC50,000 and KFC made GHC110,000 in profits (excluding the manager’s compensation). She feared that her store’s performance was connected to the top manager shirking on the job and expected that changes to her top manager’s compensation structure would improve sales. Therefore, this year she decided to offer him a fixed salary of $40,000 plus 5 percent of the store’s profit. Since the change, the store is performing much better, and she forecasts profits this year to be $300,000 (again, excluding the manager’s compensation). Assuming the change of compensation is the reason for owner make (net of payment to her top manager) because of this change? Does the manager make more money under the new payment scheme?Recently, the owner of KFC Franchise decided to change how she compensated her top manager. Last year, the manager received a fixed salary of GHC50,000 and KFC made GHC110,000 in profits (excluding the manager’s compensation). She feared that her store’s performance was connected to the top manager shirking on the job and expected that changes to her top manager’s compensation structure would improve sales. Therefore, this year she decided to offer him a fixed salary of $40,000 plus 5 percent of the store’s profit. Since the change, the store is performing much better, and she forecasts profits this year to be $300,000 (again, excluding the manager’s compensation). Assuming the change of compensation is the reason fothe increased profits, and the forecast is accurate, how much more money will the owner make (net of payment to her top manager) because of this change? Does the manager make more money under the new payment scheme?Shinas Food Shop decided to increase the salary of the workers due to high cost of living caused by COVID-19. This type of decision is called as: a. Individual decision b. Simple decision c. Minor decision d. Complex decision

- Anita Brown is the manager of a wholesale food company. Her compensation, in part, is incentive-based. In other words, the higher the company income, the higher her incentive compensation. Each year, in an effort to influence her bonus, Anita makes several recommendations, concerning adjusting entries, to the company controller. One of her favorites is to ask the controller to reduce the estimate of doubtful accounts.1. How does lowering the estimate of doubtful accounts affect the income statement and balance sheet?2. Is there an ethical consideration in this case? If so, what is it?3. Should Anita be permitted to weigh in on adjusting entries under these circumstances? Why or why not?Brenda Sheldon, CPA, pays her new staff accountant, Abby , a salary equivalent to $21 per hour while Brenda receives a salary equivalent to $37 per hour. The firm's predetermined indirect cost allocation rate for the year is $11 per hour. Sheldon bills for the firm's services at 34% over cost. Assume Brenda works 6 hours and Abby works 8 hours preparing a tax return for Mikayla Touchstone. 1. What is the total cost of preparing Touchstone's tax return? 2. How much will Brenda bill Touchstone for the tax work?Sheehan works for Andy Company and is a superior sales guy. His total compensation this year is $600,000. Andy sponsors an integrated profit sharing plan with a base percentage of 5.5% and a maximum excess percentage. It uses the current wage base as the integration level. How much will the company contribute for Sheehan for 2019? Select one: $15,125 $23,491 $23,785 $56,000