May 1: Prepaid rent for three months, $2,400 • May 5: Received and paid electricity bill, $70 • May 9: Received cash for meals served to customers, $110 • May 14: Paid cash for kitchen equipment, $2,690 • May 23: Served a banquet on account, $2,240 • May 31: Made the adjusting entry for rent (from May 1). • May 31: Accrued salary expense, $3,920 • May 31: Recorded depreciation for May on kitchen equipment, $590 If Sweet Catering had recorded transactions using the Cash method, how much net income (loss) would they have recorded for the month of May? If there is a loss, enter it with parentheses or a negative sign. If Sweet Catering had recorded transactions using the Accrual method, how much net income (loss) would they have recorded for the month of May? If there is a loss, enter it with parentheses or a negative sign.

May 1: Prepaid rent for three months, $2,400 • May 5: Received and paid electricity bill, $70 • May 9: Received cash for meals served to customers, $110 • May 14: Paid cash for kitchen equipment, $2,690 • May 23: Served a banquet on account, $2,240 • May 31: Made the adjusting entry for rent (from May 1). • May 31: Accrued salary expense, $3,920 • May 31: Recorded depreciation for May on kitchen equipment, $590 If Sweet Catering had recorded transactions using the Cash method, how much net income (loss) would they have recorded for the month of May? If there is a loss, enter it with parentheses or a negative sign. If Sweet Catering had recorded transactions using the Accrual method, how much net income (loss) would they have recorded for the month of May? If there is a loss, enter it with parentheses or a negative sign.

College Accounting (Book Only): A Career Approach

12th Edition

ISBN:9781305084087

Author:Cathy J. Scott

Publisher:Cathy J. Scott

Chapter1: Asset, Liability, Owner’s Equity, Revenue, And Expense Accounts

Section: Chapter Questions

Problem 5PB: In October, A. Nguyen established an apartment rental service. The account headings are presented...

Related questions

Question

100%

Keep getting the wrong answer when I check. Not sure what to do

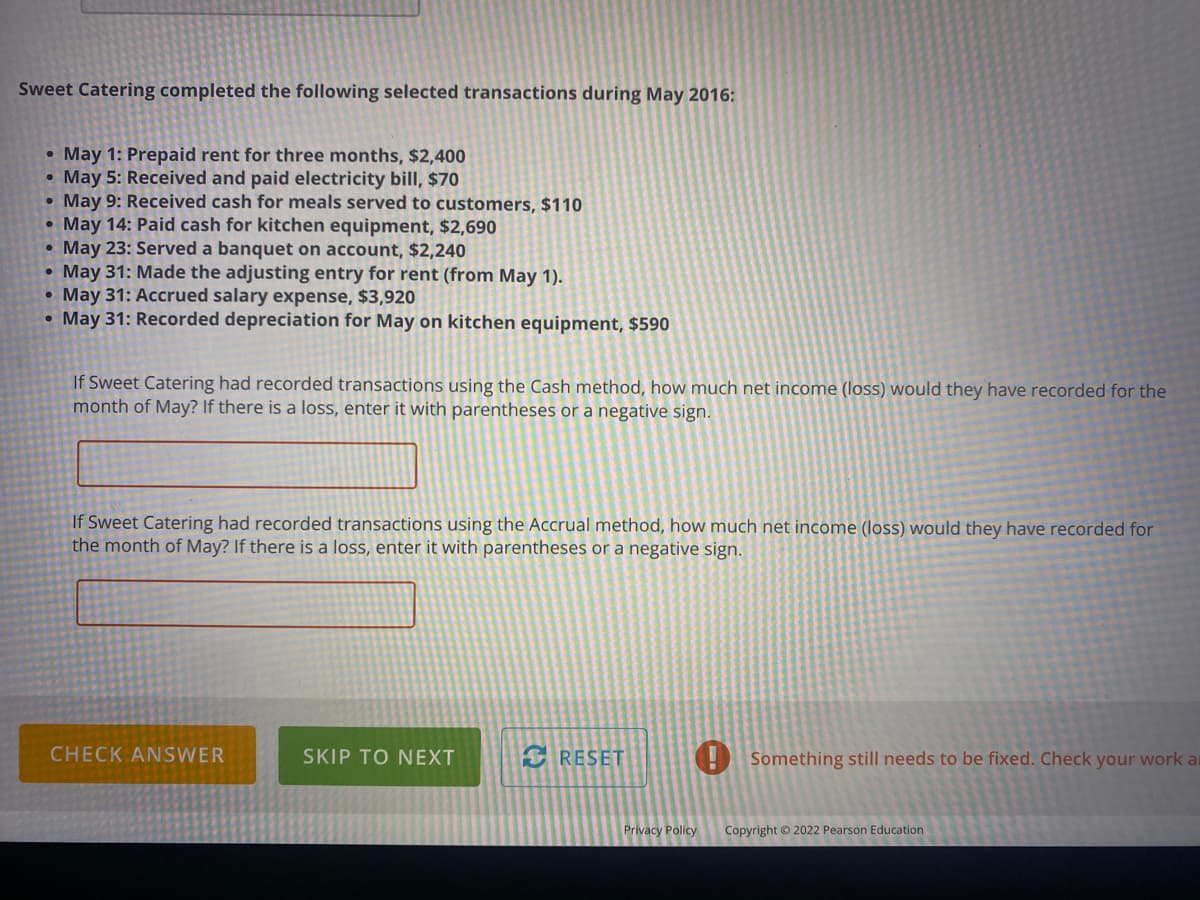

Transcribed Image Text:Sweet Catering completed the following selected transactions during May 2016:

• May 1: Prepaid rent for three months, $2,400

• May 5: Received and paid electricity bill, $70

• May 9: Received cash for meals served to customers, $110

• May 14: Paid cash for kitchen equipment, $2,690

• May 23: Served a banquet on account, $2,240

• May 31: Made the adjusting entry for rent (from May 1).

• May 31: Accrued salary expense, $3,92O

• May 31: Recorded depreciation for May on kitchen equipment, $590

If Sweet Catering had recorded transactions using the Cash method, how much net income (loss) would they have recorded for the

month of May? If there is a loss, enter it with parentheses or a negative sign.

If Sweet Catering had recorded transactions using the Accrual method, how much net income (loss) would they have recorded for

the month of May? If there is a loss, enter it with parentheses or a negative sign.

CHECK ANSWER

SKIP TO NEXT

RESET

Something still needs to be fixed. Check your work at

Privacy Policy

Copyright 2022 Pearson Education

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning