May 26, company sells 4 units of cookware @ $2,000 May 26 takes $5,000 for owner's benefit May 27 Adjusts for utility expense, rent expense and interest expense Required: the following accounting equation is given, but the previous correction is in case something went wrong. then make an adjusting entry (Transaction May 27). Create income statements and cash flow statements.

May 26, company sells 4 units of cookware @ $2,000 May 26 takes $5,000 for owner's benefit May 27 Adjusts for utility expense, rent expense and interest expense Required: the following accounting equation is given, but the previous correction is in case something went wrong. then make an adjusting entry (Transaction May 27). Create income statements and cash flow statements.

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter3: Processing Accounting Information

Section: Chapter Questions

Problem 3.12MCE: Determining an Ending Account Balance Jessies Accounting Services was organized on June 1. The...

Related questions

Question

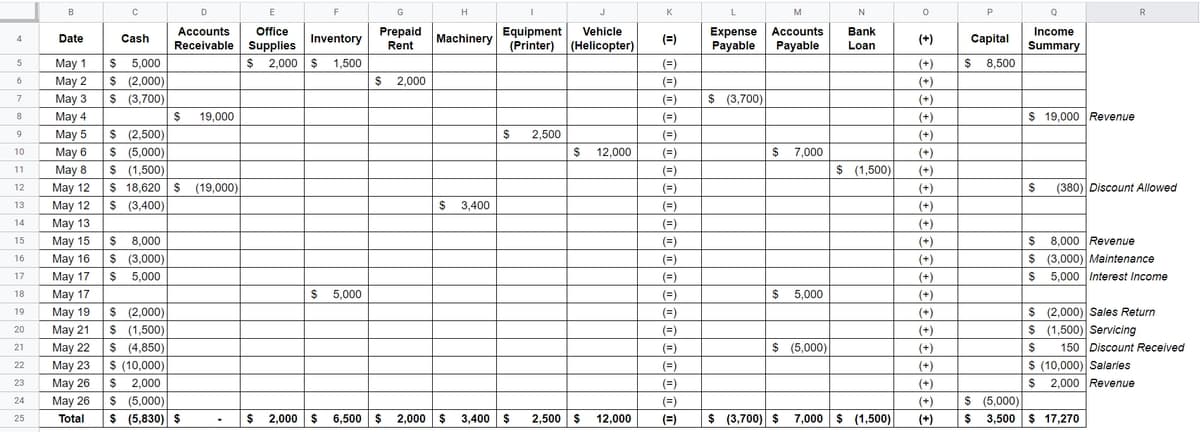

Transcribed Image Text:B

D

E

F

G

H

K

L

M

P

R

Expense Accounts

Payable

Payable

Prepaid

Office

Receivable supplies

$ 2,000 $

Accounts

Bank

Equipment

(Printer) (Helicopter)

Vehicle

Income

Date

Cash

Inventory

Machinery

(=)

(+)

Capital

4

Rent

Loan

Summary

$ 5,000

$ (2,000)

$ (3,700)

May 1

1,500

(=)

(+)

$ 8,500

May 2

$ 2,000

(=)

(+)

May 3

May 4

(=)

$ (3,700)

(+)

(+)

7

19,000

(=)

$ 19,000 Revenue

8

$ (2,500)

$ (5,000)

$ (1,500)

$ 18,620 $ (19,000)

$ (3,400)

May 5

2,500

(=)

(+)

$

12,000

$ 7,000

10

May 6

(=)

(+)

May 8

May 12

11

(=)

$ (1,500)

(+)

(=)

(=)

(=)

(+)

(+)

12

(380) Discount Allowed

13

May 12

$

3,400

14

May 13

(+)

$ 8,000

$ (3,000)

May 17 $ 5,000

$ 8,000 Revenue

$ (3,000) Maintenance

15

May 15

(=)

(+)

16

May 16

(=)

(+)

17

(=)

(+)

$ 5,000 Interest Income

18

May 17

$ 5,000

(=)

2$

5,000

(+)

$ (2,000)

$ (1,500)

$ (4,850)

$ (10,000)

$ 2,000

$ (5,000)

$ (5,830) $

19

May 19

(=)

(+)

$ (2,000) Sales Return

May 21

(+)

$ (1,500) Servicing

20

(=)

$ (5,000)

$

$ (10,000) Salaries

$ 2,000 Revenue

21

May 22

(=)

(+)

150 Discount Received

22

May 23

(=)

(+)

23

May 26

(=)

(+)

$ (5,000)

$ 3,500 $ 17,270

24

May 26

(=)

(+)

(+)

Total

2,000 $

6,500 $

2,000 $

3,400 $

2,500 $

12,000

(=)

$ (3,700) $

7,000 $ (1,500)

25

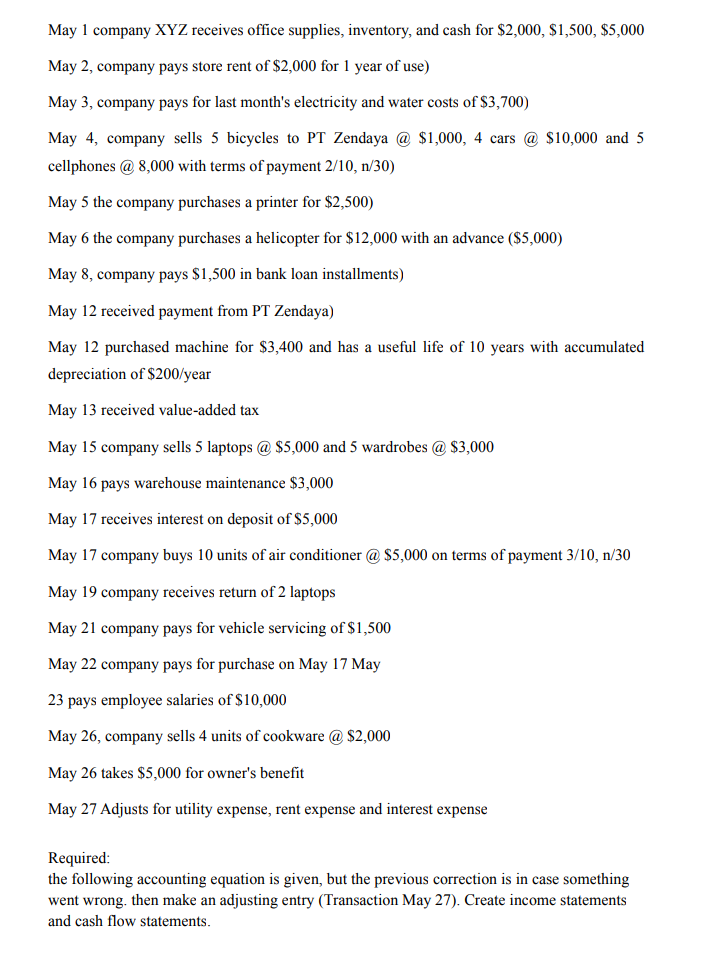

Transcribed Image Text:May 1 company XYZ receives office supplies, inventory, and cash for $2,000, $1,500, $5,000

May 2, company pays store rent of $2,000 for 1 year of use)

May 3, company pays for last month's electricity and water costs of $3,700)

May 4, company sells 5 bicycles to PT Zendaya @ $1,000, 4 cars @ $10,000 and 5

cellphones @ 8,000 with terms of payment 2/10, n/30)

May 5 the company purchases a printer for $2,500)

May 6 the company purchases a helicopter for $12,000 with an advance ($5,000)

May 8, company pays $1,500 in bank loan installments)

May 12 received payment from PT Zendaya)

May 12 purchased machine for $3,400 and has a useful life of 10 years with accumulated

depreciation of $200/year

May 13 received value-added tax

May 15 company sells 5 laptops @ $5,000 and 5 wardrobes @ $3,000

May 16 pays warehouse maintenance $3,000

May 17 receives interest on deposit of $5,000

May 17 company buys 10 units of air conditioner @ $5,000 on terms of payment 3/10, n/30

May 19 company receives return of 2 laptops

May 21 company pays for vehicle servicing of $1,500

May 22 company pays for purchase on May 17 May

23 pays employee salaries of $10,000

May 26, company sells 4 units of cookware @ $2,000

May 26 takes $5,000 for owner's benefit

May 27 Adjusts for utility expense, rent expense and interest expense

Required:

the following accounting equation is given, but the previous correction is in case something

went wrong. then make an adjusting entry (Transaction May 27). Create income statements

and cash flow statements.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 5 steps

Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning