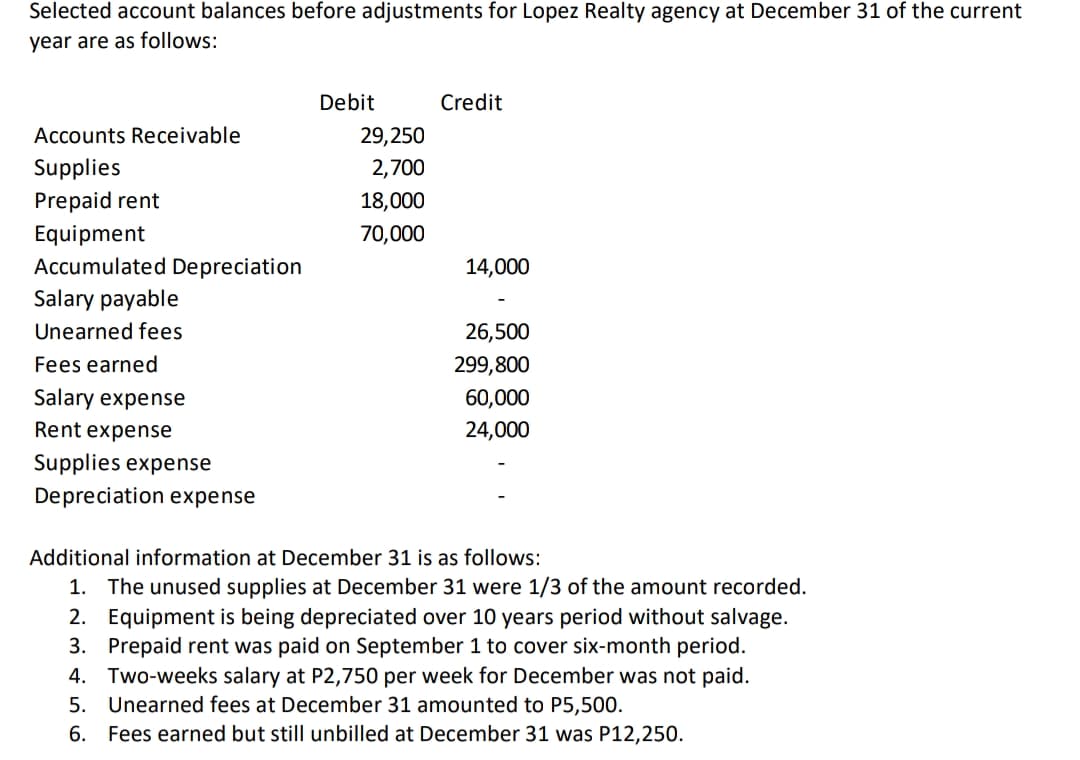

DdldiceS belore dajus Tor Lupez Reaity agenty at Delember שר הב year are as follows: Debit Credit Accounts Receivable 29,250 Supplies Prepaid rent 2,700 18,000 70,000 Equipment Accumulated Depreciation 14,000 Salary payable Unearned fees 26,500 Fees earned 299,800 Salary expense 60,000 Rent expense 24,000 Supplies expense Depreciation expense Additional information at December 31 is as follows: 1. The unused supplies at December 31 were 1/3 of the amount recorded. 2. Equipment is being depreciated over 10 years period without salvage. 3. Prepaid rent was paid on September 1 to cover six-month period. 4. Two-weeks salary at P2,750 per week for December was not paid. Unearned fees at December 31 amounted to P5,500. 5. 6. Fees earned but still unbilled at December 31 was P12,250.

DdldiceS belore dajus Tor Lupez Reaity agenty at Delember שר הב year are as follows: Debit Credit Accounts Receivable 29,250 Supplies Prepaid rent 2,700 18,000 70,000 Equipment Accumulated Depreciation 14,000 Salary payable Unearned fees 26,500 Fees earned 299,800 Salary expense 60,000 Rent expense 24,000 Supplies expense Depreciation expense Additional information at December 31 is as follows: 1. The unused supplies at December 31 were 1/3 of the amount recorded. 2. Equipment is being depreciated over 10 years period without salvage. 3. Prepaid rent was paid on September 1 to cover six-month period. 4. Two-weeks salary at P2,750 per week for December was not paid. Unearned fees at December 31 amounted to P5,500. 5. 6. Fees earned but still unbilled at December 31 was P12,250.

Chapter4: The Adjustment Process

Section: Chapter Questions

Problem 13PB: Prepare adjusting journal entries, as needed, considering the account balances excerpted from the...

Related questions

Question

What are the balances of each account after adjustments had been made?

Transcribed Image Text:Selected account balances before adjustments for Lopez Realty agency at December 31 of the current

year are as follows:

Debit

Credit

Accounts Receivable

29,250

Supplies

2,700

Prepaid rent

18,000

Equipment

70,000

Accumulated Depreciation

Salary payable

14,000

Unearned fees

26,500

Fees earned

299,800

Salary expense

60,000

Rent expense

24,000

Supplies expense

Depreciation expense

Additional information at December 31 is as follows:

1. The unused supplies at December 31 were 1/3 of the amount recorded.

2. Equipment is being depreciated over 10 years period without salvage.

3. Prepaid rent was paid on September 1 to cover six-month period.

4. Two-weeks salary at P2,750 per week for December was not paid.

5. Unearned fees at December 31 amounted to P5,500.

6. Fees earned but still unbilled at December 31 was P12,250.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning