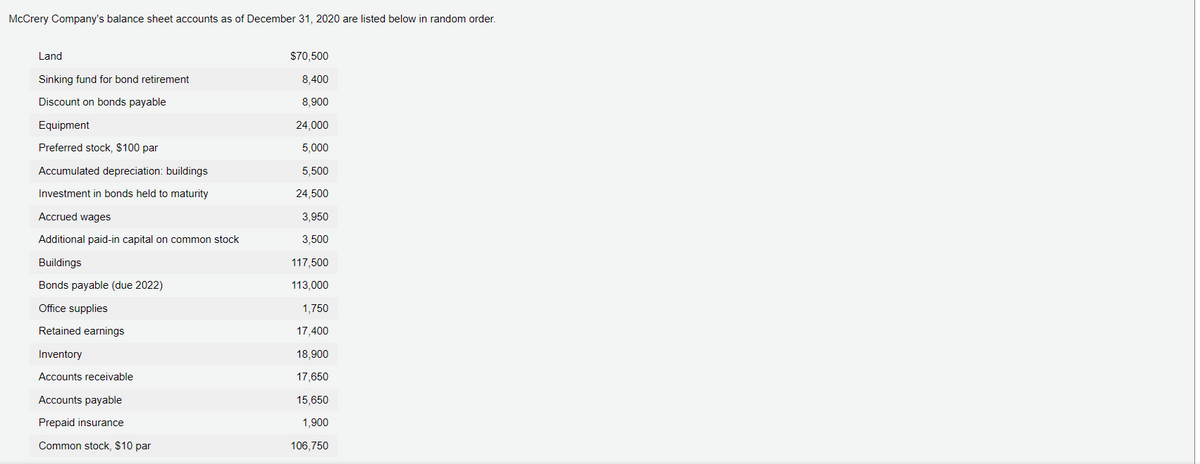

McCrery Company's balance sheet accounts as of December 31, 2020 are listed below in random order. Land S70,500 Sinking fund for bond retirement 8,400 Discount on bonds payable 8,900 Equipment 24,000 Preferred stock, $100 par 5,000 Accumulated depreciation: buildings 5,500 Investment in bonds held to maturity 24,500 Accrued wages 3,950 Additional paid-in capital on common stock 3,500 Buildings 117,500 Bonds payable (due 2022) 113,000 Office supplies 1,750 Retained earnings 17,400 Inventory 18,900 Accounts receivable 17,650 Accounts payable 15,650 Prepaid insurance 1,900 Common stock, $10 par 106,750

McCrery Company's balance sheet accounts as of December 31, 2020 are listed below in random order. Land S70,500 Sinking fund for bond retirement 8,400 Discount on bonds payable 8,900 Equipment 24,000 Preferred stock, $100 par 5,000 Accumulated depreciation: buildings 5,500 Investment in bonds held to maturity 24,500 Accrued wages 3,950 Additional paid-in capital on common stock 3,500 Buildings 117,500 Bonds payable (due 2022) 113,000 Office supplies 1,750 Retained earnings 17,400 Inventory 18,900 Accounts receivable 17,650 Accounts payable 15,650 Prepaid insurance 1,900 Common stock, $10 par 106,750

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter4: The Balance Sheet And The Statement Of Shareholders' Equity

Section: Chapter Questions

Problem 8RE

Related questions

Question

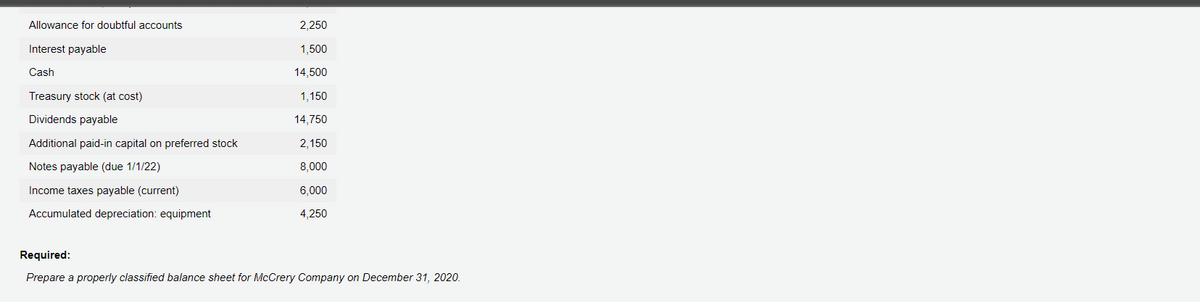

Transcribed Image Text:Allowance for doubtful accounts

2,250

Interest payable

1,500

Cash

14,500

Treasury stock (at cost)

1,150

Dividends payable

14,750

Additional paid-in capital on preferred stock

2,150

Notes payable (due 1/1/22)

8,000

Income taxes payable (current)

6,000

Accumulated depreciation: equipment

4,250

Required:

Prepare a properly classified balance sheet for McCrery Company on December 31, 2020.

Transcribed Image Text:McCrery Company's balance sheet accounts as of December 31, 2020 are listed below in random order.

Land

$70,500

Sinking fund for bond retirement

8,400

Discount on bonds payable

8,900

Equipment

24,000

Preferred stock, $100 par

5,000

Accumulated depreciation: buildings

5,500

Investment in bonds held to maturity

24,500

Accrued wages

3,950

Additional paid-in capital on common stock

3,500

Buildings

117,500

Bonds payable (due 2022)

113,000

Office supplies

1,750

Retained earnings

17,400

Inventory

18,900

Accounts receivable

17,650

Accounts payable

15,650

Prepaid insurance

1,900

Common stock, $10 par

106,750

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning