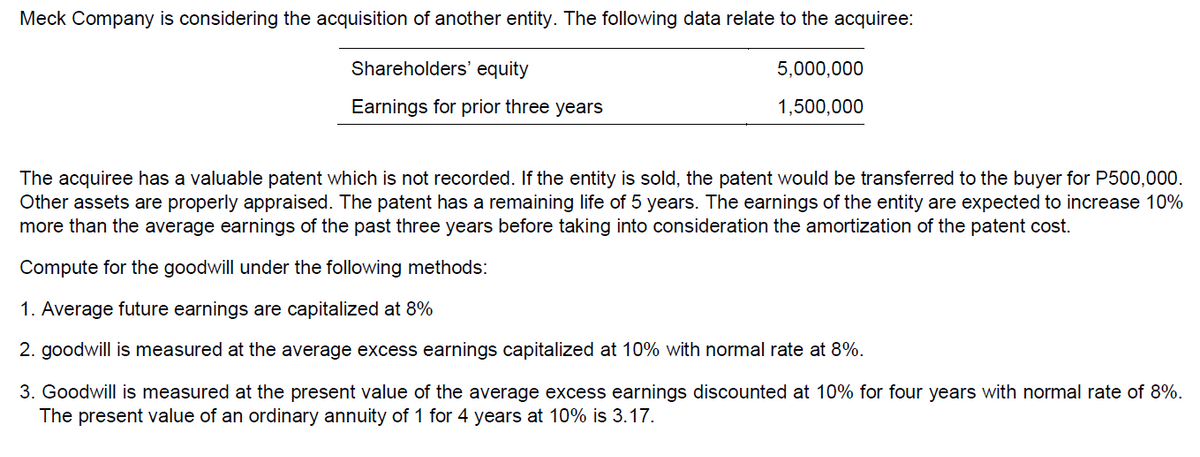

Meck Company is considering the acquisition of another entity. The following data relate to the acquiree: Shareholders' equity 5,000,000 Earnings for prior three years 1,500,000 The acquiree has a valuable patent which is not recorded. If the entity is sold, the patent would be transferred to the buyer for P500,000. Other assets are properly appraised. The patent has a remaining life of 5 years. The earnings of the entity are expected to increase 10% more than the average earnings of the past three years before taking into consideration the amortization of the patent cost. Compute for the goodwill under the following methods: 1. Average future earnings are capitalized at 8% 2. goodwill is measured at the average excess earnings capitalized at 10% with normal rate at 8%. 3. Goodwill is measured at the present value of the average excess earnings discounted at 10% for four years with normal rate of 8%. The present value of an ordinary annuity of 1 for 4 years at 10% is 3.17.

Meck Company is considering the acquisition of another entity. The following data relate to the acquiree: Shareholders' equity 5,000,000 Earnings for prior three years 1,500,000 The acquiree has a valuable patent which is not recorded. If the entity is sold, the patent would be transferred to the buyer for P500,000. Other assets are properly appraised. The patent has a remaining life of 5 years. The earnings of the entity are expected to increase 10% more than the average earnings of the past three years before taking into consideration the amortization of the patent cost. Compute for the goodwill under the following methods: 1. Average future earnings are capitalized at 8% 2. goodwill is measured at the average excess earnings capitalized at 10% with normal rate at 8%. 3. Goodwill is measured at the present value of the average excess earnings discounted at 10% for four years with normal rate of 8%. The present value of an ordinary annuity of 1 for 4 years at 10% is 3.17.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter12: Intangibles

Section: Chapter Questions

Problem 7P: Hamilton Companys balance sheet on January 1, 2019, was as follows: Korbel Company is considering...

Related questions

Question

Transcribed Image Text:Meck Company is considering the acquisition of another entity. The following data relate to the acquiree:

Shareholders' equity

5,000,000

Earnings for prior three years

1,500,000

The acquiree has a valuable patent which is not recorded. If the entity is sold, the patent would be transferred to the buyer for P500,000.

Other assets are properly appraised. The patent has a remaining life of 5 years. The earnings of the entity are expected to increase 10%

more than the average earnings of the past three years before taking into consideration the amortization of the patent cost.

Compute for the goodwill under the following methods:

1. Average future earnings are capitalized at 8%

2. goodwill is measured at the average excess earnings capitalized at 10% with normal rate at 8%.

3. Goodwill is measured at the present value of the average excess earnings discounted at 10% for four years with normal rate of 8%.

The present value of an ordinary annuity of 1 for 4 years at 10% is 3.17.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning