Medical Center Group Company. Body Beautiful charged Ms. Ganda the amount of P224,000 (inclusive of 12% but exclusive of excise tax) for the service Pehdere Ms. Ganda bought residential house for P4,000,000. He paid P1,000,000 down and mortgage back the property as security for the P3,000,000. Based on the information above, how much is the DST from the mortgage?

Medical Center Group Company. Body Beautiful charged Ms. Ganda the amount of P224,000 (inclusive of 12% but exclusive of excise tax) for the service Pehdere Ms. Ganda bought residential house for P4,000,000. He paid P1,000,000 down and mortgage back the property as security for the P3,000,000. Based on the information above, how much is the DST from the mortgage?

Chapter5: Gross Income: Exclusions

Section: Chapter Questions

Problem 27P

Related questions

Question

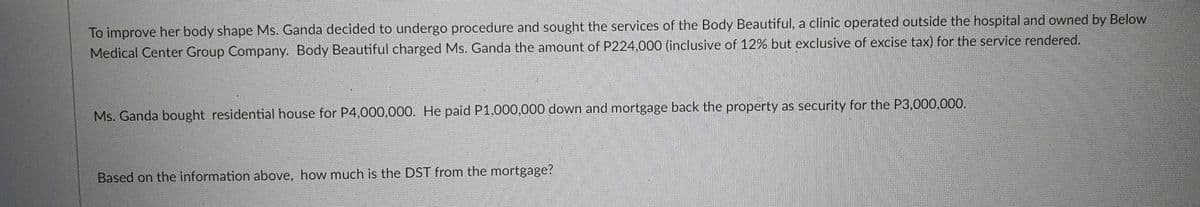

Transcribed Image Text:To improve her body shape Ms. Ganda decided to undergo procedure and sought the services of the Body Beautiful, a clinic operated outside the hospital and owned by Below

Medical Center Group Company. Body Beautiful charged Ms. Ganda the amount of P224,000 (inclusive of 12% but exclusive of excise tax) for the service rendered.

Ms. Ganda bought residential house for P4,000,000. He paid P1,000,000 down and mortgage back the property as security for the P3,000,000.

Based on the information above, how much is the DST from the mortgage?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT